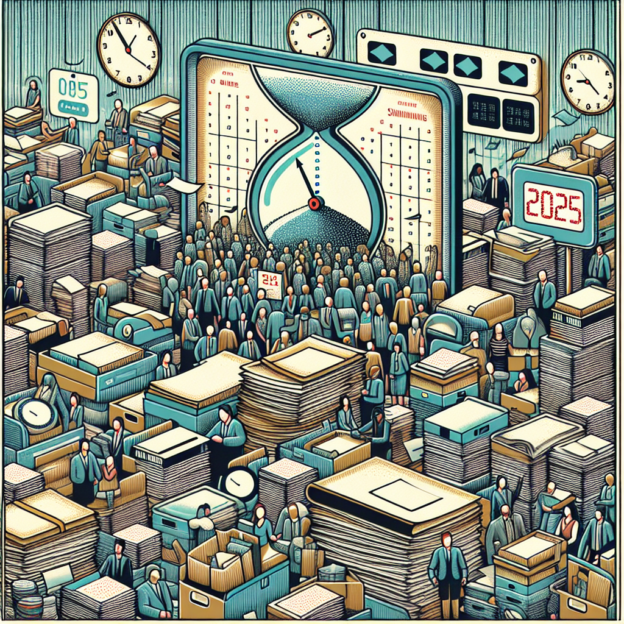

Title: “How Potential IRS Staff Cuts Could Impact Your 2025 Tax Refund Timeline”

Post:

Are you concerned about potential delays in receiving your 2025 tax refund? With ongoing discussions about staff cuts at the IRS, many taxpayers are wondering how this could affect the processing times for refunds.

The IRS plays a crucial role in processing tax returns and issuing refunds in a timely manner. If there are significant cuts to the IRS staff, it could potentially lead to delays in processing returns and issuing refunds. This means that you may have to wait longer than usual to receive your refund in 2025.

To ensure that you are prepared for any potential delays, it is important to stay informed about the latest developments regarding IRS staff cuts. Additionally, it is a good idea to file your tax return as early as possible to avoid any potential backlog in processing.

While it is impossible to predict the exact impact of IRS staff cuts on your 2025 tax refund timeline, staying informed and being proactive can help you navigate any potential delays. Keep an eye on updates from the IRS and be prepared for any changes that may affect your refund.

Tags:

IRS staff cuts, 2025 tax refund, IRS delays, tax refund delays, IRS budget cuts, tax refund timeline, IRS operations, tax filing process, tax preparation, IRS staff reductions, tax refund processing, IRS budget impacts, tax refund delays 2025

#expected #IRS #staff #cuts #delay #tax #refund