Fix today. Protect forever.

Secure your devices with the #1 malware removal and protection software

President-elect Donald Trump prepares to take the White House tonight during his inauguration as the next leader of the U.S. This will mark the second time that Trump has won the presidential election, with the first being in his 2016 run. With Trump taking office comes an increased interest in crypto stocks.

Stay Ahead of the Market:

Crypto is a hot topic for incoming President Trump as he’s signaled dedication to these digital assets. For example, Trump and his wife Melania launched two crypto tokens before taking office. These are trading under the TRUMP and MELANIA tickers and quickly attracted investors’ attention.

Additionally, Trump desires to create a Bitcoin (BTC) reserve. This would have the U.S. holding BTC akin to how it holds gold. The government would use Bitcoin seized by authorities to kick off this reserve.

What This Means for Crypto Stocks

With all of this positive sentiment toward crypto, it’s no surprise several crypto stocks rallied on Friday ahead of Trump’s inauguration. Marathon Digital (MARA) closed out Friday 8.8% higher, Microstrategy (MSTR) was up 8.04% when the bell rang, and Coinbase Global (COIN) had jumped 4.92% when normal trading hours ended that day.

The real question is how these stocks will perform after Trump takes the White House. The crypto stock sector is likely to undergo a rally while Trump is President of the U.S. That might not last his whole term, but traders can expect extreme movement in the first few weeks as crypto stocks adjust to the change.

MARA vs. MSTR vs. COIN: Which Crypto Stocks Are Worth Betting On?

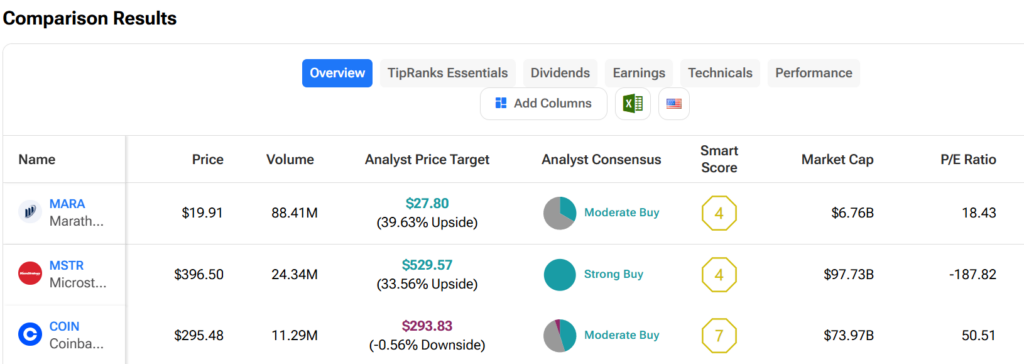

Using the TipRanks stock comparison tool, traders can deduce which crypto stocks offer the best potential profits during a Trump presidency. A quick look shows MARA has the most upside potential at 39.63%, with MSTR following it at 33.56%. However, investors might be wary of COIN stock and its potential 0.56% downside.

Fix today. Protect forever.

Secure your devices with the #1 malware removal and protection software

As the presidential election approaches, many investors are keeping a close eye on the potential impact a Trump victory could have on the cryptocurrency market. In particular, stocks like MARA (Marathon Digital Holdings), MSTR (MicroStrategy), and COIN (Coinbase) are poised to benefit from a Trump administration.

Marathon Digital Holdings (MARA) is a leading digital asset mining company that has seen significant growth in recent months. With a focus on mining Bitcoin, MARA stands to benefit from any pro-crypto policies that a Trump administration may implement.

MicroStrategy (MSTR) is another crypto stock that could see a boost under a Trump presidency. The business intelligence firm has been investing heavily in Bitcoin and has seen its stock price soar as a result. A Trump win could further validate MicroStrategy’s bullish stance on cryptocurrency.

Coinbase (COIN), the popular cryptocurrency exchange, is also likely to thrive under a Trump administration. As more retail and institutional investors flock to digital assets, Coinbase stands to benefit from increased trading volume and revenue.

Overall, the outlook for crypto stocks like MARA, MSTR, and COIN looks promising if Trump takes the White House. Investors should keep a close watch on these companies as the election draws nearer.

Tags:

- MARA stock

- MSTR stock

- COIN stock

- crypto stocks

- Trump presidency

- White House

- stock market

- investing

- cryptocurrency

- blockchain technology

#MARA #MSTR #COIN #Crypto #Stocks #Ready #Trump #White #House

Leave a Reply

You must be logged in to post a comment.