Apple Inc. AAPL faces mounting pressure as Jefferies downgraded the tech giant to ‘underperform,’ citing concerns over revenue growth, following President Donald Trump‘s remarks about potential new U.S. investments from the company.

The Apple Analyst: Jefferies analyst Edison Lee cut his price target to $200.75 from $211.84, reported CNBC, projecting a 12.7% downside for the stock.

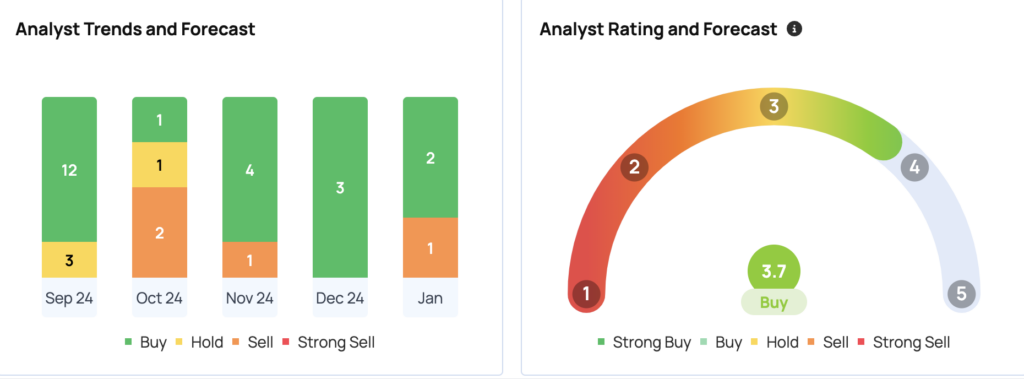

The rare bearish call stands in contrast to broader Wall Street sentiment, with only three other analysts recommending selling Apple shares compared to 19 buy ratings, according to Tipranks.com. The stock has already declined over 8% in 2024, following last year’s 30% gain.

The Apple Thesis: Lee warns Apple could miss its 5% revenue growth forecast for the first quarter of fiscal year 2025 and expects disappointing second-quarter guidance, citing weak iPhone sales and limited artificial intelligence developments.

The downgrade comes as Trump announced potential “massive investment” plans from Apple in the United States, revealed during his recent victory rally in Washington D.C. Trump cited a conversation with CEO Tim Cook, linking the investment to his election win and broader initiative to expedite approvals for companies investing $1 billion or more in the U.S.

See Also: EXCLUSIVE: Where Will S&P 500 Open Tuesday After Trump’s Inauguration? 39% Pick This Range

Apple, which recently approached but fell short of a $4 trillion valuation, is set to report earnings on Jan. 30, with investors closely watching for signs of revenue weakness highlighted in the Jefferies report.

The contrasting narratives emerge amid strong market performance, with the tech-heavy Nasdaq 100 gaining 1.9% in its best week since November. Apple’s consensus price target stands at $245.17, based on 30 analyst ratings, with recent analysis from MoffettNathanson, Bernstein, and B of A Securities suggesting a modest 2.25% upside potential.

Price Action: Apple closed at $229.98 on Friday, up 0.75% for the day. In after-hours trading, the stock dipped 0.21%. Year to date, Apple’s stock is down 5.69%, but over the past year, it has gained 18.61%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Gets Rare Downgrade From Jefferies: Analyst Warns On Slowing Revenue Growth, Missed Forecasts, And Falling iPhone Demand

In a surprising move, tech giant Apple (NASDAQ:AAPL) has received a rare downgrade from Jefferies analyst, warning investors about slowing revenue growth, missed forecasts, and falling iPhone demand.

The downgrade comes as a blow to Apple, which has been a market leader in the tech industry for years. Analysts had previously been bullish on the company’s prospects, but recent trends have raised concerns about its future performance.

According to the Jefferies analyst, Apple’s revenue growth has been slowing down in recent quarters, leading to missed forecasts and disappointing earnings reports. This has raised questions about the company’s ability to maintain its strong position in the market.

In addition, the analyst highlighted a decline in demand for Apple’s flagship product, the iPhone. With competition increasing in the smartphone market, Apple has been facing challenges in maintaining its market share and attracting new customers.

Despite these challenges, Apple remains a strong player in the tech industry, with a loyal customer base and a strong brand reputation. However, investors will be keeping a close eye on the company’s performance in the coming quarters to see if it can overcome these obstacles and continue its growth trajectory.

Overall, the downgrade from Jefferies serves as a reminder that even the strongest companies can face challenges in a rapidly changing market. Investors should carefully monitor Apple’s performance and future strategies to assess its long-term potential.

Tags:

- Apple downgrade

- Jefferies analyst

- slowing revenue growth

- missed forecasts

- falling iPhone demand

- Apple stock (NASDAQ:AAPL)

- Apple news

- technology sector

- tech industry analysis

- stock market update

#Apple #Rare #Downgrade #Jefferies #Analyst #Warns #Slowing #Revenue #Growth #Missed #Forecasts #Falling #iPhone #Demand #Apple #NASDAQAAPL

Leave a Reply

You must be logged in to post a comment.