Your cart is currently empty!

Tag: Corporations

How Managed Service Providers Can Help Small Businesses Compete with Larger Corporations

In today’s competitive business landscape, small businesses often find themselves struggling to keep up with larger corporations that have larger budgets, more resources, and greater access to technology. However, with the help of managed service providers (MSPs), small businesses can level the playing field and compete more effectively with their larger counterparts.Managed service providers offer a wide range of IT services and support to businesses of all sizes, including small businesses. By outsourcing their IT needs to an MSP, small businesses can access the same level of expertise and technology that larger corporations use, without the high costs associated with hiring an in-house IT team.

One of the key ways that MSPs can help small businesses compete with larger corporations is by providing access to the latest technology and software solutions. MSPs are constantly staying up-to-date with the latest trends and developments in technology, allowing them to provide small businesses with cutting-edge solutions that can improve efficiency, productivity, and overall performance.

Additionally, MSPs can help small businesses improve their cybersecurity measures, which is crucial in today’s digital age where cyber threats are constantly evolving. By implementing robust cybersecurity measures, small businesses can protect their sensitive data and prevent costly data breaches that can damage their reputation and bottom line.

Furthermore, MSPs can also help small businesses streamline their IT operations and improve their overall efficiency. By outsourcing their IT needs to an MSP, small businesses can focus on their core business activities and leave the technical aspects to the experts. This can result in cost savings, increased productivity, and better overall performance.

Overall, managed service providers can play a crucial role in helping small businesses compete with larger corporations. By providing access to the latest technology, improving cybersecurity measures, and streamlining IT operations, MSPs can help small businesses level the playing field and achieve greater success in today’s competitive business environment. If you are a small business owner looking to compete with larger corporations, consider partnering with a managed service provider to help you achieve your business goals.

Here’s What to Expect From PPL Corporation’s Next Earnings Report

Valued at a market cap of $24.5 billion, PPL Corporation (PPL) is a leading energy company providing electricity and natural gas to millions of customers across the U.S. The company operates through three key segments: Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated, delivering both electricity and natural gas services to meet the diverse needs of its customer base. The Allentown, Pennsylvania-based company is expected to unveil its fiscal Q4 earnings results on Friday, Feb. 21.

Before the event, analysts anticipate the energy and utility holding company to report a profit of $0.39 per share, down 2.5% from $0.40 per share in the year-ago quarter. However, the company has surpassed Wall Street’s bottom-line estimates in the past four quarters. In the last reported quarter, PPL exceeded the consensus EPS estimate by a margin of 7.7%.

For fiscal 2024, analysts expect PPL to report EPS of $1.72, up 7.5% from $1.60 in fiscal 2023.

www.barchart.com

PPL’s shares have returned 27.8% over the past 52 weeks, slightly outperforming both the S&P 500 Index’s ($SPX) 26.5% gain. However, the stock has lagged behind the Utilities Select Sector SPDR Fund’s (XLU) 30.2% increase over the same period.

www.barchart.com

Despite reporting better-than-expected Q3 adjusted EPS of $0.42, shares of PPL fell 3.1% on Nov. 1 due to a miss on revenue expectations, with total revenue of $2.1 billion. Additionally, higher operating expenses and increased interest expenses weighed on the overall financial performance. Concerns regarding the rise in long-term debt to $16.5 billion, also added to investor worries. The narrowing of the 2024 earnings guidance range to $1.67 – $1.73 and subdued performance in the Pennsylvania Regulated segment contributed to the decline in stock price.

Analysts’ consensus rating on PPL stock is cautiously optimistic, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, opinions include 10 “Strong Buys,” two “Moderate Buys,” and four “Holds.” This configuration is more bullish than three months ago, with eight analysts suggesting a “Strong Buy.”

As of writing, PPL is trading below the average analyst price target of $35.62.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

PPL Corporation, a leading energy company, is set to release its next earnings report soon. Here’s what investors can expect from the upcoming report:1. Revenue Growth: Analysts are anticipating an increase in revenue for PPL Corporation, driven by strong performance in its utility segment and potential growth in its energy supply business.

2. Earnings Per Share: The company is expected to report solid earnings per share, supported by cost-saving initiatives and operational efficiencies.

3. Guidance: Investors will be keen to hear about PPL Corporation’s guidance for the remainder of the year and any strategic initiatives the company plans to undertake to drive growth.

4. Regulatory Updates: Given the regulatory environment in the energy sector, investors will be watching for any updates on regulatory approvals or changes that could impact PPL Corporation’s operations.

5. Sustainability Initiatives: PPL Corporation has been focusing on sustainability and clean energy initiatives. Investors will be interested in hearing about the company’s progress in this area and any new projects or partnerships in the pipeline.

Overall, investors can expect a strong earnings report from PPL Corporation, with potential growth opportunities and a focus on sustainable business practices. Stay tuned for the latest updates from the company’s earnings call.

Tags:

PPL Corporation, earnings report, financial performance, electricity generation, utility company, stock market analysis, earnings forecast, investor news, company updates.

#Heres #Expect #PPL #Corporations #Earnings #Report

What Does Boyd Gaming Corporation’s (NYSE:BYD) Share Price Indicate?

While Boyd Gaming Corporation (NYSE:BYD) might not have the largest market cap around , it saw a double-digit share price rise of over 10% in the past couple of months on the NYSE. The recent share price gains has brought the company back closer to its yearly peak. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. However, what if the stock is still a bargain? Today we will analyse the most recent data on Boyd Gaming’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis for Boyd Gaming

Good news, investors! Boyd Gaming is still a bargain right now. Our valuation model shows that the intrinsic value for the stock is $115.96, but it is currently trading at US$72.41 on the share market, meaning that there is still an opportunity to buy now. However, given that Boyd Gaming’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

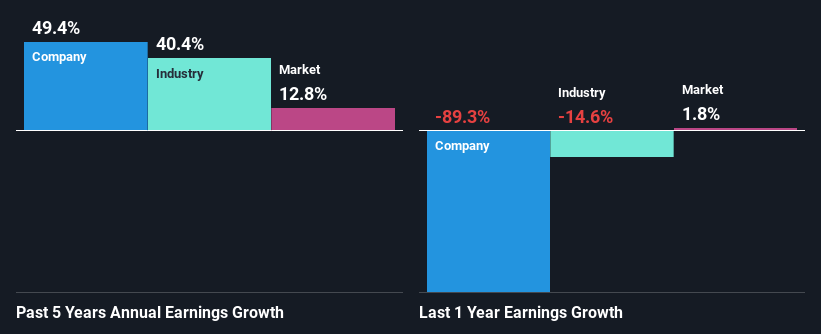

NYSE:BYD Earnings and Revenue Growth December 28th 2024 Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations. Boyd Gaming’s earnings growth are expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value.

Are you a shareholder? Since BYD is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on BYD for a while, now might be the time to enter the stock. Its prosperous future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy BYD. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed buy.

Keep in mind, when it comes to analysing a stock it’s worth noting the risks involved. In terms of investment risks, we’ve identified 3 warning signs with Boyd Gaming, and understanding these should be part of your investment process.

Boyd Gaming Corporation’s (NYSE:BYD) Share Price: What Does It Indicate?Boyd Gaming Corporation (NYSE:BYD) is a well-known player in the gaming and hospitality industry, with a portfolio of properties across the United States. As of [date], the company’s share price stood at [price], reflecting [percentage change] change from the previous trading day.

But what does Boyd Gaming Corporation’s share price indicate for investors? Here are a few key points to consider:

1. Market sentiment: The share price of a company like Boyd Gaming Corporation is often a reflection of market sentiment towards the stock. A rising share price may indicate positive sentiment and confidence in the company’s future prospects, while a falling share price may suggest concerns or negative sentiment.

2. Financial performance: Boyd Gaming Corporation’s share price can also be influenced by the company’s financial performance. Strong earnings, revenue growth, and profitability can drive the share price higher, while weak financial results may lead to a decline in share price.

3. Industry trends: The gaming and hospitality industry is subject to various trends and factors that can impact Boyd Gaming Corporation’s share price. Factors such as consumer spending, regulation, competition, and economic conditions can all influence the company’s performance and share price.

4. Analyst recommendations: Analysts covering Boyd Gaming Corporation often provide recommendations and price targets for the stock based on their analysis of the company’s fundamentals and industry outlook. Investors may consider these recommendations when evaluating the company’s share price.

Overall, Boyd Gaming Corporation’s share price is a key indicator of investor sentiment, financial performance, industry trends, and analyst recommendations. By closely monitoring these factors, investors can gain valuable insights into the company’s prospects and make informed investment decisions.

Tags:

Boyd Gaming Corporation, BYD, Share Price, Stock Analysis, NYSE, Financial News, Market Trends

#Boyd #Gaming #Corporations #NYSEBYD #Share #Price

Has EQT Corporation’s (NYSE:EQT) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

EQT’s (NYSE:EQT) stock is up by a considerable 25% over the past three months. We wonder if and what role the company’s financials play in that price change as a company’s long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on EQT’s ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company’s success at turning shareholder investments into profits.

View our latest analysis for EQT

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for EQT is:

1.5% = US$316m ÷ US$20b (Based on the trailing twelve months to September 2024).

The ‘return’ is the amount earned after tax over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.02 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company’s future earnings. We now need to evaluate how much profit the company reinvests or “retains” for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

A Side By Side comparison of EQT’s Earnings Growth And 1.5% ROE

It is quite clear that EQT’s ROE is rather low. Even compared to the average industry ROE of 15%, the company’s ROE is quite dismal. Despite this, surprisingly, EQT saw an exceptional 49% net income growth over the past five years. We reckon that there could be other factors at play here. For example, it is possible that the company’s management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that EQT’s growth is quite high when compared to the industry average growth of 40% in the same period, which is great to see.

NYSE:EQT Past Earnings Growth January 2nd 2025 The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). Doing so will help them establish if the stock’s future looks promising or ominous. If you’re wondering about EQT’s’s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is EQT Making Efficient Use Of Its Profits?

EQT has a really low three-year median payout ratio of 9.0%, meaning that it has the remaining 91% left over to reinvest into its business. So it looks like EQT is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Moreover, EQT is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Looking at the current analyst consensus data, we can see that the company’s future payout ratio is expected to rise to 19% over the next three years. However, EQT’s future ROE is expected to rise to 8.1% despite the expected increase in the company’s payout ratio. We infer that there could be other factors that could be driving the anticipated growth in the company’s ROE.

Summary

Overall, we feel that EQT certainly does have some positive factors to consider. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. With that said, the latest industry analyst forecasts reveal that the company’s earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company’s fundamentals? Click here to be taken to our analyst’s forecasts page for the company.

Valuation is complex, but we’re here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

EQT Corporation (NYSE:EQT) has been making headlines with its impressive stock performance in recent months, but many investors are left wondering if this surge has anything to do with the company’s fundamentals.The natural gas producer has seen its stock price skyrocket in the past year, fueled by a rebound in natural gas prices and increased demand for its products. Additionally, EQT has been focusing on cost-cutting measures and operational efficiencies, which have helped improve its bottom line and drive investor confidence.

However, some analysts are skeptical about the sustainability of EQT’s stock rally, suggesting that the company’s fundamentals may not fully support its current valuation. While EQT has made strides in reducing debt and improving its balance sheet, there are concerns about its ability to maintain this growth trajectory in the long term.

Investors should carefully consider both the company’s fundamentals and market trends before making any investment decisions in EQT Corporation. While its impressive stock performance is certainly noteworthy, it’s important to conduct thorough research and analysis to determine if this growth is truly sustainable.

Tags:

- EQT Corporation stock performance

- NYSE:EQT stock analysis

- EQT Corporation fundamentals review

- EQT stock price analysis

- EQT Corporation financial performance

- EQT stock value assessment

- EQT Corporation market analysis

- EQT stock growth potential

- EQT Corporation stock news

- NYSE:EQT investment analysis

#EQT #Corporations #NYSEEQT #Impressive #Stock #Performance #Fundamentals

Business Continuity : It Risk Management for International Corporations, Pape…

Business Continuity : It Risk Management for International Corporations, Pape…

Price :129.00– 67.22

Ends on : N/A

View on eBay

Business Continuity: IT Risk Management for International CorporationsIn today’s globalized world, international corporations face a myriad of challenges when it comes to managing IT risks. From cyber attacks to data breaches, the threat landscape is constantly evolving, making it crucial for businesses to have a robust business continuity plan in place.

In our latest white paper, we delve into the importance of IT risk management for international corporations and provide practical tips on how to mitigate these risks effectively. We discuss the key components of a solid business continuity plan, including risk assessment, incident response, and disaster recovery.

We also explore best practices for international corporations to ensure compliance with data protection regulations across different jurisdictions. With the increasing focus on privacy and security, it is more important than ever for businesses to prioritize IT risk management.

Whether your corporation operates in multiple countries or has a global customer base, having a comprehensive business continuity plan is essential to protect your assets and reputation. Download our white paper today to learn more about IT risk management strategies for international corporations.

Stay ahead of the curve and safeguard your business against potential threats with a proactive approach to IT risk management. Let us help you navigate the complex world of cybersecurity and ensure the continuity of your operations in an increasingly digital landscape.

Download our white paper now and take the first step towards strengthening your business continuity plan.

#Business #Continuity #Risk #Management #International #Corporations #Pape.., Disaster Recovery

Narrowing the Gap of Financial Fraud Detection in Corporations by Solomon Aborbie (2015-01-01)

Price: $9.95

(as of Dec 27,2024 12:36:30 UTC – Details)

ASIN : B01A0BQHWS

Publisher : The Educational Publisher / Biblio Publishing (January 1, 2015)

Language : English

Paperback : 121 pages

ISBN-10 : 1622492641

ISBN-13 : 978-1622492640

Narrowing the Gap of Financial Fraud Detection in CorporationsFinancial fraud is a serious issue that can have devastating consequences for companies and their stakeholders. Detecting and preventing fraud is crucial for maintaining the integrity of financial markets and ensuring the long-term success of businesses.

In recent years, there has been a growing awareness of the need for improved fraud detection measures in corporations. However, there is still a significant gap between the capabilities of fraud detection technologies and the evolving tactics of fraudsters.

To address this gap, companies must invest in advanced fraud detection tools and technologies that can keep pace with the changing landscape of financial fraud. This includes implementing data analytics, artificial intelligence, and machine learning algorithms to identify patterns and anomalies that may indicate fraudulent activity.

Furthermore, companies should prioritize employee training and awareness programs to educate staff about the risks of financial fraud and empower them to report suspicious behavior. Creating a culture of transparency and accountability within the organization is essential for detecting and preventing fraud.

By taking proactive steps to narrow the gap of financial fraud detection, companies can protect their assets, reputation, and bottom line. It is imperative that businesses stay vigilant and continuously adapt their fraud detection strategies to stay one step ahead of fraudsters.

– Solomon Aborbie (2015-01-01)

#Narrowing #Gap #Financial #Fraud #Detection #Corporations #Solomon #Aborbie

South-Western Federal Taxation 2025: Corporations, Partnerships, Estates, Trusts

South-Western Federal Taxation 2025: Corporations, Partnerships, Estates, Trusts

Price : 299.00

Ends on : N/A

View on eBay

In this post, we will dive into the latest edition of South-Western Federal Taxation 2025: Corporations, Partnerships, Estates, Trusts. This comprehensive textbook provides a thorough analysis of federal taxation laws and regulations that pertain to corporations, partnerships, estates, and trusts.The 2025 edition includes updated information on recent tax legislation changes, as well as case studies and examples to help students understand how these concepts apply in real-world scenarios. From tax planning strategies to compliance issues, this textbook covers a wide range of topics that are essential for anyone studying taxation law.

Whether you are a student, tax professional, or business owner, South-Western Federal Taxation 2025: Corporations, Partnerships, Estates, Trusts is a valuable resource for staying up-to-date on the latest tax laws and regulations. Stay tuned for more updates and insights from this authoritative textbook.

#SouthWestern #Federal #Taxation #Corporations #Partnerships #Estates #Trusts

American Jurisprudence 2d State and Federal Vol 18 A Corporations W Supplement

American Jurisprudence 2d State and Federal Vol 18 A Corporations W Supplement

Price : 27.99

Ends on : N/A

View on eBay

American Jurisprudence 2d State and Federal Vol 18 A Corporations W Supplement: A Comprehensive Guide to Corporate LawIn the complex world of corporate law, staying up-to-date on the latest legal principles and precedents is essential. That’s where American Jurisprudence 2d State and Federal Vol 18 A Corporations comes in.

This comprehensive volume delves into the intricacies of corporate law, covering everything from formation and governance to mergers and acquisitions. Written by legal experts, this authoritative resource provides in-depth analysis and insight into key issues facing corporations today.

But the legal landscape is constantly evolving, which is why the supplement included in this volume is so valuable. Updated regularly to reflect the latest developments in corporate law, the supplement ensures that you have the most current information at your fingertips.

Whether you’re a practicing attorney, law student, or business professional, American Jurisprudence 2d State and Federal Vol 18 A Corporations W Supplement is an indispensable resource for navigating the complexities of corporate law. Stay informed, stay ahead, and stay compliant with this essential guide.

#American #Jurisprudence #State #Federal #Vol #Corporations #Supplement

Second Year Flashcards: PMBR Evidence, Constitutional Law, & Corporations

Second Year Flashcards: PMBR Evidence, Constitutional Law, & Corporations

Price : 75.00

Ends on : N/A

View on eBay

Are you ready to tackle your second year law school subjects with confidence? Look no further than these PMBR flashcards for Evidence, Constitutional Law, and Corporations. With comprehensive coverage of key concepts and principles, these flashcards are the perfect study tool to help you ace your exams.Whether you’re struggling to understand the rules of evidence, grappling with complex constitutional law doctrines, or trying to make sense of corporate governance structures, these flashcards have got you covered. Packed with essential information and practice questions, they’ll help you master the material and excel in your classes.

Don’t wait until the last minute to start studying – get your hands on these PMBR flashcards today and take your second year law school experience to the next level. With these handy study aids in your arsenal, you’ll be well on your way to academic success.

#Year #Flashcards #PMBR #Evidence #Constitutional #Law #Corporations, Technical Support

Pearson’s Federal Taxation 2020 Corporations, Partnerships, Estat

Pearson’s Federal Taxation 2020 Corporations, Partnerships, Estat

Price : 8.48

Ends on : N/A

View on eBay

es & Trusts: A Comprehensive GuideLooking for a comprehensive guide on federal taxation for corporations, partnerships, estates, and trusts? Look no further than Pearson’s Federal Taxation 2020. This top-rated textbook provides a thorough analysis of the tax laws and regulations that govern these entities, making it an essential resource for tax professionals, accountants, and business owners.

With in-depth explanations of key tax concepts, detailed examples, and practical guidance on tax planning strategies, Pearson’s Federal Taxation 2020 is the ultimate reference for navigating the complex world of federal taxation. Whether you’re a seasoned tax professional or just starting out in the field, this book will help you stay up-to-date on the latest changes in tax laws and regulations.

Don’t let tax season overwhelm you – arm yourself with the knowledge and expertise you need to succeed with Pearson’s Federal Taxation 2020. Order your copy today and take your tax knowledge to the next level!

#Pearsons #Federal #Taxation #Corporations #Partnerships #Estat