Your cart is currently empty!

Tag: Expect

‘I Expect Good Numbers And The Shorts Are Going To Continue To Be Routed’

We recently compiled a list of the Jim Cramer’s Game Plan: Top 14 Stocks to Watch. In this article, we are going to take a look at where SoFi Technologies, Inc. (NASDAQ:SOFI) stands against the other stocks.

Jim Cramer, the host of Mad Money, recently shared his thoughts on the upcoming earnings season, emphasizing that investors should tread carefully and avoid making any big moves.

“When people think about an exciting time for stocks, they think of the next two weeks, that’s when some of the most important consequential companies on Earth report, practically at the same time. Throw in the actions of the new president and all I can say is, we’re not gonna have any idea what the heck we’re doing until we have time, probably at night to sift through all the data points and study all the conference calls.”

READ ALSO Jim Cramer Looked At These 7 Stocks Recently and Jim Cramer Recently Shed Light on These 9 Stocks

Cramer stressed that the current week, in particular, is too difficult for snap judgments. He warned that the Federal Reserve’s decision on Wednesday will only add to the uncertainty. At one point, it seemed like the market could expect a rate cut, which would push stocks higher, but then Amex reported that its customers were spending at a rapid pace. He said:

“But when American Express says today that its millions of customers are spending like mad, the Fed can’t possibly give us a rate cut, can it?”

He added that if the Fed does lower rates on Wednesday, it would likely be because Chairman Jerome Powell has caved to President Trump’s demand for immediate cuts. In this complex situation, Cramer advised investors to just sit tight and not act, pointing out that it would be a “no-win situation” for Powell.

As if the pressure of earnings reports and the Fed’s decision were not enough, Cramer also noted that this week would feature the release of the Fed’s favored inflation measure, the Personal Consumption Expenditures (PCE) price index. However, Cramer does not expect good news, given the high level of consumer spending.

“The exhausting bottom line: Look it’s a sheer hell week. Our heads will be spinning, swivel-like, lazy Susan even, as each day you can expect a flood of earnings and a sound bite from President Trump that upsets whatever order there might be. Like I always say, don’t try to make decisions during this part of earnings season, just listen. It’s too hard and I don’t want you to lose money just because this is one of eight super exciting weeks of the year.”

Our Methodology

For this article, we compiled a list of 14 stocks that were discussed by Jim Cramer during the episode of Mad Money on January 24. We listed the stocks in the order that Cramer mentioned them. We also provided hedge fund sentiment for each stock as of the third quarter of 2024, which was taken from Insider Monkey’s database of 900 hedge funds.

In the world of investing, sometimes it’s all about expectations. And right now, I have high expectations for some good numbers coming our way. The shorts are going to continue to be routed as we see positive growth and potential in the market.With the economy rebounding and businesses starting to thrive again, it’s no surprise that investors are feeling optimistic. And with good reason – the numbers don’t lie. Earnings reports are coming in strong, and companies are exceeding expectations left and right.

As a result, those who have been betting against the market are getting squeezed. The shorts are feeling the pressure as the market continues to rally and push higher. And I expect this trend to continue as more and more positive news comes out.

So buckle up, because we’re in for a wild ride. I have high hopes for the future, and I fully expect good numbers to keep rolling in. And as for the shorts? Well, they better watch out because they’re going to continue to be routed.

Tags:

- Stock Market Predictions

- Market Analysis

- Short Selling

- Investment Strategies

- Financial Forecasting

- Stock Market Trends

- Market Volatility

- Trading Strategies

- Investment Opportunities

- Stock Market News

#Expect #Good #Numbers #Shorts #Continue #Routed

CrowdStrike’s Q4 2025 Earnings: What to Expect

Headquartered in Austin, Texas, CrowdStrike Holdings, Inc. (CRWD) is a global leader in cybersecurity, providing cutting-edge endpoint protection and threat intelligence to organizations worldwide. Known for its innovative Falcon platform, CrowdStrike helps businesses detect, prevent, and respond to sophisticated cyber threats. With a market cap of $92.3 billion, the company continues to drive advancements in cloud-based security solutions. CrowdStrike is set to release its Q4 earnings results on Tuesday, Mar. 4.

Ahead of the event, analysts expect CRWD to report a profit of $0.01 per share, down 95.8% from $0.24 in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters while missing on one other occasion. Its earnings of $0.08 per share for the last quarter surpassed the consensus estimate by a whopping 700%.

For fiscal 2025, analysts expect CRWD to report an EPS of $0.55, up 10% from $0.50 in fiscal 2024.

www.barchart.com CrowdStrike’s shares have gained 28.7% over the past year, outperforming the S&P 500 Index’s ($SPX) 22.9% gain and the Technology Select Sector SPDR Fund’s (XLK) 12.8% returns during the same period.

www.barchart.com CrowdStrike Holdings has outperformed the broader benchmark, fueled by robust revenue growth, consistent earnings beats, a strong position in the cybersecurity market, and optimistic management guidance.

Despite surpassing Wall Street expectations in its Q3 earnings report on Nov. 26, the stock fell 4.6% in the next trading session. The company reported $1.01 billion in revenue, a 28.5% year-over-year increase, beating estimates by 2.8%. Adjusted operating income reached $194.9 million with a 19.3% margin, exceeding forecasts by 15.1%, while Q4 revenue guidance of $1.03 billion aligned with expectations.

The consensus opinion on CRWD stock is bullish, with an overall “Strong Buy” rating. Of 44 analysts covering the stock, 34 advise a “Strong Buy” rating, three indicate a “Moderate Buy,” and seven suggest a “Hold.”

CRWD’s average analyst price target is $386.61, suggesting a potential upside of 3.4% from the current levels.

On the date of publication,did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy

here.

More news from BarchartThe views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

It’s that time of year again – earnings season is here, and investors are eagerly awaiting CrowdStrike’s Q4 2025 earnings report. As one of the leading cybersecurity companies in the market, CrowdStrike has been on a steady growth trajectory, with its stock price reaching new highs in recent months.So, what can investors expect from CrowdStrike’s upcoming earnings report? Here are a few key things to keep an eye on:

1. Revenue Growth: CrowdStrike has been consistently delivering strong revenue growth quarter after quarter, driven by the increasing demand for its cybersecurity solutions. Analysts will be looking to see if the company can continue this trend in Q4 2025 and exceed revenue expectations.

2. Profitability: While CrowdStrike has been growing its top line, investors will also be looking at the company’s bottom line. Can CrowdStrike maintain or improve its profitability in Q4 2025, or will increasing expenses impact its margins?

3. Customer Growth and Retention: CrowdStrike’s success is largely dependent on its ability to attract new customers and retain existing ones. Analysts will be looking for updates on customer acquisition and retention rates in the upcoming earnings report.

4. Guidance: Lastly, investors will be paying close attention to CrowdStrike’s guidance for the upcoming quarter and full year. Will the company provide optimistic guidance, signaling continued growth and momentum, or will there be any potential headwinds on the horizon?

Overall, CrowdStrike’s Q4 2025 earnings report is sure to be a key event for investors and analysts alike. Stay tuned for the latest updates and insights on CrowdStrike’s performance in the cybersecurity market.

Tags:

CrowdStrike, Q4 earnings, earnings report, financial results, cybersecurity, tech industry, stock market, investor analysis, revenue forecast, growth projections, market trends, earnings call, cybersecurity company, data protection, threat detection, cloud security, endpoint security

#CrowdStrikes #Earnings #ExpectHard-hitting Brockton true crime writer takes on Karen Read murder case. What to expect

BROCKTON — Brockton author Dave Wedge has signed a deal to write a book on the murder trials of Karen Read.

The commonwealth says Read struck her boyfriend, Boston Police Officer John O’Keefe, with her SUV outside the home of another Boston cop in Canton after a night of heavy drinking. Read’s lawyers argue that people inside the house killed him. The first trial ended in a hung jury. A second trial is scheduled for April. Read is charged with second-degree murder.

BenBella Books aims to publish “Cop Town: Scandal, Corruption and Murder in Suburban America” in 2026. The plan is to release the project in hardcover, paperback, e-book and audiobook.

Scenes from the courtroom during day 20 of Karen Read’s murder trial at Norfolk Superior Court in Dedham.

Wedge said the O’Keefe case is an important story with great public interest.

“It’s a story of a woman fighting for her life, a story of justice delayed for the O’Keefe family and a tale of how several families and communities have been torn apart in a very public fashion. It’s become a sensational national true crime story, but at the end of the day, it’s about the people involved, how it’s impacted their lives and most importantly, whether anyone will be held accountable for John O’Keefe’s death,” Wedge said.

Does Wedge think Read is guilty or innocent?

So, does Wedge think Read is guilty or innocent? He said the book won’t focus on whether she did it or not. “There’s a lot of questions on both sides,” Wedge said in a Friday phone call, saying the case has destroyed many lives.

Matthew Pervier of Worcester with a sign he made to support Karen Read as her murder trial started in Norfolk Superior Court in Dedham with jury selection on Tuesday April 16, 2024.

How many books has Wedge published?

Wedge has been busy. “Cop Town” will be his eighth book. His book on Brockton’s Marvelous Marvin Hagler is due out on June 17, he said. A Hagler movie based on the forthcoming book, to be directed by Sam Rockwell, is also in the works.

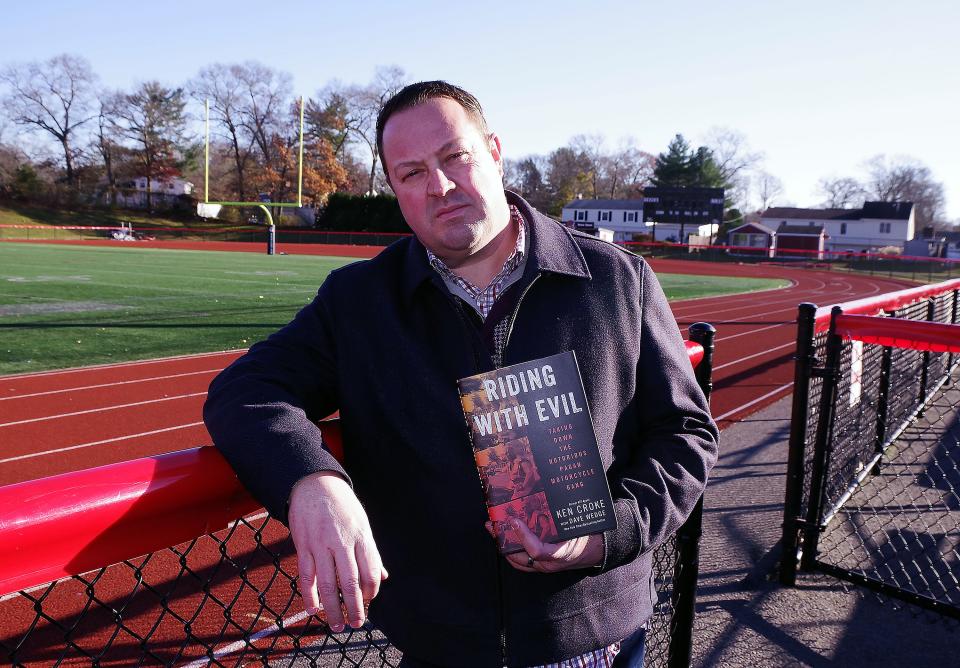

Writer Dave Wedge, a Brockton native and 1988 graduate of Brockton High School, with his book, “Riding With Evil” on Tuesday, Nov. 22, 2022.

Who is Dave Wedge, Brockton High alum?

Wedge went to Brockton Public Schools, including elementary at the Arnone and Brockton High. He became an investigative reporter for the Boston Herald before establishing himself as a New York Times best-selling author. His previous true-crime book, “Riding With Evil: Taking Down the Notorious Pagans Motorcycle Gang,” is in development as a feature film.

Wedge’s stories are no stranger to the silver screen. His 2015 book about the Boston Marathon bombing became the basis for “Patriots Day” starring Mark Wahlberg.

Send your news tips to reporter Chris Helms by email at CHelms@enterprisenews.com or connect on X at @HelmsNews.

This article originally appeared on The Enterprise: ‘Cop town’: Brockton’s Wedge to write book on Karen Read murder case

In this post, we will be diving into the world of true crime writing with a focus on Brockton’s very own hard-hitting author who is taking on the infamous Karen Read murder case. With a reputation for uncovering the gritty details and unraveling the mysteries behind some of the city’s most notorious crimes, this writer is sure to bring a fresh perspective to this chilling case.Readers can expect a gripping narrative that delves deep into the events surrounding Karen Read’s tragic death, shedding light on the key players, motives, and shocking twists that have kept this case unsolved for so long. With a keen eye for detail and a dedication to uncovering the truth, this writer is sure to leave readers on the edge of their seats as they follow along with the investigation.

So, buckle up and get ready for a wild ride as we explore the dark and twisted world of the Karen Read murder case through the eyes of Brockton’s most fearless true crime writer. It’s sure to be a riveting and unforgettable journey that will leave you questioning everything you thought you knew about this chilling crime.

Tags:

Brockton true crime writer, Karen Read murder case, true crime investigation, crime writer, Brockton murder case, Karen Read case, crime writer blog, crime writer investigation, Brockton crime writer, Karen Read murder mystery

#Hardhitting #Brockton #true #crime #writer #takes #Karen #Read #murder #case #expectMicrosoft earnings are coming. Here’s what to expect

Microsoft CEO Satya Nadella at CES 2024 on January 9, 2024 in Las Vegas, Nevada. – Photo: Ethan Miller (Getty Images) Microsoft (MSFT) is expected to report earnings results for the second fiscal quarter after the market closes on Wednesday.

The company’s stock was slightly down by about 0.6% at $444.06 per share at the end of the trading day on Friday.

The tech giant is expected to report revenues of $68.9 billion for the second quarter of fiscal year 2025, according to analysts’ estimates compiled by FactSet (FDS). Net income for the quarter ended in December is estimated to be $23.3 billion, while earnings per share is expected at $3.11.

In October, the company announced that its customers would be able to build their own autonomous agents in Copilot Studio that can “understand the nature of your work and act on your behalf.” Microsoft also announced 10 new autonomous agents for its enterprise platform, Dynamics 365, designed for workers in sales, service, finance, and the supply chain — with more planned.

Meanwhile, Microsoft has joined a slew of tech companies — including its longstanding partner, OpenAI — on a $500 billion artificial intelligence infrastructure project called Stargate, that was announced by President Donald Trump last week. Microsoft is one of the project’s “key technology partners,” OpenAI said.

The project builds upon Microsoft and OpenAI’s relationship, the startup said, adding that it plans to continue increasing its use of Microsoft’s Azure cloud computing service alongside “additional compute” from Stargate.

Microsoft said that its new agreement with OpenAI “includes changes to the exclusivity on new capacity” and will follow a model where Microsoft has the right of first refusal. The company is OpenAI’s largest investor, and had been its exclusive compute provider.

“To further support OpenAI, Microsoft has approved OpenAI’s ability to build additional capacity, primarily for research and training of models,” the company said.

Microsoft, one of the biggest tech companies in the world, is set to release its quarterly earnings report soon. As investors eagerly anticipate the results, here’s what to expect from the tech giant.1. Strong cloud computing growth: Microsoft’s cloud computing division, Azure, has been a major driver of growth for the company in recent years. With the increasing demand for cloud services due to remote work and digital transformation, analysts expect Azure to continue to show strong growth in the upcoming earnings report.

2. Office 365 and Teams usage: As more people work and learn from home, the usage of Microsoft’s productivity tools like Office 365 and Teams has surged. Analysts will be closely watching the usage metrics and subscription numbers for these services in the earnings report.

3. Gaming revenue: With the launch of the new Xbox Series X and Series S consoles, Microsoft’s gaming division is expected to show strong performance in the earnings report. The company has been investing heavily in gaming through acquisitions and new game releases, which could drive revenue growth in this segment.

4. Windows and Surface sales: As the PC market experiences a resurgence due to increased demand for laptops and desktops for remote work and learning, Microsoft’s Windows and Surface hardware sales are expected to show positive growth in the earnings report.

Overall, analysts are optimistic about Microsoft’s earnings report and expect the company to continue its momentum in the tech industry. Stay tuned for the official results and analysis once the earnings report is released.

Tags:

Microsoft earnings, Microsoft financial report, Microsoft stock performance, Microsoft quarterly earnings, technology industry news, Microsoft forecast, Microsoft revenue analysis, Microsoft market trends, Microsoft earnings report, Microsoft investor update

#Microsoft #earnings #coming #Heres #expectWhat To Expect in the Markets This Week

Key Takeaways

- Investors will be watching the Federal Reserve’s interest rate decision and comments from Chair Jerome Powel on Wednesday.

- New data releases on PCE inflation and U.S. GDP are also scheduled for this week.

- Magnificent 7 members Tesla, Meta Platforms, Microsoft and Apple are scheduled to report earnings.

- Earnings are also expected from AT&T, Intel, Caterpillar, Comcast, Visa and ExxonMobil.

Wednesday’s Federal Reserve interest-rate decision and a spate of closely watched earnings reports are among the top items scheduled for a busy week ahead for investors.

Fed Chair Jerome Powell will deliver remarks after the Fed meeting concludes, with investors listening for more clues about the path forward for rates with a new presidential administration now under way. Investors will also get updates for fourth-quarter gross domestic product and Personal Consumption Expenditures inflation data for December.

Several noteworthy companies are scheduled to report earnings, including Magnificent 7 members Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA) and Apple (AAPL). Updates from AT&T (T), General Motors (GM), Intel (INTC), Caterpillar (CAT), Visa (V) and ExxonMobil (XOM) are also on tap.

Monday, Jan. 27

Tuesday, Jan. 28

- FHFA Home price index (November)

- S&P Case-Shiller home price index (November)

- Consumer confidence (January)

- Durable-goods orders (November)

- Federal Open Market Committee meeting begins

- SAP SE (SAP), Stryker (SYK), RTX (RTX), Boeing (BA), Lockheed Martin (LMT), Starbucks (SBUX), Chubb (CB), Royal Caribbean (RCL), General Motors and Sysco (SYY) scheduled to report earnings

Wednesday, Jan. 29

- U.S. trade deficit (December)

- Wholesale inventories (December)

- Retail inventories (December)

- FOMC interest rate decision

- Fed Chair Jerome Powell press conference

- Microsoft, Meta Platforms, Tesla, ASML Holdings (ASML), T-Mobile US (TMUS), ServiceNow (NOW) and IBM (IBM) scheduled to report earnings

Thursday, Jan. 30

- Gross domestic product (Q4 and full year 2024)

- Initial jobless claims (Week ending Jan. 25)

- Pending home sales (December)

- Apple, Visa, Mastercard (MA), ThermoFisher (TMO), Shell (SHEL), Caterpillar, Comcast (CMCSA), Blackstone (BX), United Parcel Service (UPS) and Intel scheduled to report earnings

Friday, Jan. 31

- Employment cost index (Q4)

- Personal Consumption Expenditures price index (December)

- Chicago Business Barometer (January)

- ExxonMobil, AbbVie (ABBV), Chevron (CVX) and Colgate-Palmolive (CL) scheduled to report earnings

Investors Watching Fed Rate Decision, GDP, December Inflation Data

The Federal Open Market Committee (FOMC) is scheduled to meet this week, with officials considering whether to cut interest rates for a fourth consecutive meeting. Futures traders think a cut is unlikely, with persistent inflation and a strong labor market giving officials little room to reduce interest rates.

After the meeting, Fed Chair Jerome Powell is expected to take media questions, which could have an impact on market movements—especially if he offers details on how the Fed might proceed with further rate decisions this year.

On Thursday, the fourth-quarter and 2024 full-year gross domestic product measurement for the U.S. economy is scheduled to be released. The Atlanta Federal Reserve estimates that GDP growth will come in at 3% in the fourth quarter, an increase over the 2.8% economic growth measured in the third quarter.

The Friday release of the Personal Consumption Expenditures price index will show whether inflation continued to climb in December after moving up to an annual rate of 2.4% in November.

Investors will also get data on home prices and sales levels, retail inventories, jobless claims, employment costs and the U.S. trade deficit.

Tesla Joins Other Tech Titans in Busy Week of Earnings

Several high-profile companies are scheduled to release quarterly financial updates this week, including several members of the Magnificent 7 and top tech, energy, financial and manufacturing firms.

Magnificent 7 members Microsoft, Meta Platforms and Tesla are scheduled to report on Wednesday, while Apple is scheduled to release its financials Thursday.

Tesla’s report comes as its Chief Executive Officer Elon Musk has taken a role in the administration of President Donald Trump. The EV maker’s latest data on vehicle deliveries came in lower than analysts were expecting.

Microsoft’s scheduled report follows a stream of news of artificial intelligence funding initiatives, including last week’s announcement of a $500 billion AI initiative that includes Microsoft-backed OpenAI. Meta’s scheduled report comes as it lifted its projections on how much it would invest in emerging tech like AI. Apple’s scheduled report follows analyst downgrades driven by worries about demand for new iPhones.

Several other noteworthy tech firms are scheduled to release financials this week, including chipmaker ASML Holdings, IBM, Intel and ServiceNow.

Oil producers ExxonMobil, Chevron and Shell are scheduled to release quarterly financials amid optimism regarding energy policy under the new Trump administration. Expected reports from AT&T, T-Mobile and Comcast will give investors a look at the health of the telecommunications sector.

Expected earnings from Visa, Mastercard and SoFi this week could give market watchers a look at the health of consumers as debt levels have tapered back recently.

Boeing is scheduled to host its investor call on Tuesday after the aircraft maker released earnings data early last week. RTX and Lockheed Martin are also slated to release reports this week.

General Motors is scheduled to issue its quarterly financials on Tuesday, coming after it received an analyst upgrade based on recent moves like shuttering its Cruise robotaxi program.

As we kick off a new week in the markets, investors are bracing for a flurry of economic data releases and corporate earnings reports that could have a significant impact on stock prices. Here’s a rundown of what to expect in the markets this week:1. Economic Data: Key economic indicators to watch include the monthly jobs report, which will provide insights into the state of the labor market, as well as data on consumer spending, inflation, and manufacturing activity. Investors will be closely monitoring these reports for signs of economic growth and inflationary pressures.

2. Federal Reserve Meeting: The Federal Reserve is set to hold its regular policy meeting this week, where policymakers will discuss interest rates and the central bank’s monetary policy stance. Investors will be paying close attention to any signals from the Fed on its plans for interest rate hikes and its assessment of the economy’s recovery.

3. Corporate Earnings: A slew of major companies are scheduled to report earnings this week, including tech giants like Apple, Amazon, and Facebook, as well as financial institutions like JPMorgan Chase and Bank of America. These earnings reports will provide insights into the health of corporate America and could drive stock prices higher or lower.

4. Geopolitical Developments: Investors will also be monitoring geopolitical developments, including the ongoing conflict between Russia and Ukraine, as well as tensions in the Middle East and Asia. Any escalation in these geopolitical hotspots could roil markets and increase volatility.

Overall, investors should brace for a week of heightened volatility and potential market-moving events. It’s important to stay informed, diversify your portfolio, and be prepared for any unexpected developments in the markets. Stay tuned for updates as the week unfolds.

Tags:

- Market forecast

- Weekly market update

- Market trends

- Investment outlook

- Stock market analysis

- Economic indicators

- Market volatility

- Trading strategies

- Market news

- Financial analysis

#Expect #Markets #Week

Here’s when to expect your 2025 tax refund, how to track it

Tax season begins Monday.

That’s when the IRS officially starts accepting tax returns.

Many Americans are already counting on refunds. A recent survey conducted by Qualtrics for Intuit Credit Karma found that more than a third of taxpayers rely on their tax refunds to make ends meet. That rate was even higher, 50%, among millennials.

The survey of 1,000 U.S. adults also found, “of those who depend on their refund to make ends meet, nearly half (45%) say it’s because of the rising cost of living and necessities (i.e. housing, groceries). Others point to inflation (41%), living paycheck to paycheck (37%) and depleted savings (21%).”

Whether you’re among them or just want your money, here’s when you can expect your tax refund and how to track it.

Need a break? Play the USA TODAY Daily Crossword Puzzle.

Should you file your your own taxes?When to consider bringing in tax pros and how to find one

When should I expect my tax refund?

It depends on how you file your taxes and how you choose to receive your refund.

If you file electronically and your return is accurate and complete, the IRS says it should take less than three weeks to receive your refund and even less time if you choose direct deposit.

If you mail in a paper return, the refund should be issued within roughly six to eight weeks of the date the IRS receives the filing, again assuming it’s accurate and complete.

How do I track my refund for taxes?

Once you file your taxes, you can track your refund on the IRS website.

To do so, you’ll need your:

- Social Security number or individual taxpayer ID number (ITIN)

- Filing status

- Exact refund amount

The IRS says information is updated once daily, overnight. And once a refund is marked sent, “It may take 5 days for it to show in your bank account or several weeks for your check to arrive in the mail.”

If there is an issue with your tax return requiring more information or additional review, the IRS will send you a letter and your refund could be delayed.

As we approach the end of the year, many people are already thinking about their 2025 tax refund. If you’re wondering when you can expect to receive your refund and how you can track it, you’ve come to the right place.The IRS typically begins accepting tax returns in late January or early February each year. This means that if you file your taxes promptly, you could potentially receive your refund as early as mid-February. However, the exact timing of your refund will depend on several factors, including how you filed your taxes (electronically or by mail) and whether you opted for direct deposit or a paper check.

To track the status of your refund, you can use the IRS’s “Where’s My Refund?” tool on their website. Simply input your Social Security number, filing status, and the exact amount of your expected refund, and the tool will provide you with real-time updates on the status of your refund.

Remember, it’s important to file your taxes accurately and on time to avoid any delays in receiving your refund. If you have any questions or concerns about your tax return, don’t hesitate to reach out to a tax professional for assistance. By staying informed and proactive, you can ensure a smooth and timely refund process in 2025.

Tags:

2025 tax refund, tax refund tracking, tax refund timeline 2025, 2025 tax refund updates, IRS tax refund 2025, tax refund status 2025, track tax refund 2025, 2025 tax refund process, tax refund estimate 2025

#Heres #expect #tax #refund #trackHere’s What To Expect As Flights Begin—But Colombia Rejects Them

Topline

Colombia banned U.S. flights of deported migrants as the Trump administration said it has begun his promise to conduct the “largest deportation operation” in U.S. history—one of the first signs Trump’s plan could face pushback from migrants’ home countries.

The White House said the “largest deportation operation” in U.S. history was underway.

Key Facts

Colombian President Gustavo Petro said Sunday in a post on X the country would reject the flights, after reports that two U.S. military flights en route to Colombia were turned away, writing that “the US cannot treat Colombian migrants as criminals.”

Petro’s announcement comes after Mexico blocked a flight last week, a matter an unnamed White House official attributed to “an administrative issue” in a text message to NBC News.

The White House said deportation flights began Friday, after Immigration and Customs Enforcement made 538 arrests and lodged 373 detainees on Thursday, in addition to hundreds of “illegal immigrant criminals” who were flown out of the U.S. on military aircraft.

ICE made 308 arrests Tuesday, Trump’s first full day in office, Border Czar Tom Homan told Fox News, similar to figures under the Biden administration, which made 282 daily arrests on average in September, the last month for which data is available.

The administration says removals will pick up quickly, though: ICE and Border Patrol agents have been ordered to deport people who cross the border without authorization immediately and conduct “expedited removals” for people found within the interior of the United States, CBS reports, while major raids are expected in various cities.

Trump on Monday signed a string of executive orders targeting immigration: The military was ordered to the border, migrants can no longer make advance appointments with border officials and they must wait in Mexico while their asylum cases play out.

Trump also suspended the parole program for migrants from four countries and is attempting to restrict birthright citizenship for children of undocumented and non-permanent immigrants, though a judge on Thursday blocked the policy while legal challenges to the order work their way through the courts.

While Trump has said the deportations would begin “very quickly,” the operations will likely require Congress to approve additional funding, as ICE already faces a budget shortfall to maintain existing deportation levels in the current spending plan that expires on March 14, according to NBC.

There are also logistical hurdles like a limited number of beds to hold people in pre-deportation and planes to use for deportation flights, though Trump ordered the military to assist with aircraft and detention space—and removals are only possible if countries are willing to accept deportees, posing a challenge, especially for people from U.S. adversaries like Venezuela.

When Did The Mass Arrests And Deportations Start?

Deportation flights began Friday as the “largest deportation operation” in U.S. history was underway, according to the White House. It remains to be seen whether the number of deportations surpass the number under Biden—which was greater than the number under the first Trump administration.

Where Will The Deportations Happen?

The Trump administration is reportedly aiming to make examples of sanctuary cities—which have policies not to cooperate with the federal government on immigration enforcement—by conducting mass arrests there first, according to the Journal. NBC lists Chicago, New York, Los Angeles, Denver and D.C. as possible early targets, citing unnamed sources. Cities with large immigration shelter systems, including Los Angeles, Denver and Miami, are also targets, the Journal reported. ICE said it carried out a “targeted enforcement operation” in the sanctuary city of Newark, New Jersey, on Thursday, though it’s not immediately clear whether the operation was linked to the agency’s larger deportation efforts. A mass arrest operation was expected to begin in Chicago Tuesday, the day after Trump was inaugurated, the Wall Street Journal reported last week, citing unnamed sources familiar with the planning who said ICE would send 100 to 200 officers there to make the arrests. The operation does not appear to have come to fruition yet—and while recent ICE arrests have drawn publicity, it’s unclear if they are related to Trump’s plans.

Who Is Being Targeted?

Trump has repeatedly emphasized that migrants accused of crimes will be the initial targets for deportation, but he’s also said all migrants in the U.S. illegally could be subject to deportations. Homan has said ICE could arrest undocumented immigrants who aren’t suspected of crimes but were found near people who were ICE targets—known as “collateral arrests.” His administration expanded a policy that allows federal officials to expedite deportations for migrants who can not prove they have applied for asylum and have been in the U.S. for less than two years. Previously, officials were only allowed to process migrants for expedited removal who were apprehended within 100 miles of the border and could prove they had been in the U.S. for at least two weeks, but the expanded policy applies to the entire U.S. The American Civil Liberties Union has challenged the expanded expedited removal rule in court.

How Are Local Officials Preparing?

Leaders in sanctuary cities are taking a mixed approach. Some, including in New York City and Philadelphia, have softened their rhetoric against Trump’s hardline immigration policies, apparently aware that criticizing the initiatives could make them targets for raids. Philadelphia Mayor Cherelle Parker and District Attorney Larry Krasner did not answer directly when asked by NBC in recent days whether the city was a sanctuary city, for example. New York City Mayor Eric Adams has continued to own the label, but he has criticized the Biden administration as the city has dealt with an influx of migrants over the past year. Other local leaders in sanctuary cities, including in Chicago and Denver, have doubled down on their vows to protect migrants in the wake of Trump’s election. Denver Mayor Mike Johnston suggested that citizens and local police could team together to physically prevent ICE arrests, he told the Denverite last month.

Have Citizens Been Caught Up In Raids?

Newark Mayor Ras Baraka said Thursday that ICE agents raided a “local establishment” without a warrant and detained “undocumented residents” as well as some U.S. citizens. Among the detainees was a U.S. military veteran, who Baras said “suffered the indignity of having the legitimacy of his military documentation questioned.” ICE reportedly said the agency may encounter U.S. citizens while conducting operations and may request identification to “establish an individual’s identity,” citing the Newark raid.

Do Churches Provide Cover For Mass Deportations?

No. The Trump administration announced Tuesday it was cancelling a policy preventing ICE from making arrests in schools, churches and hospitals. The administration has also indicated it could conduct raids at workplaces, a tactic the Biden administration typically avoided.

How Does The Laken Riley Act Impact Deportations?

It subjects more people to immediate deportations by instructing federal officials to detain and deport undocumented migrants accused of minor crimes, such as shoplifting, before they’re actually convicted. It’s unclear how quickly ICE can begin implementing the law, which passed Congress on Wednesday, as the agency has said it needs an additional $27 billion in funding to carry out the new measures.

What Special Powers Has Trump Given Law Enforcement To Deport People?

In addition to empowering ICE to raid previously protected venues, Trump ordered the FBI, DEA, ATF, U.S. Marshals and the Bureau of Prisons to scan their databases for information on the possible whereabouts and identities of undocumented migrants in the U.S. The president also instructed federal officials to investigate local authorities that interfere with the new anti-immigration measures, according to a Justice Department memo sent Tuesday and obtained by NBC News.

How Is Mexico Preparing For Mass Deportations?

Border towns have begun to erect tents where migrants who travel to the border and realize they can not cross under the new Trump-era restrictions can take refuge, The Associated Press reported. The Mexican government is building shelters in nine border cities to receive deportees and will bus some people to their home cities, according to the AP.

How Much Will Mass Deportations Cost?

The pro-immigration American Immigration Council estimates a one-time push to deport all 11 million undocumented immigrants would cost $315 billion, while deporting one million people a year would cost $88 million annually. The operation could also have economic impacts, the group notes, including lost tax revenue, less consumer spending and labor shortages—especially in industries like agriculture and construction. Trump has defended the costs, saying there is “no price tag” for his mass deportation plans and “we have no choice.”

Further Reading

House Passes Laken Riley Act—Likely First Bill Trump Signs Into Law (Forbes)

Can Trump End Birthright Citizenship? What To Know After Judge Blocks Executive Order (Forbes)

As countries around the world slowly begin to reopen their borders and resume international travel, many are left wondering what to expect when it comes to flying during the ongoing COVID-19 pandemic. However, one country is taking a different approach.Colombia has announced that it will not be allowing any international flights to land in the country until at least September 1st, in an effort to prevent the spread of the virus. This decision has left travelers and airlines scrambling to make alternative plans.

While this news may come as a disappointment to those hoping to visit Colombia in the near future, it is a necessary precaution to ensure the safety and well-being of the country’s residents. As the situation continues to evolve, it is important for travelers to stay informed and be prepared for any changes that may arise.

In the meantime, airlines and airports around the world are implementing new safety measures and protocols to protect passengers and staff. From mandatory face masks to enhanced cleaning procedures, flying will look a bit different than it did before the pandemic. But with these precautions in place, travelers can feel more confident about taking to the skies once again.

As we navigate this new era of travel, it is important to stay flexible and adaptable. While the situation may be uncertain, one thing is for sure—our love of exploring the world will never waver.

Tags:

- Flights returning: What to expect as travel resumes

- Colombia’s decision on flight resumption

- Travel updates: Flights start but Colombia remains closed

- What to know about the reopening of flights

- Colombia rejects flights: What it means for travelers

- Flight resumption: Important updates and expectations

- Travel news: Colombia’s stance on flight resumption

- Prepare for travel as flights begin again

- Colombia’s rejection of flights: Impact on travel plans

- Flight resumption updates and Colombia’s decision

#Heres #Expect #Flights #BeginBut #Colombia #Rejects

What to Expect: Maryland at Indiana – Inside the Hall

Indiana will look to rebound from its second-half collapse against Northwestern when it hosts Maryland on Sunday at Simon Skjodt Assembly Hall. The Terps are top 25 in KenPom and beat Illinois 91-70 Thursday night at the State Farm Center.

Sunday’s game will tip at noon ET on CBS:

After Wednesday’s 79-70 loss at Northwestern, Indiana is now 1-3 in its last four games and facing its most challenging stretch of the regular season.

The next seven games for the Hoosiers are against teams ranked in the top 30 of KenPom. Up first is Maryland, which recorded its first road win this season at Illinois on Thursday night. The Terps beat the Illini 91-70 behind 27 points from Julian Reese and 25 from Derik Queen.

MEET THE TERRAPINS

After a disappointing 2023-24 season that ended with a 16-17 record, Kevin Willard retooled the Maryland roster for his third season at the helm.

The Terps are pushing the pace – they play the 64th fastest pace in the country – and force a ton of turnovers with their pressure.

The headlining newcomer is freshman McDonald’s All-American Derik Queen.

The 6-foot-10, 246-pound product of Montverde Academy chose Maryland over Indiana and has been dominant in his first (and likely only) season in College Park. Queen averages a team-high 15.6 points and is second in rebounding at eight per game.

Queen shoots an efficient 61.4 percent on 2s and is an excellent free throw shooter at 76.3 percent. With soft hands and terrific footwork, Queen has a high motor and his mobility makes him one of the most versatile bigs in the country.

Senior Julian Reese joins Queen in the starting frontcourt. The 6-foot-9, 252-pound big man is third on the team in scoring (13.7 ppg) and first in rebounding (9.2 rpg). Reese ranks in the top five in the Big Ten in offensive and defensive rebounding percentage. Reese shoots 57 percent on 2s and 71.9 percent from the line.

Maryland starts a three-guard set with three newcomers – South Florida transfer Selton Miguel, Belmont transfer Ja’Kobi Gillespie and Virginia Tech transfer Rodney Rice.

The 6-foot-1 Gillespie is one of the top guards in the Big Ten. He balances scoring (14.4 ppg) and playmaking (4.5 apg). Gillespie leads the Terps with 38 steals and has connected on a team-high 47 3-pointers. He shoots 42.3 percent for the season on 3s and is 44.6 percent from deep in Big Ten games.

Rice, a Maryland native, sat out last season after struggling as a freshman at Virginia Tech back in the 2022-23 campaign. He’s one of five Terps averaging in double figures at 12.1 points per game and shoots 57 percent on 2s, an excellent percentage. Rice is second on the team with 37 made 3-pointers.

Miguel is a fifth-year senior from Angola who played two seasons at Kansas State and two seasons at South Florida before using his final year of eligibility with the Terps. He’s shooting nearly 40 percent on 3s and averages 11.3 points per game.

The Terps didn’t use their bench much in the win at Illinois, as all five starters played at least 31 minutes.

The primary backup names to know are forward Tafara Gapare and guards Deshawn Harris-Smith and Jay Young.

The 6-foot-9 Garape transferred from Georgia Tech, can stretch the floor and is an efficient finisher. He’s making 61 percent of his 2s and 37.9 percent of his 3s in 13.8 minutes per game.

Harris-Smith started last season for the Terps but is now a reserve who has slightly improved his game. The 6-foot-5 guard is finishing better than a season ago – 55 percent on 2s versus 46.7 percent as a freshman.

Young played his freshman season at UCF, his sophomore season at Memphis and is now a backup for the Terps in year three of his career. He’s shooting 42.9 percent on 3s in 13.3 minutes per game.

TEMPO-FREE PREVIEW

All national rankings in the graphic below are updated through Thursday’s games.

Maryland is an elite defensive team, ranking in the top 20 nationally in KenPom’s adjusted defensive efficiency. Terrapin opponents turn the ball over on 21.9 percent of possessions, which ranks in the top 25 in the country. On average, Maryland forces 15.5 turnovers per game. That number stands out after Indiana turned it over 17 times in its loss at Welsh-Ryan Arena earlier in the week.

Maryland is also an excellent defensive-rebounding team. Its opponents grab just 25.9 percent of their missed shots, which ranks in the top 35 nationally. The Terps also defend well without fouling, as their opponents have mustered a free-throw rate (FTA/FGA) of 26.5 percent.

Offensively, Maryland is shooting 35.8 percent on 3s, 56 percent on 2s and 74.7 percent from the free throw line. Last season, those same numbers were 28.9/48.8/72, illustrating Willard’s roster upgrades in the offseason via high school recruiting and the portal.

Maryland also does an excellent job handling the ball. The Terps turn it over on 14.8 percent of their possessions, which ranks them in the top 30 nationally.

WHAT IT COMES DOWN TO

The KenPom projection is Maryland by four with a 36 percent chance of an IU victory. Bart Torvik likes the Terps by five with a 32 percent chance of a Hoosier win.

Maryland comes into Bloomington confident after dominating Illinois on its home court. The frontcourt duo of Queen and Reese is one of the best in the nation and the backcourt is much improved in year three of the Willard era.

Indiana’s last home game was ugly, as the Fighting Illini blew out the Hoosiers. Still, the Hoosiers have just one home loss and can remain in the NCAA tournament picture by winning home games. However, that task will become tough, as the next four games in Assembly Hall are against teams projected to make the 2025 NCAA tournament field.

With just 11 regular season games remaining, Indiana needs to start stacking wins to salvage a season that began with significant expectations that have not been met so far.

Filed to: Maryland Terrapins

As the Maryland Terrapins gear up to take on the Indiana Hoosiers, fans are eagerly anticipating what promises to be an intense and exciting matchup. Here’s what you can expect from this highly anticipated game:1. Key Players: Keep an eye on Maryland’s star guard Eric Ayala, who leads the team in scoring and is a threat from beyond the arc. Indiana’s Trayce Jackson-Davis is a force in the paint and will be a player to watch as he looks to dominate the boards and protect the rim.

2. Defensive Battle: Both teams are known for their strong defensive play, so expect a low-scoring and physical game. Maryland’s defense will look to disrupt Indiana’s offensive flow, while the Hoosiers will aim to contain the Terrapins’ scorers.

3. Coaching Matchup: Maryland’s Mark Turgeon and Indiana’s Mike Woodson are both experienced coaches who know how to make adjustments on the fly. Expect to see strategic decisions and tactical changes throughout the game as they try to outsmart each other.

4. Home Court Advantage: Indiana will have the home court advantage in this matchup, which could play a significant role in the outcome of the game. The Hoosiers’ loyal fan base will be loud and energized, creating a tough environment for the visiting Terrapins.

Overall, this game has all the makings of a thrilling and competitive showdown between two talented teams. Be sure to tune in to see how it all unfolds as Maryland takes on Indiana in what is sure to be a memorable clash on the hardwood.

Tags:

Maryland vs Indiana, Maryland basketball, Indiana basketball, Big Ten basketball, NCAA basketball, Maryland Hoosiers, Indiana Hoosiers, College basketball matchup, Game preview, Maryland vs Indiana predictions, Maryland vs Indiana analysis, Inside the Hall, Maryland vs Indiana breakdown, Key matchups, Player stats, Team records, College basketball news.

#Expect #Maryland #Indiana #HallHere’s What to Expect From PPL Corporation’s Next Earnings Report

Valued at a market cap of $24.5 billion, PPL Corporation (PPL) is a leading energy company providing electricity and natural gas to millions of customers across the U.S. The company operates through three key segments: Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated, delivering both electricity and natural gas services to meet the diverse needs of its customer base. The Allentown, Pennsylvania-based company is expected to unveil its fiscal Q4 earnings results on Friday, Feb. 21.

Before the event, analysts anticipate the energy and utility holding company to report a profit of $0.39 per share, down 2.5% from $0.40 per share in the year-ago quarter. However, the company has surpassed Wall Street’s bottom-line estimates in the past four quarters. In the last reported quarter, PPL exceeded the consensus EPS estimate by a margin of 7.7%.

For fiscal 2024, analysts expect PPL to report EPS of $1.72, up 7.5% from $1.60 in fiscal 2023.

www.barchart.com

PPL’s shares have returned 27.8% over the past 52 weeks, slightly outperforming both the S&P 500 Index’s ($SPX) 26.5% gain. However, the stock has lagged behind the Utilities Select Sector SPDR Fund’s (XLU) 30.2% increase over the same period.

www.barchart.com

Despite reporting better-than-expected Q3 adjusted EPS of $0.42, shares of PPL fell 3.1% on Nov. 1 due to a miss on revenue expectations, with total revenue of $2.1 billion. Additionally, higher operating expenses and increased interest expenses weighed on the overall financial performance. Concerns regarding the rise in long-term debt to $16.5 billion, also added to investor worries. The narrowing of the 2024 earnings guidance range to $1.67 – $1.73 and subdued performance in the Pennsylvania Regulated segment contributed to the decline in stock price.

Analysts’ consensus rating on PPL stock is cautiously optimistic, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, opinions include 10 “Strong Buys,” two “Moderate Buys,” and four “Holds.” This configuration is more bullish than three months ago, with eight analysts suggesting a “Strong Buy.”

As of writing, PPL is trading below the average analyst price target of $35.62.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

PPL Corporation, a leading energy company, is set to release its next earnings report soon. Here’s what investors can expect from the upcoming report:1. Revenue Growth: Analysts are anticipating an increase in revenue for PPL Corporation, driven by strong performance in its utility segment and potential growth in its energy supply business.

2. Earnings Per Share: The company is expected to report solid earnings per share, supported by cost-saving initiatives and operational efficiencies.

3. Guidance: Investors will be keen to hear about PPL Corporation’s guidance for the remainder of the year and any strategic initiatives the company plans to undertake to drive growth.

4. Regulatory Updates: Given the regulatory environment in the energy sector, investors will be watching for any updates on regulatory approvals or changes that could impact PPL Corporation’s operations.

5. Sustainability Initiatives: PPL Corporation has been focusing on sustainability and clean energy initiatives. Investors will be interested in hearing about the company’s progress in this area and any new projects or partnerships in the pipeline.

Overall, investors can expect a strong earnings report from PPL Corporation, with potential growth opportunities and a focus on sustainable business practices. Stay tuned for the latest updates from the company’s earnings call.

Tags:

PPL Corporation, earnings report, financial performance, electricity generation, utility company, stock market analysis, earnings forecast, investor news, company updates.

#Heres #Expect #PPL #Corporations #Earnings #Report