Your cart is currently empty!

Tag: Filing

IRS workers involved in tax season can’t take buyout until filing deadline

WASHINGTON (AP) — IRS employees involved in the 2025 tax season will not be allowed to accept a buyout offer from the Trump administration until after the taxpayer filing deadline, according to a letter sent Wednesday to IRS employees.

The letter says that “critical filing season positions in Taxpayer Services, Information Technology and the Taxpayer Advocate Service are exempt” from the administration’s buyout plan until May 15. Taxpayers have until April 15 to file their taxes unless they are granted an extension.

Union leaders and worker advocates have criticized the proposal and question whether the government will honor any buyout contract.

The news comes after President Donald Trump announced a plan to offer buyouts to federal employees through a “deferred resignation program” to quickly reduce the government workforce. The program deadline is Feb. 6, and administration officials said employees who accept will be able to stop working while still collecting a paycheck until Sept. 30.

The buyouts, sent to roughly 2.3 million workers, are for all full-time federal employees with some exemptions, including military personnel, employees of the U.S. Postal Service and positions related to immigration enforcement. It’s unclear if IRS workers who accept the buyout would only receive five months of pay instead or if they would also get a full eight months.

The federal government employed more than 3 million people as of November, accounting for nearly 1.9% of the nation’s entire civilian workforce, according to the Pew Research Center.

Doreen Greenwald, president of the National Treasury Employees Union, has advised all federal workers not to accept the offer, which she says is dubious.

“This is not a good deal for them,” Greenwald told The Associated Press. “If you sign this document and then later change your mind, you are left without any power to fight back.”

Since federal employees are working under what is called a continuing resolution that keeps the government funded until March — and the Anti-Deficiency Act prohibits agencies from spending more money than is actually appropriated— funding for the buyout plan “has not been approved,” Greenwald said.

She added: “I do not recommend people sign the document. They need to have control of their own career, and this document does not give it to them.”

The NTEU union represents roughly 150,000 employees in 37 departments and agencies.

“This country needs skilled, experienced federal employees,” she said “we are urging people not to take this deal because it will damage the services to the American people and it will harm the federal employees who have dedicated themselves and their career to serving.”

Jan. 27 is the official start date of the 2025 tax season and the IRS expects more than 140 million tax returns to be filed by the April 15 deadline.

“What most people don’t realize is that 85% of the federal workforce works outside of D.C.,” she said. “They’re your neighbors, your family, your friends. And they deliver key services for the American people.”

With tax season in full swing, many IRS workers are working tirelessly to process tax returns and assist taxpayers with their filings. However, there is an interesting twist this year – IRS workers involved in tax season are not able to take a buyout until after the filing deadline.This means that for many employees, their plans to take a buyout and move on to other opportunities will have to wait until after the April filing deadline. While this may be frustrating for some workers, it is necessary to ensure that the IRS has enough staff on hand to handle the influx of tax returns during this busy time.

Despite the delay in buyouts, IRS workers continue to work diligently to help taxpayers navigate the complexities of tax season. Their dedication and hard work are crucial in ensuring that tax returns are processed accurately and efficiently.

So, next time you interact with an IRS employee during tax season, remember to show them some appreciation for their hard work and dedication, even if they can’t take a buyout just yet.

Tags:

- IRS workers

- Tax season

- Buyout

- Filing deadline

- IRS employees

- Tax filing

- Tax season workers

- IRS buyout

- IRS news

- Tax season updates

#IRS #workers #involved #tax #season #buyout #filing #deadline

WWE Trademark Filing Hints At New Show – TJR Wrestling

A new WWE show could be coming very soon after a new trademark was filed.

It was reported in early 2025 that the WWE Level Up show that was taped before NXT tapings would no longer exist. In its place is a new version of the Evolve promotion. Dave Meltzer of the Wrestling Observer Newsletter revealed that former ROH and Evolve booker Gabe Sapolsky, who now works for WWE, will be heavily involved.

“Level Up is being replaced by something called NXT Evolve although not at the start of the year. We’ve heard to expect it in a few months. It’s a Gabe Sapolsky project and essentially would be people in developmental but not on NXT television regularly, like Level Up.

I think that instead of just matches, to do angles and promos and book it more like a television show. It will be shows taped only for television/streaming.”

The “Evolve” name looks to be involved because a trademark filing was made by WWE on January 30th. The trademark description reads like this:

Entertainment services, a show about sports, entertainment and general interest; entertainment services, namely, the production and exhibition of professional wrestling events rendered live and through broadcast media; entertainment services, namely on-going reality based programs; providing entertainment and sports news and information via a global computer network or commercial online service; entertainment services, namely, provision of information and news about sports, entertainment and general interest; providing a website in the field of sports, entertainment and general interest; production of multimedia programs; providing online photos and videos featuring sports and entertainment

There is no date announced for when Evolve or NXT Evolve will debut, but it will likely be in the months ahead.

New WWE Shows Set To Debut On A&E In February

There is already a lot of WWE content out there with Raw, SmackDown, and NXT providing live action every week, but there are also going to be shows on A&E starting on February 16th. The WWE LFG show will debut on February 16th with some all-time great superstars involved.

“Beginning Sunday, February 16th at 8pm ET, “WWE LFG”, an action-packed, competitive series, redefines what it takes to make it in WWE. Each week, sixteen WWE hopefuls push their limits to earn the ultimate prize: a coveted spot on NXT, WWE’s developmental series featuring the brightest rising stars in professional wrestling.

For the first time ever, viewers get an inside look at the grueling training process including intense in-ring matches and behind-the-scenes footage. The participants receive world-class coaching from iconic WWE Legends such as Undertaker, Booker T, Mickie James, and Bubba Ray Dudley. In addition to the legendary coaches, a pair of WWE Hall of Famers – Paul “Triple H” Levesque, WWE’s Chief Content Officer, and Shawn Michaels, WWE’s Senior Vice President of Talent Development Creative – help guide the competitors as they earn points for their electrifying performances.”

In addition to WWE LFG, there will also be WWE Rivals and WWE Greatest Moments airing on A&E as well.

WWE Trademark Filing Hints At New Show – TJR WrestlingIn a recent development, WWE has filed a trademark for a new show, sparking speculation among fans and industry insiders about what the company has in store. The trademark, filed under the name “WWE Elite Series,” has led to much excitement and anticipation for a potential new program.

While details about the show are still scarce, many are speculating that the “WWE Elite Series” could be a platform for showcasing some of the company’s top talent in a more exclusive and high-profile way. With WWE’s roster boasting a wealth of talent, fans are eagerly awaiting any news about how this new show will highlight their favorite superstars.

As we await more information from WWE about the “WWE Elite Series,” be sure to stay tuned to TJR Wrestling for all the latest updates and analysis on this exciting development. What do you think the “WWE Elite Series” could entail? Share your thoughts in the comments below!

Tags:

WWE, wrestling, WWE trademark filing, new show, TJR Wrestling, WWE news, wrestling rumors, sports entertainment, pro wrestling, WWE network, wrestling show

#WWE #Trademark #Filing #Hints #Show #TJR #WrestlingWhere is my refund check? What to know about filing federal, MS taxes

Already need your tax refund check? You’re not alone.

A study by Qualtrics on behalf of Intuit Credit Karma surveyed 1,000 people planning to file about how they feel about their taxes. About 37% said they needed their tax refund check to make ends meet. (It was half of millennials.)

About 27% of Americans said they’re planning a non-essential purchase with the money, but 47% said they want to pay down debt. More than 20% of Americans have more than $10,000 in debt as we start this tax season.

About 40% want to put the spare funds in savings. Many want to be prepared for things like a car breakdown or medical bill, but others just want a larger rainy day fund or nest egg.

But about 49% of Americans are expected to owe the government this year, not get a refund, and the main way people expect to pay is dipping into savings. According to Qualtrics, another 24% of Americans can expect tax refunds to be held because they are behind on paying specific debts like student loans, taxes or child support.

Here’s what you need to know about when you can file federal and Mississippi state taxes, how to check for refunds and when you’ll have to pay if you owe.

When I can file my federal taxes?

Tax season started on Monday, Jan. 27.

When is the federal tax deadline in 2025?

April 15 is the last day you can file without an extension. Unless the date is a weekend or holiday, Tax Day is always April 15.

Can I file my taxes for free?

Federal taxes can be filed for free with some tax preparers or online.

The IRS Direct File is available in 25 states. The program, which offers free online tax filing directly with the IRS, is not available in Mississippi this year.

What is a tax refund?

If you paid more taxes than you owe the government, according to the IRS, you get that back. Or you might qualify for a refundable credit.

You have to file your taxes to qualify, and you have three years to claim it.

How do I track my federal tax refund?

You can track your federal refund online at https://www.irs.gov/wheres-my-refund.

Or call 800-829-1954 for a current-year refund or 866-464-2050 for an amended return.

Have some information ready:

- Social Security number or individual taxpayer ID number (ITIN).

- Filing status.

- Exact refund amount.

When can I expect my federal refund?

According to the IRS, most refunds will go out within 21 days for online filers and six to eight weeks for paper filers. If the documents aren’t accurate or complete, there could be delays.

But they warn people not to plan a big purchase or assume it’ll pay a bill by a specific date. Wait until the money is in your hands.

Earned Income Tax Credits and Additional Child Tax Credits will start issuing in mid-February.

According to the IRS, it might take a few days after the payment is sent for an online payment to show up in your bank account.

When can I file Mississippi state taxes?

Electronic filing opened Monday, Jan. 27. The Mississippi Department of Revenue encourages anyone who can to file electronicially.

The most common paper return forms are also available at libraries around the state.

The deadline to file is April 15, 2025.

What if I get an extension on state taxes?

People who ask for an extension can file through Oct. 15, 2025. The Mississippi Department of Revenue reminds everyone that gives extra time to file, not to pay taxes due. Anything owed should be paid on or before April 15, otherwise you could also have to pay penalties and interest.

What about the big tax cut in the news?

The Mississippi House of Representatives passed a plan to get rid of the state income tax in January. Don’t get confused. you still have to pay taxes, and the proposal to gear down the state income tax isn’t fully approved by the legislature. The Senate would still have to OK the change, as of when this article was written. The bill also would cut down the existing grocery tax and create a new gas tax.

Even if approved, the decrease to income tax would be implemented step-down decreases over a few years.

The session is expected to close on Sunday, April 6.

How can I track my Mississippi state tax refund?

You can check it online at https://tap.dor.ms.gov/. Be sure to have your ID type and number ready along with your refund amount.

Contributing: Eve Chen

Bonnie Bolden is the Deep South Connect reporter for Mississippi with Gannett/USA Today. Email her at bbolden@gannett.com.

If you’re wondering “Where is my refund check?” after filing your federal and Mississippi state taxes, there are a few things you should know.1. Check your refund status online: The easiest way to track the status of your refund is by visiting the IRS website for federal taxes and the Mississippi Department of Revenue website for state taxes. You’ll need to provide your social security number, filing status, and the exact amount of your refund to access this information.

2. Allow time for processing: It can take several weeks for your refund to be processed and sent out. The IRS typically issues refunds within 21 days of receiving your tax return, while the Mississippi Department of Revenue may take a bit longer.

3. Double-check your information: If there are any errors or discrepancies on your tax return, it could delay the processing of your refund. Make sure all of your information is accurate and up to date before filing.

4. Consider direct deposit: Opting for direct deposit can speed up the process of receiving your refund. It’s a secure and convenient way to get your money without having to wait for a check to arrive in the mail.

5. Contact the appropriate agency: If you’ve waited longer than expected for your refund and still haven’t received it, you may need to contact the IRS or the Mississippi Department of Revenue for assistance. They can help track down your refund and provide more information on its status.

Remember to file your taxes accurately and on time to avoid any delays in receiving your refund. If you have any questions or concerns about your refund, don’t hesitate to reach out to the appropriate tax agency for assistance.

Tags:

- Refund check

- Federal taxes

- Mississippi taxes

- Filing taxes

- Tax refund

- Tax refunds 2021

- Tax filing tips

- Tax refund status

- Tax refund updates

- IRS refund status

#refund #check #filing #federal #taxes

What tax form means when filing in 2024

Did you just receive a form called a 1099-K, a form that you never, ever saw in your lifetime? Well, do not ignore any 1099-K that pops up. Take your time to understand this one.

More taxpayers will be bewildered when a 1099-K hits the mailbox this tax season. And the temptation might be to pitch it, which would be exactly the wrong thing to do.

This year, taxpayers will receive a 1099-K from payment card companies, payment apps, and online marketplaces when the amount of their business transactions during 2024 was more than $5,000.

“How many people have sold something online? Or otherwise taken a payment through an online app, like PayPal or Venmo?” asked Andy Phillips, vice president of The Tax Institute at H&R Block.

Plenty of people. But most people didn’t get a 1099-K in the past, Phillips said, because a “super high threshold” existed for issuing a 1099-K.

Need a break? Play the USA TODAY Daily Crossword Puzzle.

Under the old standard, the 1099-K was only sent to those who had received more than $20,000 and had more than 200 transactions on third-party payment processing platforms in 2023 and earlier years.

A lower threshold of $5,000 for 2024 means a bigger paper trail for the Internal Revenue Service to follow relating to taxable transactions.

This year, “a lot more people are going to get a 1099-K and not know what to do with it,” Phillips said.

The threshold is currently set to drop again in 2025, which means you’d receive a 1099-K during next year’s tax season if you have transactions for more than $2,500 this year.

Common examples for when people could be surprised by a 1099-K include selling concert tickets for substantially elevated prices, like those for the Taylor Swift Eras Tour, which ran through 2024.

Or maybe you sold football tickets online — such as Detroit Lions or Philadelphia Eagles tickets, another in-demand ticket — during the past season or the playoffs. You would have to have pushed above that $5,000 threshold in 2024 to receive a 1099-K for this tax season.

Resale platforms such as StubHub, Ticketmaster, Etsy, eBay, and others all list information online about when they’re sending out a 1099-K. But you’d want to know more about what’s taxable and what’s not.

The American Rescue Plan Act of 2021 revamped reporting requirements for third-party networks and initially was to trigger a 1099-K if you had more than $600 in transactions. We’ve not seen such a drastic change yet.

“The IRS has been delaying implementation,” said Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting in Riverwoods, Illinois.

The IRS is phasing in changes in the threshold, which, according to the IRS, would allow the agency to address the complex administrative challenges that will pop up once millions of additional 1099-K forms start being issued. The phase-in also gives taxpayers more time to adjust.

Right now, we’re set to hit that $600 threshold — the limit that the law technically requires — in 2026 and afterward to cover transactions that are more than $600.

Luscombe said it’s possible that Congress will change the law before the $600 threshold goes into place and raise the limit back up by some amount again to avoid an onslaught of 1099-Ks.

“People should start seeing 1099-Ks that they hadn’t been used to getting in the past,” Luscombe said.

What Trump says on ‘no tax on tips’

Republicans have been critical of the efforts by the IRS to delay a flood 1099-K forms hitting mailboxes, and at the same time GOP leaders are calling for repealing the American Rescue Plan Act provision involving the expansion of 1099-K paperwork to more taxpayers.

Jason Smith, chairman of the U.S. House Ways and Means Committee, posted a statement in October titled: “Will the IRS save Democrats from implementation of their own unpopular 1099-K surveillance scheme?”

The statement noted that gig workers use apps like Venmo and PayPal to sell services and receive tips and indicated that lowering the threshold to $600 would trigger a massive burden on more middle income taxpayers.

The Missouri Republican said the burden will be the hardest on taxpayers earning less than $200,000 a year.

“In fact, it will operate like an additional tax on tips — making life harder for hairdressers, Uber drivers, and other gig workers just trying to make a living,” Smith stated.

“If even the IRS is afraid to implement this monster, then repealing it is just common sense,” Smith said in October.

President Donald Trump on Jan. 25 said a legislative package he’s working on with Republican lawmakers to enact his domestic agenda will include his campaign pledge to eliminate taxes on tips.

White House and Republican congressional leaders are discussing using the budget reconciliation process to pass some broader proposals, including the extension of Trump’s Tax Cuts and Jobs Act of 2017, which is set to expire at the end of 2025, and initiating a no tax on tips rule.

More:Guide to 2024 taxes: W-2 arrival dates, 1099-K form confusion, free filing options

What’s taxable and what’s not

Granted, the IRS has noted, that all income, no matter the amount, is taxable unless it’s excluded by law whether a Form 1099-K is sent or not.

What taxpayers need to know, though, is that receiving the extra 1099-K paperwork does not mean you’re always dealing with a taxable situation. Yes, it could get really tricky.

You pay taxes on a gain, not a loss. And the 1099-K only shows your gross receipts. The number you see on the 1099-K might not be fully taxable.

You’d pay taxes on the profit, so you’d need to take into account what you paid for an item that you sold online too, such as Detroit Lions or Taylor Swift tickets, as well.

“Always remember that the amount reported on a tax form is not necessarily the full amount that’s taxable,” Phillips said.

If you sold something online, Phillips said, you probably paid something for whatever you sold. Or he said if you provided a service, you probably have expenses related to providing that service.

If you sell a designer handbag for $200 and you paid $500 for it, you’re not going to face a tax bill. You lost $300 on that deal.

On the other hand, the IRS notes, if you bought concert tickets for a $500 purchase price and sold them for $900 to someone else, you have a gain of $400. And the gain on a sale of a personal item is taxable.

A key point to know here: The loss on the sale of a personal item is not deductible. Don’t expect a tax break there.

The IRS notes online that if you had a seasonal crafts business and accepted money through payment cards or payment apps, you’d receive a 1099-K “for the gross payment amounts sent to you through the use of a payment card during the calendar year, no matter how much the total.”

“This reporting requirement for payment cards has not changed, and there is no minimum reporting threshold for these types of payment transactions,” the IRS states.

If the 1099-K shows the sale of a personal item that was sold at a loss, you’d have to reconcile that on your tax return.

You’d enter those amounts that were included in error or involving personal items sold at a loss at the very top line on Schedule 1 for 2024 returns. This area is even above the section called “Part 1: Additional Income.”

“The place at the top of Schedule 1 to enter incorrect 1099-K information is new,” Luscombe said.

More:Will I get a stimulus check now? IRS sending money to 1 million taxpayers

In addition, third-party networks might not necessarily know whether some transactions are personal transfers, such a money sent to a friend to split the cost of a meal, or taxable business deals, such as selling your football tickets online at a profit.

“You might get a 1099-K for a transaction that wasn’t even taxable,” Luscombe said.

One example of an amount included on a 1099-K in error, he suggested, might include a situation such as when a roommate reimburses you via a third-party payment provider for the rent you paid to a landlord if you covered the full cost.

It’s important not just to toss that 1099-K aside and ignore it. “The IRS would have gotten that also and won’t know it’s not taxable unless you tell them,” Luscombe said.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X@tompor.

As we approach the tax season in 2024, it’s important to understand what each tax form means when filing your taxes. Whether you’re a seasoned taxpayer or filing for the first time, knowing the ins and outs of tax forms can help you accurately report your income and deductions. In this post, we’ll break down the most common tax forms you may encounter and what they mean for your tax filing in 2024. Stay tuned for helpful tips and information to make this tax season a breeze!

Tags:

tax form, filing taxes, tax season 2024, tax preparation, IRS forms, tax filing tips

#tax #form #means #filingWhen can you file your taxes? Key dates for the 2025 filing season

Benjamin Franklin famously said that “death and taxes” are the only two certainties in this world.

Well, the timing of the first certainty is unclear. But you can reliably count on tax season to roll around at the same time every year, and for taxpayers in the United States, it’s about to get underway.

Some Americans may be ahead of the game, having filed their returns already with the Internal Revenue Service, while many others may be looking to procrastinate it as long as possible.

But it’s important to keep track of the filing deadline, including for when to request an extension. And of course, everyone wants to know when they can expect the modest windfall that could come from a refund.

Here are key dates to know for the 2025 tax filing season.

Need a break? Play the USA TODAY Daily Crossword Puzzle.

Tax filing season:Is it better to pay someone to do your taxes or do them yourself?

When does the 2025 tax season start?

Tax season officially starts Monday, Jan. 27.

But that does not mean you can’t get started on your tax filing now.

While Monday is the first day the IRS will begin accepting tax returns for the 2024 tax year, Americans can file their taxes even earlier to ensure their return is in the queue and among the first to be processed by the IRS.

When is the 2025 tax deadline?

This year’s deadline will fall on the traditional date of April 15.

Tax Day always falls on that date, unless April 15 is a weekend or holiday. This year, it comes on a Tuesday.

What is the deadline to file an extension?

The deadline to file for an extension is April 15, according to the IRS. That gives taxpayers until Oct. 15 to file without penalties.

For people affected by natural disasters, the extension is automatically given.

Extension requests can be done through the IRS at no charge – both electronically and with a paper form 4868 – and require taxpayers to simply provide basic information like their names, home addresses, Social Security numbers and payment, if they owe anything. But because the extension only applies to filing a tax return, taxpayers must still pay any taxes owed by the April 15 deadline.

What happens if I miss the tax deadline?

For people who forget or miss the deadline altogether, the standard penalty is 5% of the tax due for every month the return is late, up to 25% of the unpaid balance.

A smaller penalty of 0.5% is added if you file a return but fail to pay any taxes you owe, or if you get an extension on your return but fail to pay your owed taxes.

How fast are refunds issued?

You can expect your tax refund in a month or less, in most cases.

The IRS says it issues most refunds within 21 calendar days. Paper returns, however, can take four weeks or more.

The Where’s My Refund? tool, which is updated each night, is the simplest way to track your refund within 24 hours of e-filing. For taxpayers who filed a paper return, refund information is normally available after four weeks.

How many people file their taxes every year?

More than 163 million tax returns were received in 2024, a 0.9% increase compared to 2023, according to the IRS.

The IRS said it expects more than 140 million individual tax returns for tax year 2024 to be filed ahead of the April deadline.

Contributing: Medora Lee, Daniel de Visé, USA TODAY

As we approach the new year, many people are already thinking about filing their taxes. It’s important to know the key dates for the 2025 filing season so you can stay organized and on track. Here are the important dates to keep in mind:January 1, 2025: The IRS begins accepting e-filed tax returns for the 2025 tax year.

January 27, 2025: The IRS begins processing paper tax returns.

April 15, 2025: This is the deadline for filing your tax return and paying any taxes owed. If you need more time, you can request an extension until October 15, 2025, but remember that this only extends the time to file your return, not to pay any taxes owed.

October 15, 2025: This is the deadline for filing your tax return if you requested an extension.

It’s important to note that these dates may vary slightly depending on weekends and holidays, so be sure to double-check the IRS website for any updates or changes. Make sure to gather all your necessary documents and start preparing early to avoid any last-minute stress. Happy filing!

Tags:

- Tax filing deadlines 2025

- Key dates for filing taxes 2025

- Tax season 2025 dates

- Important tax deadlines 2025

- When to file taxes in 2025

- IRS filing dates 2025

- Tax preparation schedule 2025

- Tax season calendar 2025

- Tax return deadlines 2025

- Filing season timeline 2025

#file #taxes #Key #dates #filing #season

Tax Filing: Two Details That Could Speed Up Delivery of IRS Refunds

Americans could speed up the timeline of receiving tax refunds this year if filers follow two important steps.

Why It Matters

Taxes can begin to be filed on January 27, but tax refunds could hit filers’ accounts at different times depending on choices made when filing.

What Tax Year Are We Filing for in 2025?

In 2025, the tax season applies for income earned in 2024. That means every taxpayer who files between January 27 and April 15 should fill out forms based on the money they made in the prior year.

When Is the Earliest I Can File My Taxes?

The tax season doesn’t officially start until January 27. At that point filers can start filing in order to get refunds as early as possible.

Taxpayers should keep in mind that they might have to wait for employers to send the applicable W2 form to fill out the information required on a tax return.

A sign marks the entrance to the U.S. Internal Revenue Service (IRS) headquarters building on September 15, 2024, in Washington, D.C.

J. David Ake/Getty Images

Where Is My Refund From the IRS?

The Internal Revenue Service tends to accept tax returns within 48 to 72 hours. At that point, Americans will likely wait between two and three weeks for refunds to show up.

To track the status of an individual refund, filers can use the IRS’s “Where’s My Refund” tool on IRS.gov or the IRS2Go mobile app.

The refund status will be available within 24 hours after an e-filed return is received.

Tips for Filing

There are several ways to expedite a tax return hitting a bank account.

For one, filers should e-file taxes as this speeds up the process by taking information straight into the IRS system rather than relying on paper forms.

Additionally, taxpayers should sign up for direct deposit, which leads to refunds arriving sooner. Filers can also choose to split the refund into several accounts, according to the IRS.

How Long Does It Take for Tax Refund To Show In My Bank Account After It Was Approved?

Tax refunds should show up within 21 days of the IRS accepting a tax return. However, that process can be expedited if a filer opts for e-filing and direct deposit for their return.

The average tax refund in 2024 was roughly $3,050 for tax year 2023. That was a 5 percent jump from the prior year, according to the IRS.

What Is the Standard Deduction for the 2024 Year?

The standard deduction for tax year 2024 is $14,600 for single filers and $29,200 for those married filing jointly.

This refers to the set amount a person can subtract from their income to reduce how much of an income is taxed.

What People Are Saying

Drew Powers, the founder of Illinois-based Powers Financial Group, told Newsweek: “Getting the biggest refund in the shortest amount of time is a two-step process. First, prepare ahead of time to file by gathering last year’s returns and schedules and gathering all of this year’s forms: W-2 for employment wages, 1099 for self-employed income, dividends and interest, 1098 for mortgage interest, 1095-A for health insurance, charitable donation receipts, and so on. Being organized makes the process of preparing a return go much faster. Second, always use e-filing and direct deposit. The IRS reports these combined methods have a turnaround time of about 21 days versus 6 to 8 weeks when done on paper and a mailed check.”

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “File early and virtually. For all the grief it receives, the IRS has become more efficient at issuing refunds since the e-file option has become the preferred method for millions of Americans. Direct deposit normally ensures a faster processing time of up to a week earlier. Also, using tax preparation software that verifies what you’ve entered and alerts you to any potential errors is pivotal in ensuring there’s not a delay in your refund being processed.”

What Is the Deadline to File?

While the tax season is just getting started, Americans only have a few months to get returns submitted on time.

The deadline is April 15 unless an IRS approved extension is attained.

How To Extend Tax Filing

There are several ways to extend the tax filing deadline to avoid facing legal or financial trouble with the IRS.

To request an automatic filing extension using IRS Free File, Form 4868 can be filed online. This is the Application for Automatic Extension of Time to File.

On that form, a filer needs to estimate the amount of taxes owed for the year.

Tax season is upon us, and one thing that everyone looks forward to is getting their IRS refund as quickly as possible. While the IRS typically processes refunds within 21 days of receiving a tax return, there are a few key details that could help speed up the delivery of your refund even further.The first detail to keep in mind is the method of filing your taxes. While paper filing is still an option, filing electronically is the fastest and most secure way to submit your tax return. E-filing allows the IRS to process your return much quicker than if you were to mail in a paper return. Additionally, choosing direct deposit for your refund instead of a paper check can also speed up the delivery process.

The second detail that can help expedite your refund is making sure all of your information is accurate and up to date. This includes double-checking your Social Security number, bank account information, and any other personal details that may be required on your tax return. Any errors or discrepancies could delay the processing of your refund, so it’s important to take the time to review your return before submitting it.

By filing electronically and ensuring that all of your information is accurate, you can help speed up the delivery of your IRS refund and get your money back in your pocket sooner. So don’t wait, file your taxes as soon as possible and take advantage of these two details to expedite the process.

Tags:

tax filing, IRS refunds, tax refunds, tax preparation, tax tips, tax deductions, income tax, tax season, tax refund status, tax refund process, tax refund timeline, tax refund delays, tax refund updates.

#Tax #Filing #Details #Speed #Delivery #IRS #RefundsIs Joann closing? What to know after second bankruptcy filing

Joann, an 82-year-old fabric and craft retailer, announced it has filed for Chapter 11 bankruptcy for a second time within a year due to financial and inventory issues.

The company originally announced in March 2024 that it had filed for bankruptcy protection in Delaware after securing around $132 million in new financing, which was expected to reduce its $1 billion total debt by about $500 million. On Wednesday, the Ohio-based retailer released a statement about the second bankruptcy filing and its intention to “facilitate a sale process to maximize the value of its business.”

“Since becoming a private company in April, the Board and management team have continued to execute on top-and bottom-line initiatives to manage costs and drive value,” Michael Prendergast, interim CEO of Joann, said. “However, the last several years have presented significant and lasting challenges in the retail environment, which, coupled with our current financial position and constrained inventory levels, forced us to take this step.”

Despite announcing the commencement of voluntary Chapter 11 proceedings, Joann said its stores and website are “open in the ordinary course and continue to serve customers.”

Here is what to know about Joann’s bankruptcy filing and what could come next for the struggling retailer.

What does the bankruptcy mean for Joann?

Joann is seeking court approval to sell substantially all of its assets, the retailer’s statement reads.

Gordon Brothers Retail Partners, LLC, which recently bought much of Big Lots, would be the “stalking horse” bidder to acquire Joann, the company said. The proposed sale of Joann is “subject to higher and better offers” as the company “continues to actively solicit alternate bids.”

If more qualified bids are submitted during the court-supervised sale processes, Joann plans to conduct an auction or auctions, according to the statement. In this scenario, the stalking horse bidder, Gordon Brothers Retail Partners, would set the floor for the auction process.

Joann announces store closures amid financial struggles

Joann has more than 800 stores across 49 states, but last week, Retail Dive reported that at least eight stores across Iowa, North Carolina, Maryland, Pennsylvania, New York and Massachusetts are closing.

Amanda Hayes, Joann’s director of corporate communications, told Retail Drive in a statement that the closures are “part of routine store location evaluation and optimization.” She added how Joann “opened new and remodeled locations in recent months, including new stores in Great Falls, MT and Maplewood, MN.”

Joann did not provide information on the date of the looming closings. Local news outlets in Pennsylvania, Iowa, Massachusetts and Delaware reported dates for local store closures ranging from Jan. 12 to Jan. 19. A worker at the Owings Mills, Maryland location said it would be closing Jan. 19.

According to Retail Dive, local news reports and confirmation provided to USA TODAY, the closing stores are located at:

Who owns Joann?

Joann was founded in 1943 and sells various crafting supplies, including fabric by the yard, sewing machines, Cricut machines, yarn, home decor and more.

The company went private in 2011 when it was acquired by the equity firm Leonard Green & Partners for about $1.6 billion. In 2021, Joann, still majority-owned by Leonard Green & Partners, went public at an initial $12 a share.

Joann became a private company again in April following its initial bankruptcy filing, so its shares were no longer listed by the Nasdaq or any other national stock exchange.

Contributing: Mary Walrath-Holdridge & Emily DeLetter/ USA TODAY

As of now, Joann has not officially announced any plans to close their stores following their second bankruptcy filing. However, it is always a possibility that some locations may be affected by restructuring or financial difficulties.If you are a loyal customer of Joann, here are some things to keep in mind:

1. Stay informed: Keep an eye on news updates and official announcements from Joann regarding any potential store closures or changes.

2. Stock up on supplies: If you have any essential crafting or sewing supplies that you may need in the future, consider stocking up on them now just in case.

3. Support local stores: If you have a favorite local craft store, consider supporting them during this uncertain time to ensure their survival.

Remember, nothing is certain until an official announcement is made. Stay informed and prepared, and continue to enjoy your crafting and sewing projects regardless of the outcome.

Tags:

- Joann store closures

- Joann bankruptcy update

- Joann financial troubles

- Joann news

- Joann second bankruptcy filing

- Joann closure rumors

- Joann store shutdown

- Joann company update

- Joann bankruptcy aftermath

- Joann business status

#Joann #closing #bankruptcy #filing

Tax return filing stress peaks during festive season, says Intuit

Small business owners and sole traders face heightened stress during the festive season, impacting their well-being and personal time, as the UK’s Self-Assessment tax return deadline approaches, revealed Intuit QuickBooks.

With the January deadline for Self Assessment tax returns fast approaching, more than 12 million individuals are expected to file.

The period leading up to Christmas is said to be stressful for small business owners and sole traders, according to a study commissioned by Intuit QuickBooks and conducted by market researcher Censuswide in November 2024.

This survey of 2,000 consumers, required to complete a self-assessment, found that 63% experience stress during this time, with 28% sacrificing leisure time and 27% spending less time with friends and family.

The pressures of being a sole trader are significant, with the need to balance books, pay taxes promptly, and remain solvent in a challenging economic environment.

Intuit QuickBooks UK product compliance & programmes head Pauline Green said: “With 63% of people finding tax returns stressful and over half (55%) admitting they procrastinate, it’s no surprise that this time of year can feel overwhelming for small business owners.”

The toll on mental and physical well-being is considerable, with previous research indicating a 56% average increase in stress levels when recalling the Self-Assessment experience.

The same study, conducted in November 2023, highlighted that 22% of the 1,257 sole traders and small business owners surveyed reported sleep disruptions and negative impacts on their well-being.

During the last festive season, HMRC reported that more than 25,000 individuals filed their tax returns between Christmas Eve and Boxing Day.

The latest findings show that 11% use the period between Christmas and New Year’s Day to complete their Self Assessments.

To mitigate the mental health impact of these financial pressures, executive and leadership coach Jessica Rogers offers practical advice for maintaining financial health over this busy period.

Her key tips include scheduling tax preparation before 20 December, prioritising challenging tasks, taking regular breaks, seeking professional support, and utilising technology to streamline administrative tasks.

“Tax return filing stress peaks during festive season, says Intuit” was originally created and published by International Accounting Bulletin, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Tax return filing stress peaks during festive season, says IntuitAccording to a recent study conducted by Intuit, the stress levels related to filing tax returns tend to peak during the festive season. With the holiday season in full swing, many individuals find themselves juggling between shopping for gifts, attending parties, and making travel plans, all while trying to meet the deadline for filing their tax returns.

The study found that the combination of holiday festivities and the impending tax deadline can create a perfect storm of anxiety and stress for many people. In fact, nearly 70% of respondents reported feeling more stressed about filing their tax returns during the festive season compared to other times of the year.

To help alleviate some of this stress, Intuit recommends taking proactive steps to stay organized and on top of your tax filing responsibilities. This includes setting aside dedicated time to gather all necessary documents, seeking assistance from tax professionals if needed, and utilizing online tools and resources to streamline the filing process.

By staying organized and proactive, individuals can minimize the stress associated with filing their tax returns during the festive season and enjoy a smoother and more relaxed holiday season overall.

Tags:

- Tax return filing

- Tax season stress

- Intuit tax software

- Filing taxes during holidays

- Tax filing deadlines

- Intuit tax solutions

- Holiday tax preparation

- Tax return anxiety

- Intuit tax services

- Stress-free tax filing with Intuit

#Tax #return #filing #stress #peaks #festive #season #Intuit

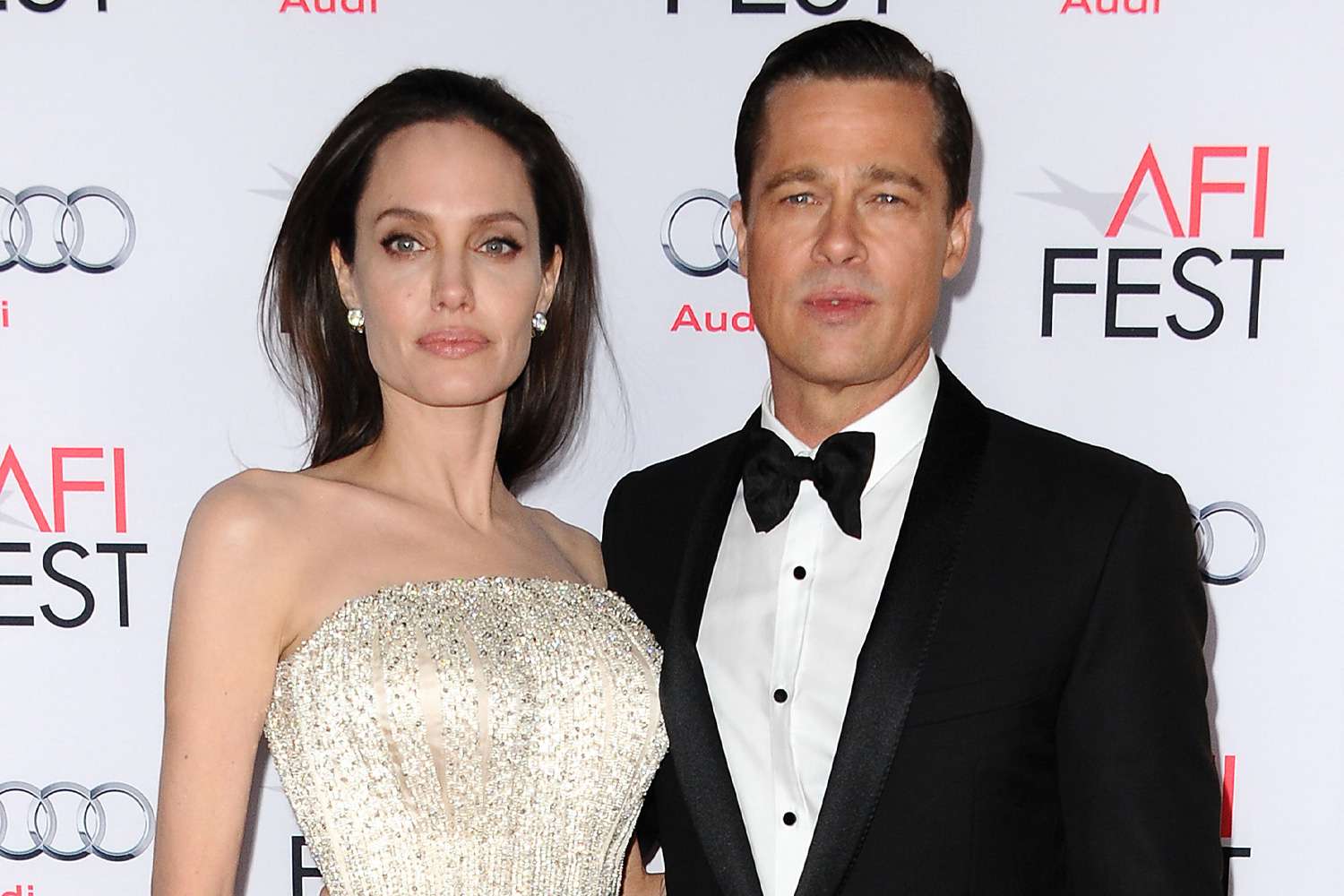

Brad Pitt and Angelina Jolie Reach Divorce Settlement 8 Years After Filing (Exclusive)

Brad Pitt and Angelina Jolie have reached a settlement in their divorce eight years after the Maria star filed to end their two-year marriage, citing irreconcilable differences.

Jolie, 49, and Pitt, 61, signed off on their divorce on Monday, Dec. 30, according to Jolie’s lawyers.

“More than eight years ago, Angelina filed for divorce from Mr. Pitt. She and the children left all of the properties they had shared with Mr. Pitt, and since that time she has focused on finding peace and healing for their family,” Jolie’s lawyer James Simon tells PEOPLE in a statement. “This is just one part of a long ongoing process that started eight years ago. Frankly, Angelina is exhausted, but she is relieved this one part is over.”

The statement also read that both parties have requested a jury trial lasting 10 to 15 days and have agreed to participate in a settlement conference or mediation session as a form of alternative dispute resolution. In his case management statement, Pitt also agreed to mediation.

A source close to Jolie adds, “She doesn’t speak ill of [Pitt] publicly or privately. She’s been trying hard to be light after a dark time.”

A rep for Pitt declined to confirm or comment.

Jolie filed for dissolution of marriage on Sept. 19, 2016, days after a private plane flight on which she has claimed Pitt was abusive to her and their six children; he was not charged by authorities after investigations at the time and Jolie declined to press charges.

Four months later, the former couple released a joint statement indicating that they reached an agreement to handle their divorce in a private forum, and would keep future details of their divorce confidential by utilizing a private judge.

“The parties and their counsel have signed agreements to preserve the privacy rights of their children and family by keeping all court documents confidential and engaging a private judge to make any necessary legal decisions and to facilitate the expeditious resolution of any remaining issues,” according to the statement.

Never miss a story — sign up for PEOPLE’s free daily newsletter to stay up-to-date on the best of what PEOPLE has to offer, from juicy celebrity news to compelling human-interest stories.

Brad Pitt and Angelina Jolie with five of their six children in Hollywood, California, on May 28, 2014.

It concluded, “The parents are committed to act as a united front to effectuate recovery and reunification.”

Leading up to the 2017 privacy agreement, Pitt and Jolie had been locked in “strained” divorce negotiations centered on custody issues and trading harsh accusations in filings in Los Angeles Superior Court.

In January 2017, they agreed to seal sensitive records relating to their six children, the majority of whom are now adults: Maddox, 23, Pax, 21, Zahara, 19, Shiloh, 18, and twins Vivienne and Knox, now 16.

The exes, who had their divorce bifurcated, were declared legally single in 2019. (Pitt has been dating L.A. jewelry exec Ines de Ramon, 34, since 2022.)

In the following years, the former couple battled over custody as well as legal issues pertaining to the $164 million French estate and winery that they shared, Château Miraval.

Angelina Jolie; Brad Pitt.

Getty(2)

Pitt sued Jolie in February 2022 over her sale of her Château Miraval stake, and the Tomb Raider star filed a countersuit in which she stated her ex was “waging a vindictive war against” her.

The lawsuit was filed by Nouvel, a business founded by Jolie. The company claimed that Pitt “masterminded a so-far-successful plan to seize control” of Château Miraval following the couple’s split in 2016.

Of the countersuit, a source close to Pitt told PEOPLE, “This is just the latest in a series of deliberate efforts to misdirect, recycle and reposition the truth of what has happened over the last six years, thinking that reasonable people would be duped by these obvious misrepresentations.”

In a case management statement, Jolie called Pitt’s legal actions “frivolous, malicious and part of a problematic pattern.” The actress is holding firm that she and Pitt did not have “a secret, unwritten, unspoken contract” that required them to ask for consent before selling their shares of Château Miraval.

The statement also read that Jolie has requested a jury trial lasting 10 to 15 days and has agreed to participate in a settlement conference or mediation session as a form of alternative dispute resolution. In his case management statement, Pitt also agreed to mediation.

Brad Pitt and Angelina Jolie on March 2, 2014, in Hollywood, California.

Ethan Miller/WireImage

The pair have continued to fight over Miraval throughout 2024, which is not connected to their divorce proceedings. In November, Jolie scored a legal win when a judge in the case ruled that Pitt must disclose documents, including emails and texts, that Jolie’s lawyer Paul Murphy claims will prove her allegations of abuse against Pitt and “years of cover-up” on his part.

The same month, Pitt also notched his own victory in the winery battle when Jolie’s motions to dismiss the lawsuit were rejected and the case inched closer to trial with potential proof that there was a written agreement between the former couple about selling, which a Pitt source said “demonstrates the legitimacy of his claims.”

His lawyers have called Jolie’s request for the documents “a sensationalist fishing expedition.”

After a long and tumultuous legal battle, Brad Pitt and Angelina Jolie have finally reached a divorce settlement, eight years after initially filing for divorce.According to exclusive sources, the former Hollywood power couple have come to an agreement on custody of their six children, as well as the division of their assets. The details of the settlement have not been disclosed, but it is believed to be a fair and amicable resolution for both parties.

Pitt and Jolie first announced their separation in 2016, shocking fans around the world. Since then, their divorce proceedings have been marred by accusations of infidelity, substance abuse, and child custody disputes.

Now, with this settlement in place, it seems that Pitt and Jolie can finally move on from their past and focus on co-parenting their children in a healthy and positive environment.

Stay tuned for more updates on this developing story.

Tags:

- Brad Pitt

- Angelina Jolie

- Divorce settlement

- Celebrity divorce

- Brad Pitt and Angelina Jolie divorce

- Brad and Angelina

- Hollywood divorce

- Celebrity news

- Brad Pitt news

- Angelina Jolie news

#Brad #Pitt #Angelina #Jolie #Reach #Divorce #Settlement #Years #Filing #Exclusive