Your cart is currently empty!

Tag: Deductions

IRS tax deductions changing in 2025

When you file your 2024 and 2025 taxes, the IRS says they’ve increased your standard deductions to bring some inflation relief.

WARNER ROBINS, Ga. — After emptying your wallets this holiday season, you may be eager to get some of that money back.

Tax season is weeks away, and it’s time where you either empty your pocket again or hope to get a refund.

“I love the tax world,” Roland Cliffe said.

Everyday, all year long Cliffe and his wife Pam work at the H & R Block Franchise on Moody Road. Cliffe works in tax preparation and IRS correspondence.

Every year, the amount you pay in federal taxes is based on your tax bracket.

“The tax brackets themselves, the percentages have not changed in quite a while. What seems to change every single year is the amount of money, the dollars that are being taxed in each bracket,” Cliffe said.

He says these changes are due to inflation.

Here are the brackets for the 2025 tax year (filed in 2024):

- Incomes over $609,350 ($731,200 for married couples filing jointly) – 37%

- Incomes over $243,725 ($487,450 for married couples filing jointly) – 35%

- Incomes over $191,950 ($383,900 for married couples filing jointly) – 32%

- Incomes over $100,525 ($201,050 for married couples filing jointly) – 24%

- Incomes over $47,150 ($94,300 for married couples filing jointly) – 22%

- Incomes over $11,600 ($23,200 for married couples filing jointly) – 12%

- Incomes of $11,600 or less ($23,200 for married couples filing jointly) – 10%

Cliffe says their average customer in Warner Robins falls in the 12% or 22% bracket. He says the jump is a big difference in tax.

“It doesn’t take a whole lot of dollars to go from the one to the other, a small raise and you’re there,” he said.

However, the IRS says there is good news. They plan to offer some relief. The agency increased their standard deductions. Single taxpayers and married couples filing separately will see a $4,600 deduction. For couples filing jointly, the deduction will be $29,200.

Cliffe says saving over time is also a good way to bring yourself some relief.

“It’s easier on the wallet by taking a few dollars along, rather than tax time. There’s the 1040. Your balance due is, “oh my goodness, $4000, I wasn’t expecting that,” he said.

He says H & R Block has programs to help you track your finances throughout the year, so you aren’t shocked by tax day.

“So many people say. I don’t think I can save anything. Well, let me tell you what, uh, you can’t afford not to save,” he said.

There’s more good news. Cliffe says if you filed a 2023 extension those were extended through May 2025.

Plus the IRS says deductions will go up again in 2026 when you file your 2025 taxes. Those deductions range from an additional 400 to 800 dollars in relief.

Are you prepared for changes to IRS tax deductions in 2025? The IRS has announced that there will be significant alterations to tax deductions starting in 2025. Stay informed and make sure you are taking advantage of all available deductions before these changes take effect. Keep an eye out for more information on how these changes could impact your tax returns in the coming years. #IRS #taxdeductions #2025changes

Tags:

IRS tax deductions, tax deductions 2025, IRS changes, tax deductions updates, tax deductions law, tax deductions news, IRS updates, tax deductions 2025, tax deductions changes, IRS tax deductions 2025.

#IRS #tax #deductions #changing

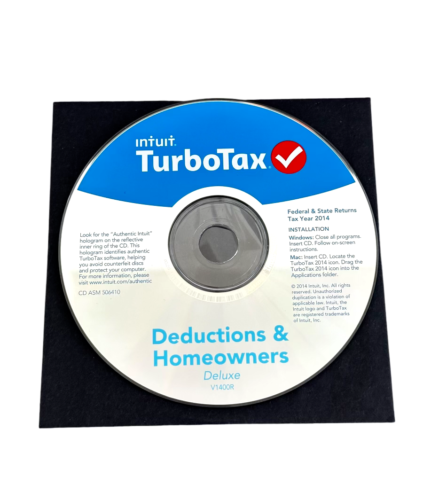

TurboTax Deluxe 2014 Deductions & Homeowners Federal & State Returns Windows&MAC

TurboTax Deluxe 2014 Deductions & Homeowners Federal & State Returns Windows&MAC

Price : 39.99

Ends on : N/A

View on eBay

Are you a homeowner looking to maximize your deductions for your 2014 taxes? Look no further than TurboTax Deluxe 2014! This software is perfect for those who want to easily navigate through their federal and state tax returns while taking advantage of all possible deductions.With TurboTax Deluxe 2014, you can easily input your information and the software will automatically find all available deductions for homeowners. This means you can potentially save more money and get a bigger refund on your taxes.

Whether you’re a Windows or MAC user, TurboTax Deluxe 2014 is compatible with both operating systems, making it convenient for everyone to use.

Don’t miss out on potential savings and deductions – get TurboTax Deluxe 2014 today and make tax season a breeze!

#TurboTax #Deluxe #Deductions #Homeowners #Federal #State #Returns #WindowsMAC