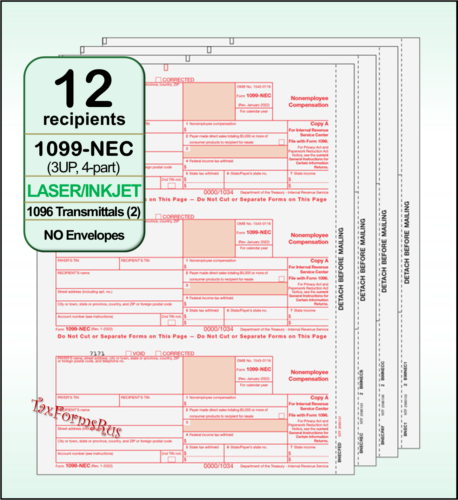

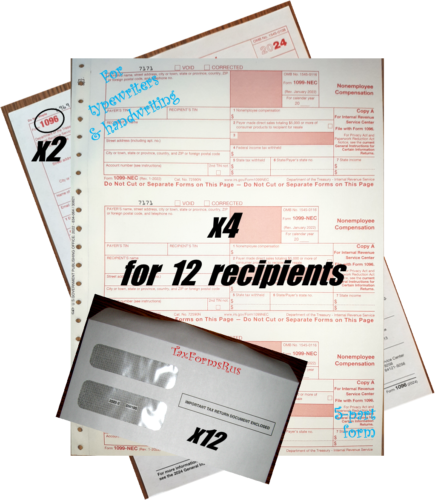

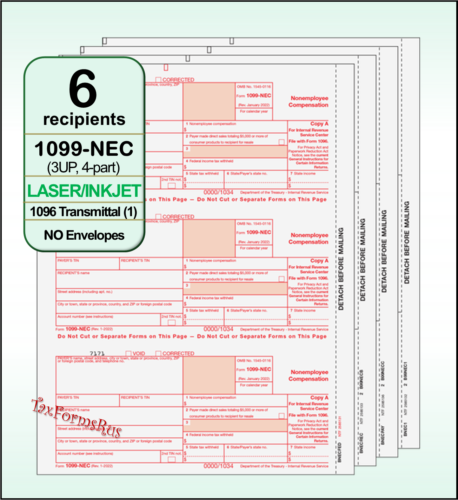

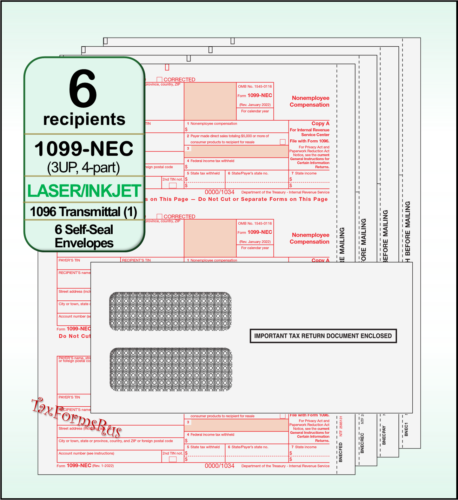

2024 TWO IRS FORM 1099-NEC and FORM 1096 (SIX RECIPIENTS)

Price : 3.99

Ends on : N/A

View on eBay

Are you a small business owner or freelancer who needs to file IRS Form 1099-NEC for tax year 2024? Look no further! In this post, we will walk you through the process of filling out both Form 1099-NEC and Form 1096 for six recipients.

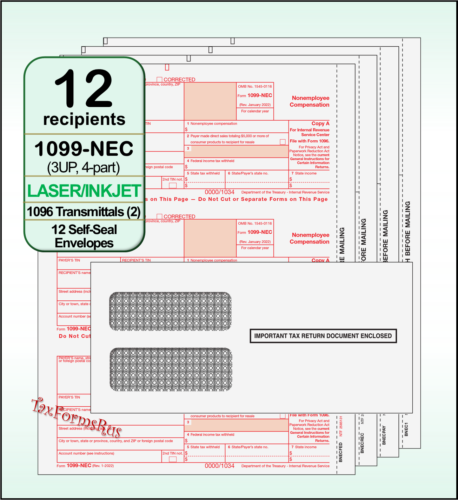

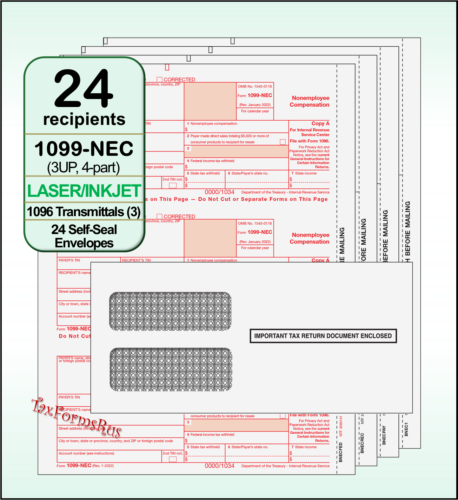

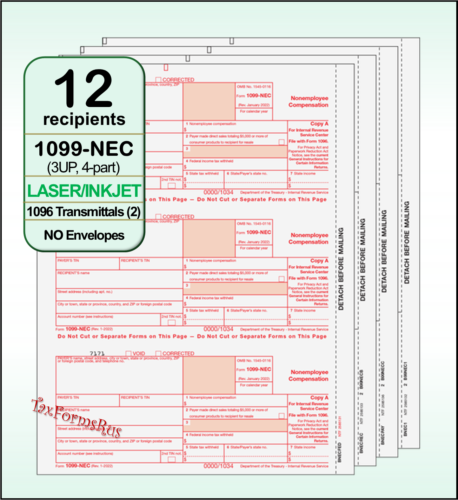

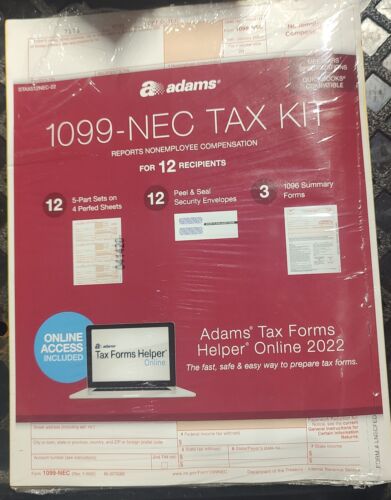

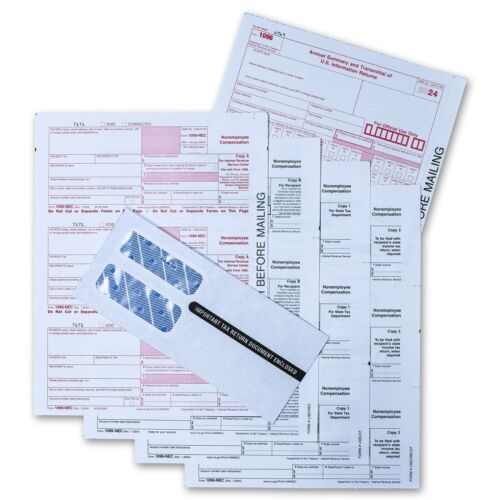

Form 1099-NEC is used to report non-employee compensation, such as payments made to independent contractors, freelancers, and vendors. Form 1096 is a transmittal form that summarizes all of the 1099 forms you are submitting to the IRS.

To get started, gather the necessary information for each recipient, including their name, address, and taxpayer identification number (TIN). You will also need to know the total amount of non-employee compensation paid to each recipient during the tax year.

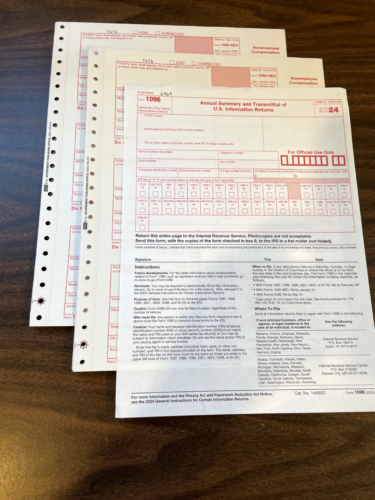

Next, fill out Form 1099-NEC for each recipient, making sure to accurately report the total amount of non-employee compensation in box 1. Once you have completed all six forms, you will need to fill out Form 1096 to summarize the information from the 1099 forms.

On Form 1096, enter your name, address, and TIN in the appropriate boxes. Then, enter the total number of 1099 forms you are submitting in box 3, and the total amount of non-employee compensation in box 4.

Once you have completed both forms, make sure to file them with the IRS by the deadline. Failure to file these forms on time can result in penalties and fines, so it is important to stay organized and on top of your tax obligations.

By following these steps and staying organized, you can successfully file IRS Form 1099-NEC and Form 1096 for six recipients for tax year 2024. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for help.

#IRS #FORM #1099NEC #FORM #RECIPIENTS