Motley Fool – Tue Jan 21, 6:00AM CST

These three artificial intelligence stocks try to follow Palantir‘s (NASDAQ: PLTR) footsteps and gain broader adoption.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

*Stock prices used were the afternoon prices of Jan. 17, 2025. The video was published on Jan. 19, 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia:if you invested $1,000 when we doubled down in 2009,you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

When it comes to investing in artificial intelligence (AI) stocks, there are several promising companies to consider. In this post, we will compare three top players in the AI industry: C3.ai, SoundHound AI, and BigBear.ai.

1. C3.ai: C3.ai is a leading provider of enterprise AI software solutions. The company’s platform enables organizations to harness the power of AI to drive digital transformation and improve operational efficiency. C3.ai’s impressive list of customers includes major corporations across various industries, such as Shell, 3M, and the U.S. Air Force. With a strong track record of growth and innovation, C3.ai is a top contender in the AI space.

2. SoundHound AI: SoundHound AI is known for its cutting-edge voice recognition technology. The company’s flagship product, the Hound voice assistant, is widely regarded as one of the most advanced AI-powered virtual assistants on the market. SoundHound AI’s technology is used in a variety of applications, from smart speakers to automotive systems. As the demand for voice-enabled devices continues to rise, SoundHound AI is well-positioned for future growth.

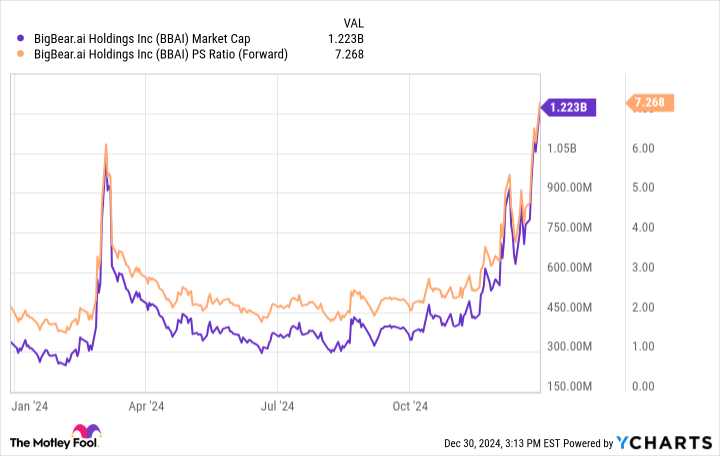

3. BigBear.ai: BigBear.ai is a provider of AI-driven solutions for defense and intelligence agencies. The company’s technology is used to analyze large volumes of data and extract valuable insights for national security purposes. With a focus on mission-critical applications, BigBear.ai has established itself as a trusted partner for government clients. As defense spending increases and the need for advanced AI capabilities grows, BigBear.ai is poised for continued success.

In conclusion, all three companies offer unique strengths and opportunities for investors looking to capitalize on the growing AI market. While C3.ai is a leader in enterprise AI solutions, SoundHound AI excels in voice recognition technology, and BigBear.ai has carved out a niche in the defense and intelligence sector. Ultimately, the best AI stock for your portfolio will depend on your investment goals and risk tolerance.

Tags:

- AI stocks comparison

- C3.ai vs SoundHound AI vs BigBear.ai

- Best artificial intelligence stocks

- AI investing opportunities

- C3.ai stock analysis

- SoundHound AI performance

- BigBear.ai growth potential

- Top AI companies to invest in

- AI stock market trends

- AI technology investments

#Stocks #C3.ai #SoundHound #BigBear.ai

You must be logged in to post a comment.