Your cart is currently empty!

Tag: Forex

ATR Bands : The Secret Weapon for Successful Forex Trading

Price: $3.99

(as of Dec 26,2024 02:17:10 UTC – Details)

Are you looking for a secret weapon to take your forex trading to the next level? Look no further than ATR Bands!ATR Bands, short for Average True Range Bands, are a powerful tool that can help you identify potential trading opportunities and manage your risk more effectively. By using ATR Bands, you can gauge the volatility of the market and adjust your trading strategy accordingly.

One of the key benefits of ATR Bands is that they provide a visual representation of market volatility, making it easier for traders to determine when to enter or exit a trade. This can help you avoid getting caught in choppy or range-bound markets, and instead focus on trading in trending markets where the potential for profit is higher.

In addition, ATR Bands can also be used to set stop-loss levels and take-profit targets based on the current market conditions. This can help you protect your capital and maximize your profits, ultimately leading to more successful trades.

So if you’re looking to improve your forex trading results, consider adding ATR Bands to your arsenal. With their ability to help you identify trading opportunities and manage risk more effectively, ATR Bands could be the secret weapon you need to take your trading to the next level.

#ATR #Bands #Secret #Weapon #Successful #Forex #Trading, Technical Support

The Ultimate Support and Resistance Techniques used by Forex Experts: Minimize losses in Forex Trades using this easy tips on support and Resistance,for dummies and expert traders,smart money concept

Price: $4.99

(as of Dec 26,2024 01:29:15 UTC – Details)

ASIN : B0BY7GCP23

Publication date : March 11, 2023

Language : English

File size : 5031 KB

Text-to-Speech : Enabled

Screen Reader : Supported

Enhanced typesetting : Enabled

X-Ray : Not Enabled

Word Wise : Enabled

Print length : 44 pages

Forex trading can be a lucrative but risky venture, especially for beginners. One of the key strategies used by experts to minimize losses and increase profits in their trades is the concept of support and resistance.Support and resistance are key levels in the market that indicate where the price of a currency pair is likely to stop and reverse direction. Support is a level where the price tends to stop falling and bounce back up, while resistance is a level where the price tends to stop rising and reverse downwards.

Here are some ultimate tips on how to effectively use support and resistance in your Forex trades:

1. Identify key support and resistance levels on your charts: Look for areas where the price has bounced off multiple times in the past. These are key levels where you can expect price to react again in the future.

2. Use multiple time frames to confirm levels: Check support and resistance levels on different time frames to confirm their significance. A level that is important on a daily chart may not be as relevant on a 1-hour chart.

3. Wait for confirmation before entering a trade: Don’t just blindly trade off support and resistance levels. Wait for the price to bounce off the level and confirm the reversal before entering a trade.

4. Use stop-loss orders: Place stop-loss orders just below support levels and above resistance levels to limit your losses if the price breaks through.

5. Pay attention to market sentiment: Support and resistance levels are more likely to hold if they align with the overall market sentiment. If the market is bullish, support levels are more likely to hold, and vice versa.

By following these simple tips on support and resistance, both beginners and expert traders can minimize losses and increase profits in their Forex trades. Remember, trading with the trend and using proper risk management techniques are also crucial in successful Forex trading. Happy trading!

#Ultimate #Support #Resistance #Techniques #Forex #Experts #Minimize #losses #Forex #Trades #easy #tips #support #Resistancefor #dummies #expert #traderssmart #money #concept, Technical Support

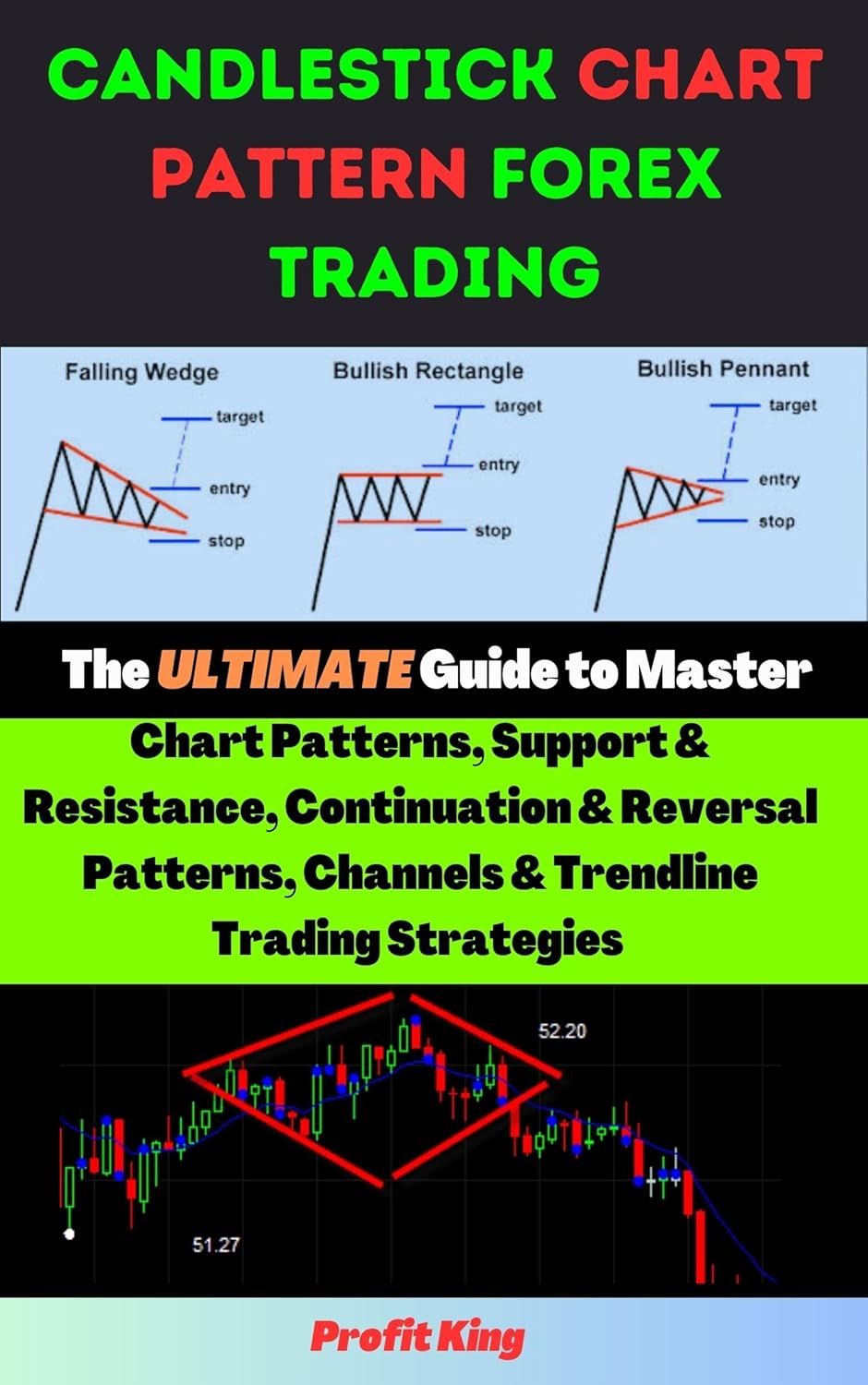

Chart Pattern Forex Trading: Beginners Guide To Master Chart Patterns, Support And Resistance, Continuation And Reversal Patterns, Channels And Trend-Line … Strategies. Chart Pattern Cheat Sheet

Price: $2.99

(as of Dec 24,2024 01:47:38 UTC – Details)

ASIN : B0BX6YXMKV

Publication date : February 28, 2023

Language : English

File size : 14918 KB

Simultaneous device usage : Unlimited

Text-to-Speech : Enabled

Screen Reader : Supported

Enhanced typesetting : Enabled

X-Ray : Not Enabled

Word Wise : Enabled

Print length : 151 pages

Page numbers source ISBN : B0BW2H5Q1V

Chart patterns are important tools for forex traders to analyze market trends and make informed trading decisions. Understanding chart patterns can help traders identify potential entry and exit points, as well as predict future price movements.In this beginner’s guide, we will cover the basics of chart patterns, including support and resistance levels, continuation and reversal patterns, channels, and trend lines. By mastering these concepts, traders can develop effective trading strategies and improve their chances of success in the forex market.

Support and resistance levels are key areas on a price chart where the price tends to bounce or reverse. Support is a level where buying interest is strong enough to prevent the price from falling further, while resistance is a level where selling interest is strong enough to prevent the price from rising further. By identifying these levels, traders can set stop-loss orders and take-profit targets to manage their risk.

Continuation patterns are chart patterns that suggest the current trend is likely to continue. These patterns include flags, pennants, and triangles, among others. Reversal patterns, on the other hand, indicate that the current trend is likely to reverse. These patterns include head and shoulders, double tops, and double bottoms, among others.

Channels and trend lines are tools used to identify the direction of the trend. Channels are formed by drawing parallel lines connecting the highs and lows of a price chart, while trend lines are diagonal lines that connect the highs or lows of a price chart. By analyzing these patterns, traders can determine whether the market is trending up, down, or sideways, and adjust their trading strategy accordingly.

In summary, mastering chart patterns is essential for successful forex trading. By understanding support and resistance levels, continuation and reversal patterns, channels, and trend lines, traders can develop effective trading strategies and improve their chances of success in the market. To help you remember these key concepts, we have created a chart pattern cheat sheet that you can refer to when analyzing price charts. Happy trading!

#Chart #Pattern #Forex #Trading #Beginners #Guide #Master #Chart #Patterns #Support #Resistance #Continuation #Reversal #Patterns #Channels #TrendLine #Strategies #Chart #Pattern #Cheat #Sheet, Technical Support

Technical Analysis in Forex and Stock Market: Supply Demand Analysis and Support Resistance

Price: $3.00

(as of Dec 24,2024 01:39:06 UTC – Details)

ASIN : B09L55ZK4Z

Publisher : www.algotrading-investment.com (November 4, 2021)

Publication date : November 4, 2021

Language : English

File size : 15289 KB

Text-to-Speech : Enabled

Screen Reader : Supported

Enhanced typesetting : Enabled

X-Ray : Not Enabled

Word Wise : Enabled

Print length : 128 pages

Technical Analysis in Forex and Stock Market: Supply Demand Analysis and Support ResistanceTechnical analysis is a popular tool used by traders in the forex and stock market to make informed decisions about their trades. One key aspect of technical analysis is supply and demand analysis, which helps traders understand the forces driving the price movements of an asset.

Supply and demand analysis in technical analysis involves examining the levels of supply (the amount of a particular asset available for sale) and demand (the amount of a particular asset that buyers are willing to purchase) in the market. When supply exceeds demand, prices tend to decrease, while when demand exceeds supply, prices tend to increase.

Another important concept in technical analysis is support and resistance levels. Support levels are price levels where a particular asset tends to find buying interest, preventing the price from falling further. Resistance levels, on the other hand, are price levels where a particular asset tends to find selling interest, preventing the price from rising further.

By using supply and demand analysis and identifying support and resistance levels, traders can make more educated decisions about when to enter or exit a trade. These tools help traders identify potential entry and exit points, manage risk, and maximize profits.

In conclusion, technical analysis, specifically through the use of supply and demand analysis and support and resistance levels, can be a valuable tool for traders in the forex and stock market. By understanding these concepts and applying them to their trading strategies, traders can increase their chances of success in the market.

#Technical #Analysis #Forex #Stock #Market #Supply #Demand #Analysis #Support #Resistance, Technical Support