Your cart is currently empty!

Tag: Borrowers

What Trump and GOP lawmakers may have in store for student-loan borrowers

-

GOP lawmakers compiled a list of ideas to help shape the budget this year.

-

The ideas included rescinding Biden’s student-debt relief efforts, including the SAVE plan.

-

Republicans have also proposed ideas that have bipartisan support, like ending interest capitalization.

President Donald Trump and the new Republican-controlled Congress could make major changes for millions of student-loan borrowers.

That new GOP trifecta is likely to unwind several of former President Joe Biden’s moves on student debt relief. A memo compiled by Republicans on the House Budget Committee and viewed by Business Insider put forth a list of options that included changes to education programs that could appear in a coming spending bill. It suggested repealing Biden’s SAVE income-driven repayment plan, repealing regulations that allowed for debt relief for defrauded borrowers, and limiting eligibility for Public Service Loan Forgiveness.

The memo also proposed allowing borrowers who default on their student loans to be eligible for a second “rehabilitation loan,” which would allow borrowers to exit default by making nine payments. The law only allows borrowers to rehabilitate their loans once. It also suggested reforming the Pell Grant to expand its eligibility to short-term credential programs.

A separate budget blueprint prepared by GOP members on the budget committee pledged to stop Biden’s “student loan bailout,” saying that “our budget resolution stops all forms of these unconstitutional, inflationary, and regressive student loan debt cancellations.”

Biden concluded his term with a final week of targeted student-debt relief measures for borrowers. He announced targeted relief for thousands of nonprofit and government workers, those with total and permanent disabilities, and those the Education Department found were defrauded by their schools, bringing total relief under Biden to $188.8 billion for 5.3 million borrowers.

The Education Department did not immediately respond to a request for comment from Business Insider on Trump’s priorities for higher education and student-loan borrowers. However, Trump has previously been critical of Biden’s debt relief efforts, and it’s likely his administration would support GOP legislation to curb Biden’s expanded relief and repayment efforts.

Rep. Tim Walberg, chair of the House education committee, told BI that he remains “committed to helping address the rising cost of college tuition.”

“Republicans are committed to pursuing policies that will lower the cost of college and protect students and taxpayers from colleges and universities that offer degrees that aren’t worth the cost,” Walberg said.

GOP higher education plans

The GOP memo said that eliminating the SAVE plan and streamlining other income-driven repayment plans would save $127.3 billion over a decade. The SAVE plan, first introduced in 2023, was intended to make monthly student-loan payments cheaper with a shorter timeline for loan forgiveness. The plan faced lawsuits from GOP-led states, and enrolled borrowers are on forbearance as they await a final court decision.

Repealing Biden’s regulations making it easier for borrowers who the government determined were defrauded by their colleges to get loan forgiveness is also among the GOP’s suggestions. The memo said this would save a total of $14.6 billion over a decade.

Additionally, the memo proposed ending interest capitalization, which is when unpaid interest is tacked onto a borrower’s principal balance, causing their overall debt load to surge. This is an idea that Democratic lawmakers have voiced support for, as well.

Some of these ideas have been previously floated in GOP legislation. The College Cost Reduction Act, introduced by GOP Rep. Virginia Foxx last January, outlined various priorities that included capping certain forms of financial aid and limiting the education secretary’s authority to implement new relief and repayment programs. The legislation would help ensure students do not take on debt they cannot afford, Foxx said.

“Student-loan debt is skyrocketing, and completion rates are plummeting. There’s bipartisan agreement that lasting reforms are needed to correct course,” Foxx told BI after the bill was introduced last year.

While Republicans hold control over Congress, their proposals are still likely to face pushback from Democratic lawmakers. Democrats on the House’s education committee introduced their road map for higher education affordability last year, which included a range of legislation that addressed financial transparency and making relief easier through PSLF.

For now, borrowers are still waiting to hear more from Trump and lawmakers on any changes that could be implemented. Trump and some Republicans have even supported getting rid of the Education Department altogether, but doing so would be operationally complicated and require approval from Congress.

Read the original article on Business Insider

As the Biden administration continues to focus on improving access to higher education and reducing student loan debt, many are wondering what the future holds for student loan borrowers under the Trump administration and GOP lawmakers.One potential change that could be on the horizon is the elimination of the Public Service Loan Forgiveness (PSLF) program, which allows borrowers who work in public service jobs to have their student loans forgiven after 10 years of payments. This program has been a target for Republicans in the past, who argue that it is too costly and benefits too few borrowers.

Additionally, there may be efforts to streamline and simplify the student loan repayment process, potentially by reducing the number of income-driven repayment plans available to borrowers. This could make it easier for borrowers to understand their options and make informed decisions about how to repay their loans.

Another possibility is the expansion of income share agreements (ISAs), which are an alternative to traditional student loans where borrowers agree to pay a percentage of their income for a set period of time in exchange for funding their education. ISAs have gained popularity among some Republicans as a way to shift the risk of student loan repayment from borrowers to investors.

Overall, it is unclear what specific changes will be made to the student loan system under the Trump administration and GOP lawmakers. However, it is clear that there will likely be efforts to reduce the burden of student loan debt on borrowers and make the repayment process more efficient and transparent.

Tags:

- Trump administration

- GOP lawmakers

- Student-loan borrowers

- Federal student loans

- Higher education

- College debt

- Loan forgiveness

- Financial aid policies

- Education reform

- Student loan repayment

#Trump #GOP #lawmakers #store #studentloan #borrowers

-

GOP Could Limit Student Loan Forgiveness For Public Service Borrowers

WASHINGTON, DC – MAY 23: Rep. Virginia Foxx (R-NC) speaks at a hearing before the House Committee on … [+]

House Republicans are floating a proposal to limit eligibility for a key federal student loan forgiveness program intended to benefit public service borrowers.

Public Service Loan Forgiveness, or PSLF, is a popular program created by bipartisan legislation in 2007 and signed by President George W. Bush. The program offers complete student loan forgiveness for Direct federal student loans after a borrower completes 10 years of employment with a qualifying nonprofit or government employer, while meeting other program criteria (such as repaying their loans under an income-driven repayment plan).

PSLF was plagued by loan servicing and oversight problems for years, resulting in low approval rates. But under the Biden administration, the Education Department enacted a number of regulatory actions and temporary waivers designed to rectify these historic issues. As a result, more than a million borrowers ultimately received student loan forgiveness through PSLF by the beginning of this year.

But as student loan forgiveness has become a more polarized issue, the once-bipartisan program is now facing more opposition from many Republican lawmakers. And some party leaders are calling for limits to PSLF, or even a full repeal. Here’s what borrowers should know.

GOP Calls For Changing Student Loan Forgiveness Eligibility Under PSLF, But With No Specifics

According to a policy memo leaked to Politico last week, House Budget Committee members are considering a number of reforms to federal student loan forgiveness and repayment programs as part of a massive budget reconciliation bill primarily intended to extend expiring tax cuts. The budget reconciliation process would allow Republicans, who narrowly control both the House and the Senate, to bypass the senate filibuster and pass legislation on a party-line, majority vote.

The committee called out PSLF in the memo, although no specifics were provided on potential changes to the program.

“Reform Public Service Loan Forgiveness (PSLF),” reads a line-item on the memo. “This option would allow the Committee on Education and the Workforce to make much-needed reforms to the PSLF, including limiting eligibility for the program.” But the memo does not explain how student loan forgiveness eligibility might be limited, nor does it offer specifics on who would be impacted. The projected budgetary savings over a 10-year period is left as “TBD.”

How Student Loan Forgiveness Eligibility Under PSLF Could Be Limited

The memo is a proposal at this juncture, not draft legislation, so nothing has been finalized yet. In addition, while detailed elements of the College Cost Reduction Act, sponsored by Rep. Virginia Foxx (R-N.C.), are included in the policy memo (including a repeal of other federal student loan forgiveness programs), PSLF reforms are not part of that draft legislation. So, it is unclear what Republican lawmakers may be looking at in terms of limiting PSLF eligibility.

However, there is precedent for PSLF reform proposals. The Obama administration had proposed capping student loan forgiveness under PSLF at $57,000 for the fiscal year budget covering 2015 to 2017. The first Trump administration proposed a full repeal of PSLF in 2018. And several Republican lawmakers in Congress also proposed repealing PSLF legislatively at that time. None of these proposals wound up passing, and current borrowers may have been grandfathered into PSLF had they been enacted.

Memo Also Calls For Repealing Other Student Loan Forgiveness Programs

The House Budget Committee’s memo calls for significant changes to other federal student loan forgiveness programs, including a repeal of Biden-era regulatory changes to the Closed School Discharge and Borrower Defense to Repayment programs, which made it easier for borrowers to qualify for relief. The memo also suggests limiting the Education Department’s ability to draft new regulations that provide for significant amounts of student loan forgiveness outside of existing programs.

The memo also suggests making changes to other federal student loan programs, such as eliminating the Graduate PLUS and Parent PLUS programs. Under the proposal, these loan options would be gradually eliminated for new borrowers beginning on July 1, 2025, with full repeal altogether by 2028. Advocates have been critical of these proposals, saying it may force families to rely more on private student loans, which tend to have less flexibility and fewer repayment options than federal student loans.

The memo calls for eliminating interest subsidies, as well, for borrowers currently enrolled in school. That would mean that borrowers would wind up owing more than what they originally borrowed by the time that they graduate and enter repayment. “Currently, the government pays the interest that accrues on a student loan while the borrower is still enrolled in school full-time, essentially meaning the student does not have to pay interest on their loan while actively studying,” says the memo. “This policy option would eliminate this arrangement.”

Perhaps most significantly, the memo suggests a full repeal of all income-driven repayment plans including the SAVE plan (which is currently bogged down in litigation) as well as the ICR, IBR and PAYE plans, along with student loan forgiveness after 20 or 25 years in repayment. These plans would be replaced with a new income-driven repayment option that uses a similar formula as these plans, but only allows for loan forgiveness after a borrower has repaid a set total amount tied to the 10-year Standard plan. This could effectively keep borrowers in debt for much longer than the 25-year maximum term envisioned under current IDR options. The changes would apply to “loans originated after June 30, 2024,” according to the memo.

Regulatory Changes To PSLF Could Also Impact Student Loan Forgiveness

Even if PSLF reforms do not make it into the upcoming reconciliation bill, the Trump administration could take unilateral steps through the regulatory process to make changes to PSLF eligibility. For example, the Education Department could rewrite or repeal new rules that went into effect under the Biden administration in July 2023. These regulations expanded the definition of full-time, qualifying public service employment; allowed additional deferment and forbearance periods (primarily associated with national and military service) to count toward PSLF; and established a safe harbor provision (now commonly known as PSLF Buyback) to give borrowers a mechanism to get certain non-qualifying periods counted.

To change regulations that would reform student loan forgiveness under PSLF, the department would have to go through a formal legal process under the Administrative Procedures Act. The is a lengthy process that often can take a year or two. And changes that go too far could potentially lead to legal challenges.

The GOP is considering limiting student loan forgiveness for borrowers who work in public service jobs. This could have a significant impact on individuals who have dedicated their careers to serving their communities and the country.Currently, the Public Service Loan Forgiveness (PSLF) program allows borrowers who work in qualifying public service jobs, such as government or non-profit organizations, to have their student loans forgiven after making 120 qualifying payments. However, some Republicans argue that this program is too costly and may be subject to abuse.

Proposed changes to the program could include capping the amount of loan forgiveness available to public service borrowers or tightening eligibility requirements. This could make it more difficult for individuals to pursue careers in public service without being burdened by student loan debt.

Critics of these potential changes argue that limiting student loan forgiveness for public service borrowers could discourage individuals from pursuing careers in fields that are vital to the well-being of society. They also point out that the PSLF program was established to encourage individuals to work in public service jobs that may not offer competitive salaries.

As discussions continue about the future of the PSLF program, it will be important for policymakers to consider the impact that any changes could have on individuals who have chosen to dedicate their careers to public service. It remains to be seen how this issue will ultimately be resolved.

Tags:

- GOP student loan forgiveness

- Public service student loan forgiveness

- GOP student loan policy

- Student loan forgiveness restrictions

- GOP higher education policy

- Public service loan repayment

- Student loan forgiveness limitations

- GOP education reform

- Public service borrower restrictions

- GOP student debt policy

#GOP #Limit #Student #Loan #Forgiveness #Public #Service #Borrowers

The Borrowers Avenged – Paperback By Joe Krush – GOOD

The Borrowers Avenged – Paperback By Joe Krush – GOOD

Price : 3.78

Ends on : N/A

View on eBay

Looking for a thrilling read that will keep you on the edge of your seat? Look no further than “The Borrowers Avenged” by Joe Krush. This gripping paperback follows the story of a group of borrowers who seek revenge on those who have wronged them.Filled with action, suspense, and unexpected twists, this book is sure to captivate readers of all ages. Krush’s vivid storytelling and dynamic characters make for an unforgettable reading experience.

If you’re a fan of adventure and justice, be sure to add “The Borrowers Avenged” to your reading list. This page-turner is guaranteed to leave you wanting more. Get your copy today and dive into a world of excitement and retribution.

#Borrowers #Avenged #Paperback #Joe #Krush #GOOD,ages 3+

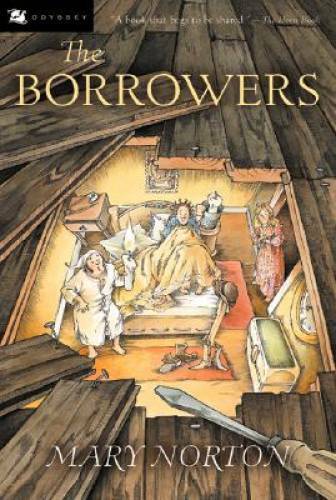

The Borrowers – Paperback By Norton, Mary – VERY GOOD

The Borrowers – Paperback By Norton, Mary – VERY GOOD

Price : 4.04

Ends on : N/A

View on eBay

Looking for a charming and whimsical read? Look no further than “The Borrowers” by Mary Norton. This classic children’s book follows the adventures of a family of tiny people who live under the floorboards of an old English house and “borrow” things from the human inhabitants.This paperback edition is in VERY GOOD condition, perfect for adding to your collection or gifting to a young reader. With its delightful storytelling and endearing characters, “The Borrowers” is sure to captivate readers of all ages.

Don’t miss out on this beloved tale of friendship, courage, and the magic of the everyday world. Get your hands on a copy of “The Borrowers” by Mary Norton today!

#Borrowers #Paperback #Norton #Mary #GOOD