Your cart is currently empty!

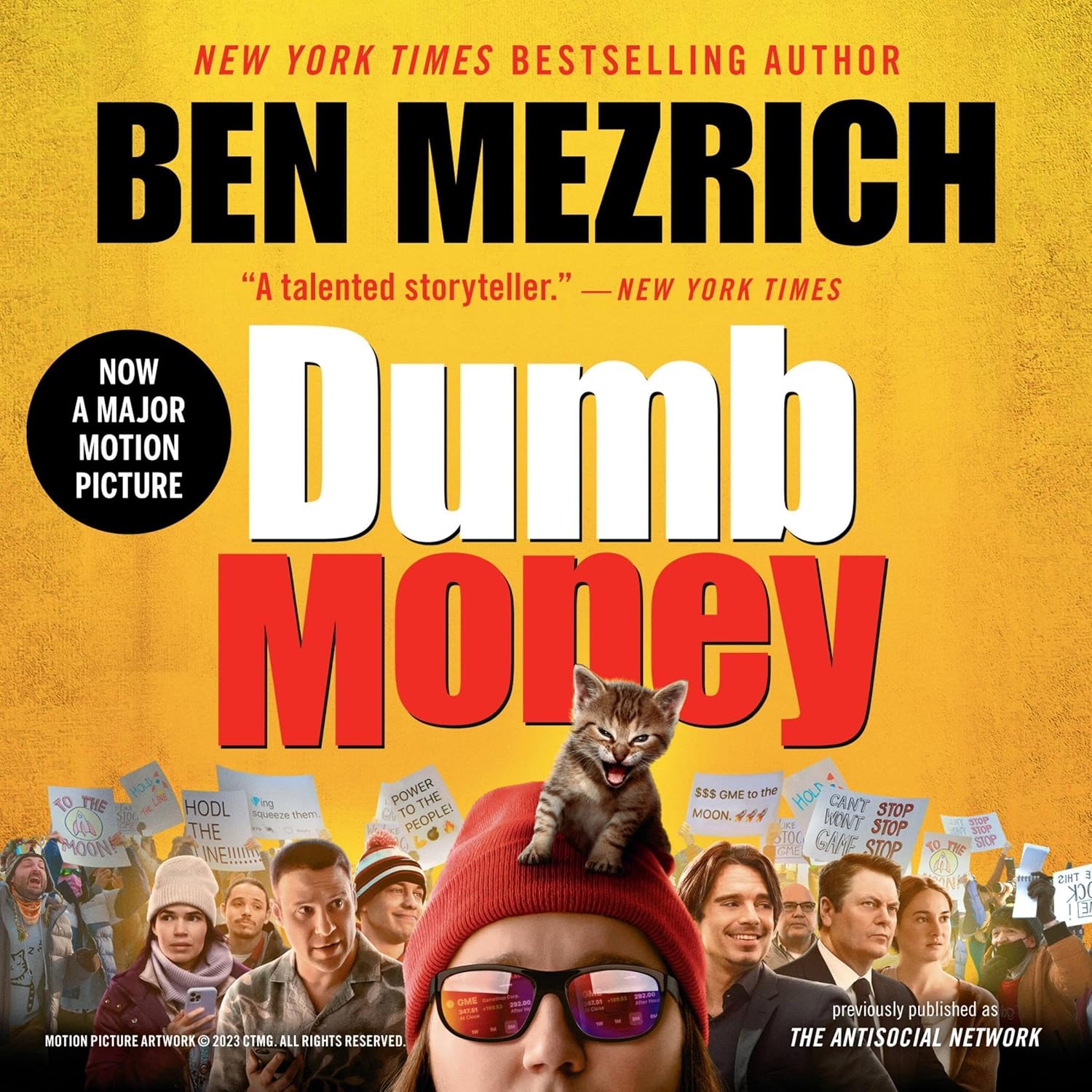

Dumb Money: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees

Price: $0.99

(as of Dec 03,2024 12:49:10 UTC – Details)

Customers say

Customers find the book fun, outstanding, and enjoyable. They also appreciate the cool way of telling the story. Opinions are mixed on the pacing, with some finding it readable enough, while others say the narratives are hard to follow and the style is maddening.

AI-generated from the text of customer reviews

The GameStop short squeeze saga has captivated the financial world in recent weeks, as a group of amateur traders on Reddit’s r/WallStreetBets forum banded together to drive up the stock price of the struggling video game retailer, causing massive losses for hedge funds who had bet against the company.

Dubbed “Dumb Money” by some on Wall Street, these amateur traders have upended the traditional power dynamics of the market, showing that a ragtag group of internet users armed with smartphones and Robinhood accounts can have a significant impact on the financial world.

The GameStop short squeeze has highlighted the growing influence of retail investors in the stock market, as social media platforms like Reddit and Twitter have democratized access to information and trading tools. While some see this as a positive development that empowers individual investors, others warn of the dangers of market manipulation and excessive risk-taking.

As the dust settles on the GameStop saga, one thing is clear: the power dynamics of Wall Street are shifting, and the old guard is being forced to reckon with the rise of “Dumb Money” traders who are unafraid to challenge the status quo. Love them or hate them, these amateur traders have proven that they can bring even the most powerful financial institutions to their knees.

#Dumb #Money #GameStop #Short #Squeeze #Ragtag #Group #Amateur #Traders #Brought #Wall #Street #Knees

Leave a Reply