Your cart is currently empty!

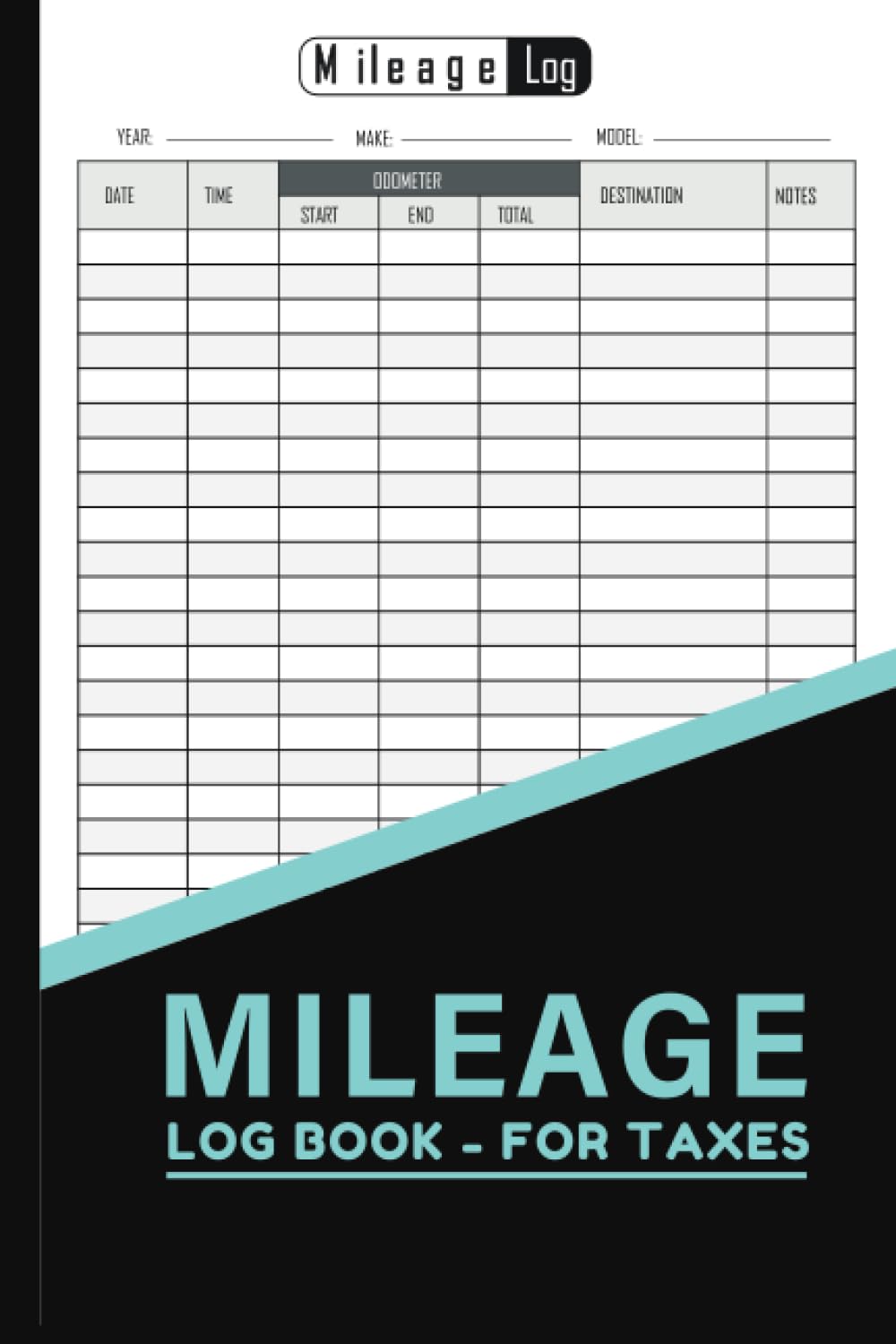

Mileage Log Book for Taxes for Self Employed 2023: Journal Tracker for Daily Car Mileage Tax Expenses and Small Business Owners’ Record Book | Perfect … Self-Employed and Independent Contractors.

Price: $4.99

(as of Dec 26,2024 21:53:11 UTC – Details)

ASIN : B0CCCN6JG4

Publisher : Independently published (July 22, 2023)

Language : English

Paperback : 120 pages

Item Weight : 8.3 ounces

Dimensions : 6 x 0.28 x 9 inches

Are you a self-employed individual or independent contractor looking for an easy way to track your car mileage for tax purposes in 2023? Look no further than our Mileage Log Book for Taxes! This journal tracker is perfect for keeping a record of your daily car mileage expenses, making tax time a breeze.

With sections for date, starting and ending mileage, purpose of trip, and total miles driven, this log book is designed to help you accurately track and report your business-related driving expenses. It’s the perfect tool for small business owners who need to keep detailed records of their vehicle usage for tax deductions.

Don’t let the headache of tracking mileage expenses get in the way of running your business efficiently. Get your hands on our Mileage Log Book for Taxes and make tax season a stress-free experience! Order yours today and take control of your tax deductions.

#Mileage #Log #Book #Taxes #Employed #Journal #Tracker #Daily #Car #Mileage #Tax #Expenses #Small #Business #Owners #Record #Book #Perfect #SelfEmployed #Independent #Contractors

Leave a Reply