Your cart is currently empty!

Tag: Corp

News Corp assures staff their data is secure despite Google AI opt-out issues — Capital Brief

News Corp has assured staff that their emails and contacts remain secure in an internal memo that took aim at Google for omitting key information that thwarted News Corp’s attempt to opt out of the search giant’s artificial intelligence tool, Gemini.

The memo puts News Corp — owner of Dow Jones and the Wall Street Journal, Harper Collins, The Sun, The Times of London, and other assets — among the largest known enterprise users of Google’s Workspace product, a competitor to Microsoft’s Office, to suffer issues with the search giant’s rollout of Gemini this month.

David Kline, News Corp’s chief technology officer, told staff in a memo on Friday that the company had attempted to opt out of Gemini but was unsuccessful due to what he described as an “omission” by the Alphabet-owned company.

Kline told News Corp’s 23,900 global employees, many of them journalists, that their data, including emails and contacts, had not been compromised and that Google Workspace remained safe to use.

News Corp, one of the world’s largest media conglomerates, has assured its staff that their data is secure despite ongoing issues with Google’s artificial intelligence opt-out feature. In a recent Capital Brief, the company reiterated its commitment to protecting employee data and privacy in light of concerns raised by recent developments in the tech industry.Google’s AI opt-out feature, which allows users to prevent the company from collecting personal data for targeted advertising purposes, has been met with skepticism and criticism from privacy advocates. Some have raised concerns about the potential for data breaches and unauthorized access to sensitive information.

In response to these concerns, News Corp has taken proactive measures to ensure the security of its employees’ data. The company has implemented strict security protocols and encryption measures to safeguard against potential threats. Additionally, News Corp has provided training and resources to help staff understand the importance of data privacy and the steps they can take to protect themselves online.

Despite the challenges posed by Google’s AI opt-out feature, News Corp remains confident in its ability to keep employee data secure. The company is committed to upholding the highest standards of data protection and privacy, and will continue to monitor and address any potential risks that may arise.

As the debate over data privacy and security continues to unfold, News Corp is taking a proactive and transparent approach to ensure the safety of its staff’s information. By prioritizing data security and privacy, the company is setting a positive example for others in the industry to follow.

Tags:

News Corp, data security, Google AI, opt-out issues, Capital Brief, staff assurance

#News #Corp #assures #staff #data #secure #Google #optout #issues #CapitalAnn Taylor Nude Cropped Career Tank Spaghetti Top Blouse Womens 10 Corp Business

Ann Taylor Nude Cropped Career Tank Spaghetti Top Blouse Womens 10 Corp Business

Price : 12.88

Ends on : N/A

View on eBay

Looking for the perfect top to elevate your work wardrobe? Look no further than this Ann Taylor Nude Cropped Career Tank Spaghetti Top Blouse in a women’s size 10. This chic and sophisticated top is perfect for corporate business settings, giving you a polished and professional look.The nude color is versatile and can be easily paired with a variety of bottoms, making it a great staple piece in your closet. The cropped length and spaghetti straps add a touch of femininity to your outfit while still maintaining a professional appearance.

Whether you’re heading to a business meeting, networking event, or just want to look put-together at the office, this Ann Taylor top is sure to impress. Don’t miss out on adding this stylish piece to your collection!

#Ann #Taylor #Nude #Cropped #Career #Tank #Spaghetti #Top #Blouse #Womens #Corp #Business,annAnn Taylor Womens Top Small Petite SP Green Lace Career Corp Classic Capsule

Ann Taylor Womens Top Small Petite SP Green Lace Career Corp Classic Capsule

Price :19.97– 15.98

Ends on : N/A

View on eBay

For sale: Ann Taylor Women’s Top Small Petite SP Green Lace Career Corp Classic CapsuleThis beautiful green lace top from Ann Taylor is the perfect addition to your career wardrobe. With its classic design and versatile color, it can easily be dressed up for a corporate meeting or dressed down for a casual day at the office.

Size: Small Petite (SP)

Color: Green

Material: LaceThis top is part of Ann Taylor’s Classic Capsule collection, known for its timeless pieces that never go out of style. Whether you’re looking to elevate your workwear or simply add a touch of sophistication to your everyday look, this top is sure to impress.

Don’t miss out on this chic and versatile piece – get it now before it’s gone! Price: $30

Message me if you’re interested or have any questions. Shipping available.

#Ann #Taylor #Womens #Top #Small #Petite #Green #Lace #Career #Corp #Classic #Capsule,annAnn Taylor Womens TOp Size 4 Black Velvet Silk Classic Retro Glam Evening Corp

Ann Taylor Womens TOp Size 4 Black Velvet Silk Classic Retro Glam Evening Corp

Price :29.97– 20.98

Ends on : N/A

View on eBay

“Get Ready to Shine in this Ann Taylor Women’s Top Size 4 Black Velvet Silk Classic Retro Glam Evening Corp!”Elevate your evening look with this stunning black velvet silk top from Ann Taylor. The classic retro glam design is perfect for any special occasion, whether it’s a holiday party, date night, or a night out with friends.

The luxurious velvet fabric adds a touch of elegance, while the sleek silhouette and timeless design ensure you’ll look effortlessly chic. The size 4 fit is flattering and comfortable, making it easy to move and dance the night away.

Pair this top with your favorite skirt or trousers for a sophisticated and stylish ensemble. Add some statement jewelry and heels to complete the look and turn heads wherever you go.

Don’t miss out on this must-have piece for your wardrobe. Shop now and be the best-dressed woman in the room!

#Ann #Taylor #Womens #TOp #Size #Black #Velvet #Silk #Classic #Retro #Glam #Evening #Corp,annVistra Corp. (VST) Dips More Than Broader Market: What You Should Know

Vistra Corp. (VST) closed the latest trading day at $191.11, indicating a -0.41% change from the previous session’s end. The stock’s performance was behind the S&P 500’s daily loss of 0.29%. Elsewhere, the Dow lost 0.32%, while the tech-heavy Nasdaq lost 0.5%.

Coming into today, shares of the company had gained 33.15% in the past month. In that same time, the Utilities sector lost 1.8%, while the S&P 500 gained 2.52%.

The investment community will be paying close attention to the earnings performance of Vistra Corp. in its upcoming release. The company’s earnings per share (EPS) are projected to be $1.07, reflecting a 322.92% increase from the same quarter last year. Meanwhile, our latest consensus estimate is calling for revenue of $4.32 billion, up 40.26% from the prior-year quarter.

Any recent changes to analyst estimates for Vistra Corp. should also be noted by investors. These revisions help to show the ever-changing nature of near-term business trends. Consequently, upward revisions in estimates express analysts’ positivity towards the company’s business operations and its ability to generate profits.

Our research suggests that these changes in estimates have a direct relationship with upcoming stock price performance. To capitalize on this, we’ve crafted the Zacks Rank, a unique model that incorporates these estimate changes and offers a practical rating system.

The Zacks Rank system, stretching from #1 (Strong Buy) to #5 (Strong Sell), has a noteworthy track record of outperforming, validated by third-party audits, with stocks rated #1 producing an average annual return of +25% since the year 1988. Over the last 30 days, the Zacks Consensus EPS estimate has witnessed a 1.09% decrease. Right now, Vistra Corp. possesses a Zacks Rank of #3 (Hold).

Looking at its valuation, Vistra Corp. is holding a Forward P/E ratio of 31.65. This valuation marks a premium compared to its industry’s average Forward P/E of 16.6.

We can additionally observe that VST currently boasts a PEG ratio of 1.82. The PEG ratio is akin to the commonly utilized P/E ratio, but this measure also incorporates the company’s anticipated earnings growth rate. Utility – Electric Power stocks are, on average, holding a PEG ratio of 2.61 based on yesterday’s closing prices.

The Utility – Electric Power industry is part of the Utilities sector. At present, this industry carries a Zacks Industry Rank of 94, placing it within the top 38% of over 250 industries.

The strength of our individual industry groups is measured by the Zacks Industry Rank, which is calculated based on the average Zacks Rank of the individual stocks within these groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Vistra Corp. (VST) Dips More Than Broader Market: What You Should KnowVistra Corp. (VST) recently experienced a dip in its stock price that was more significant than the broader market trend. This has left investors wondering what may have caused this drop and what they should do next.

One possible reason for Vistra Corp.’s decline could be related to industry-specific factors, such as changes in energy regulations or shifts in consumer demand for renewable energy sources. It’s also possible that the company’s financial performance or guidance may have fallen short of expectations, leading to a sell-off by investors.

Regardless of the specific reasons behind Vistra Corp.’s recent dip, it’s important for investors to stay informed and consider their options moving forward. This could include reassessing their investment thesis, consulting with financial advisors, or monitoring the company’s performance closely in the coming weeks.

While short-term fluctuations in stock prices are normal, it’s essential for investors to maintain a long-term perspective and make decisions based on thorough research and analysis. By staying informed and proactive, investors can navigate market volatility and make informed decisions that align with their financial goals.

Tags:

Vistra Corp, VST, stock news, market update, stock market dip, Vistra Corp analysis, Vistra Corp stock analysis, Vistra Corp stock dip, Vistra Corp market update, Vistra Corp stock news, VST stock analysis.

#Vistra #Corp #VST #Dips #Broader #MarketWhy Hedge Funds Are Bullish on Microsoft Corp (MSFT)

We recently compiled a list of the 10 Best Cloud Stocks To Buy According to Hedge Funds. In this article, we are going to take a look at where Microsoft Corp (NASDAQ:MSFT) stands against the other cloud stocks.

Based on a report by MarketsandMarkets, the global cloud industry in 2025 is projected to grow by 15.1% to $1,256.8 billion. While 2024 was marked by high adoption by the BFSI sector, the year ahead should see applications being developed that meet the unique specifications of each industry. North America and Europe should capture the bulk of the market size but APAC is expected to register the fastest growth. The integration of AI with cloud platforms accompanied by new service models is another key development expected to shape this industry.

Cloud ETFs have generated generous returns of 2.74%, 28.54% and 11.00% for 1-month, 6-month and 1-year tenors. One would assume that the underlying stocks would continue to perform well, propelled by strong industrial tailwinds.

READ ALSO 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In

For this article we picked 10 cloud stocks trending on latest news. With each stock we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

Microsoft Corporation (MSFT): Empowering Change Through AI for Good Initiatives A development team working together to create the next version of Windows.

Number of Hedge Fund Investors: 279

Microsoft Corp (NASDAQ:MSFT) has the second largest market share in the cloud computing niche with Azure having a market share of 23-25%. This segment has been growing by over 20%, driven by the increasing acceptance of AI services on the cloud platform. The revenue should reach $200 billion by 2028 and serves 85% of the Fortune 500 companies.

MSFT has entered into a revenue-sharing deal with OpenAI that would enable Azure to access OpenAI till 2030. This deal should benefit the Azure customers by providing them access to leading models. The estimated capex for supporting cloud systems and AI workload is $80 billion for the next fiscal. Half of this will be done in the US. Other key investments include a $3 billion investment in India to expand Azure cloud and AI capacity and major capacity expansion in the Middle East. While earnings in the next quarters are expected to slow, the investment in cloud and AI business should bear results from 2025.

Why Hedge Funds Are Bullish on Microsoft Corp (MSFT)Hedge funds are showing increasing interest in Microsoft Corp (MSFT) as the tech giant continues to deliver strong financial performance and innovate in key areas of the market. Here are a few reasons why hedge funds are bullish on Microsoft:

1. Strong Financial Performance: Microsoft has consistently reported strong financial results, with revenue and earnings growth in recent quarters. The company’s cloud computing segment, Azure, has been a major driver of revenue growth, with double-digit growth year over year.

2. Innovation and Product Development: Microsoft has been at the forefront of innovation in key areas such as artificial intelligence, cloud computing, and cybersecurity. The company’s focus on developing cutting-edge technology and products has not gone unnoticed by hedge funds.

3. Leadership and Management: Under the leadership of CEO Satya Nadella, Microsoft has undergone a successful transformation from a traditional software company to a cloud computing and services powerhouse. Hedge funds are confident in the company’s management team and their ability to drive future growth.

4. Market Position and Competitive Advantage: Microsoft holds a dominant position in key markets such as cloud computing, productivity software, and gaming. The company’s strong competitive advantage and market leadership position make it an attractive investment for hedge funds looking for long-term growth potential.

Overall, hedge funds are bullish on Microsoft Corp (MSFT) due to the company’s strong financial performance, innovation, leadership, and market position. As Microsoft continues to deliver strong results and drive innovation in key areas, hedge funds are likely to remain optimistic about the company’s future prospects.

Tags:

- Hedge funds

- Microsoft Corp

- MSFT

- Bullish

- Investment

- Technology

- Stock market

- Financial analysis

- Market trends

- Hedge fund strategies

#Hedge #Funds #Bullish #Microsoft #Corp #MSFT

INTEL CORP. SSDSC2KW512G8X1 545s Series 512GB 2.5 in

Price: $229.90

(as of Jan 17,2025 17:25:58 UTC – Details)

Intel 545s 512 Gb 2.5 Internal Solid State Drive – Sata – Retail

Intel 545s 512 Gb 2.5 Internal Solid State Drive – Sata – Retail

Looking for top-notch storage performance? Look no further than the INTEL CORP. SSDSC2KW512G8X1 545s Series 512GB 2.5 inch solid state drive. With lightning-fast read and write speeds, this SSD is perfect for gamers, content creators, and anyone in need of reliable storage.Upgrade your system with this high-quality SSD and experience faster boot times, quicker loading speeds, and improved overall performance. The 545s Series is known for its durability and reliability, making it a great investment for your PC or laptop.

Don’t settle for mediocre storage solutions – invest in the best with the INTEL CORP. SSDSC2KW512G8X1 545s Series 512GB 2.5 inch SSD. Upgrade your storage today and take your system to the next level.

#INTEL #CORP #SSDSC2KW512G8X1 #545s #Series #512GB,ssdpekkf512g8 nvme intel 512gbVistra Corp. (VST) Stock Drops Despite Market Gains: Important Facts to Note

The most recent trading session ended with Vistra Corp. (VST) standing at $169.17, reflecting a -0.79% shift from the previouse trading day’s closing. This change lagged the S&P 500’s daily gain of 1.83%. Meanwhile, the Dow gained 1.65%, and the Nasdaq, a tech-heavy index, added 2.45%.

Heading into today, shares of the company had gained 21.99% over the past month, outpacing the Utilities sector’s loss of 6.06% and the S&P 500’s loss of 3.31% in that time.

The investment community will be closely monitoring the performance of Vistra Corp. in its forthcoming earnings report. In that report, analysts expect Vistra Corp. to post earnings of $1.07 per share. This would mark year-over-year growth of 322.92%. Simultaneously, our latest consensus estimate expects the revenue to be $4.83 billion, showing a 56.78% escalation compared to the year-ago quarter.

Investors should also note any recent changes to analyst estimates for Vistra Corp. These latest adjustments often mirror the shifting dynamics of short-term business patterns. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Empirical research indicates that these revisions in estimates have a direct correlation with impending stock price performance. To exploit this, we’ve formed the Zacks Rank, a quantitative model that includes these estimate changes and presents a viable rating system.

The Zacks Rank system, running from #1 (Strong Buy) to #5 (Strong Sell), holds an admirable track record of superior performance, independently audited, with #1 stocks contributing an average annual return of +25% since 1988. Over the last 30 days, the Zacks Consensus EPS estimate has witnessed a 0.05% decrease. Right now, Vistra Corp. possesses a Zacks Rank of #3 (Hold).

In the context of valuation, Vistra Corp. is at present trading with a Forward P/E ratio of 28.12. This signifies a premium in comparison to the average Forward P/E of 16.13 for its industry.

Also, we should mention that VST has a PEG ratio of 1.62. The PEG ratio is similar to the widely-used P/E ratio, but this metric also takes the company’s expected earnings growth rate into account. The Utility – Electric Power was holding an average PEG ratio of 2.52 at yesterday’s closing price.

The Utility – Electric Power industry is part of the Utilities sector. Currently, this industry holds a Zacks Industry Rank of 138, positioning it in the bottom 46% of all 250+ industries.

The Zacks Industry Rank gauges the strength of our industry groups by measuring the average Zacks Rank of the individual stocks within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Vistra Corp. (VST) Stock Drops Despite Market Gains: Important Facts to NoteVistra Corp. (VST) stock recently experienced a drop in value despite overall market gains. This unexpected decline has left many investors puzzled and looking for answers. Here are some important facts to note about the situation:

1. Market Volatility: The stock market can be unpredictable, and fluctuations in stock prices are not uncommon. Vistra Corp. may be experiencing a temporary dip due to factors such as market volatility, investor sentiment, or industry trends.

2. Company Performance: It’s important to look at Vistra Corp.’s recent performance to understand the stock drop. Factors such as quarterly earnings, market share, and future growth prospects can all impact stock prices.

3. Industry Trends: The energy sector, in which Vistra Corp. operates, is subject to various external factors such as regulatory changes, competition, and market demand. These industry trends can influence stock prices in the short term.

4. Analyst Recommendations: It’s always a good idea to consult with financial analysts and experts to get a better understanding of the stock’s performance. Analyst recommendations and reports can provide valuable insights into the factors affecting Vistra Corp.’s stock price.

5. Long-Term Outlook: While short-term fluctuations can be concerning, it’s important to focus on the long-term outlook of Vistra Corp. and its potential for growth. Consider factors such as the company’s strategic initiatives, market positioning, and competitive advantage.

In conclusion, the recent drop in Vistra Corp. (VST) stock price may be a temporary setback, and investors should carefully evaluate the situation before making any decisions. By considering the factors mentioned above and conducting thorough research, investors can make informed decisions about their investments in Vistra Corp.

Tags:

Vistra Corp. stock, VST stock, market gains, stock market news, Vistra Corp. stock drops, stock market analysis, Vistra Corp. stock price, VST stock update, market performance, Vistra Corp. news, stock market trends, stock market update.

#Vistra #Corp #VST #Stock #Drops #Market #Gains #Important #Facts #Note

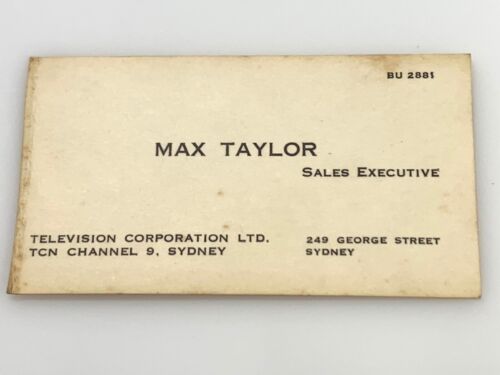

Vintage Business Card SALES EXECUTIVE TCN Ch. 9 Sydney Australia Television Corp

Vintage Business Card SALES EXECUTIVE TCN Ch. 9 Sydney Australia Television Corp

Price : 14.50

Ends on : N/A

View on eBay

Are you a collector of vintage business cards? Look no further! We have a rare find – a vintage business card from a Sales Executive at TCN Channel 9 in Sydney, Australia Television Corporation.This unique business card is a piece of television history, representing the booming industry in Sydney during that time. It features the classic logo of TCN Channel 9 and the title of Sales Executive.

Whether you’re a collector, a history buff, or just love unique pieces of memorabilia, this vintage business card is a must-have. Don’t miss out on this rare opportunity to own a piece of broadcasting history.

Contact us today to make this vintage business card yours!

#Vintage #Business #Card #SALES #EXECUTIVE #TCN #Sydney #Australia #Television #Corp,tcn

Is EQT Corp. (EQT) Standing Strong Amid Market Decline?

We recently published a list of 10 Firms Stand Strong Amid Market Decline. In this article, we are going to take a look at where EQT Corp. (NYSE:EQT) stands against other firms stand strong amid market decline.

The US stock market finished the day on a sour note anew amid the lack of fresh catalysts to spice up trading while investors repositioned their portfolios ahead of 2025.

On Monday, the Dow shed 0.97 percent or 418 points, while the S&P’s broad index decreased 0.95 percent or 56.48 points. Nasdaq Composite registered the biggest decline, down 1.19 percent or 235.24 points.

Despite losses, 10 companies managed to eke out gains, with those in the energy sector posting notable performance. Let’s explore why.

To come up with Monday’s top gainers, we considered only the stocks with at least $2 billion in market capitalization and $5 million in daily trading volume.

Is EQT Corp. (EQT) Standing Strong Amid Market Decline? A storage facility for natural gas, showing the vast reserves of this abundant energy source.

Natural gas producer EQT Corp. (NYSE:EQT) saw its share prices grow by 5.12 percent to finish Monday’s trading at $46.59 apiece.

Investor optimism was fueled by news of a spike in natural gas prices, spurred by higher electricity demand to beat the cold winter season, boding well for the company’s prospects.

In addition, EQT recently secured a fresh $3.5 billion in funding for its midstream joint venture from its affiliate Blackstone Credit & Insurance.

The company said proceeds from the transaction will be used to repay its term loan and revolving credit facility, as well as the bridge term loan facility that was used to fund the previously announced redemption and repurchase of certain senior notes of EQM Midstream Partners, LP.

Overall, EQT ranks 2nd on our list of firms stand strong amid market decline. While we acknowledge the potential of EQT as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than EQT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock

Disclosure: None. This article is originally published at Insider Monkey.

In the midst of a turbulent market environment, many investors are wondering if EQT Corp. (EQT) is able to weather the storm and remain strong. With the recent decline in global markets due to various factors such as the ongoing pandemic and geopolitical tensions, EQT Corp. has indeed faced some challenges. However, the company’s resilient business model and strategic initiatives have positioned it well to navigate through these uncertain times.One key factor contributing to EQT Corp.’s strength is its diversified portfolio of assets in the energy sector. The company’s exposure to different segments of the industry, including natural gas production and midstream operations, provides a buffer against market volatility. Additionally, EQT Corp. has been proactive in managing its costs and optimizing its operations to improve efficiency and profitability.

Furthermore, EQT Corp. has been making strategic investments in technology and innovation to drive long-term growth and sustainability. By leveraging data analytics and artificial intelligence, the company is able to make more informed decisions and enhance its operational performance. This focus on innovation has enabled EQT Corp. to stay ahead of the curve and adapt to changing market dynamics.

Overall, while EQT Corp. may face challenges in the short term due to market fluctuations, the company’s strong fundamentals and proactive approach to business management suggest that it is well-positioned to withstand the current market decline. Investors who believe in the long-term potential of the energy sector may find EQT Corp. to be a solid investment choice in these uncertain times.

Tags:

EQT Corp, EQT, market decline, economic downturn, energy sector, stock performance, financial stability, industry analysis, company resilience, market volatility, investment opportunities, oil and gas industry.

#EQT #Corp #EQT #Standing #Strong #Market #Decline