Your cart is currently empty!

Tag: Nippon

Nippon Life India Asset Management Faces Significant Stock Decline Amid Sector Underperformance

Quality: dashverdictresult.dashboard.dotsummary.q_txt

Valuation: dashverdictresult.dashboard.dotsummary.v_txt

Quarterly Financial Trend: dashverdictresult.dashboard.dotsummary.f_txt

Technicals: dashverdictresult.dashboard.dotsummary.tech_txt

Stock Info:

BSE – dashverdictresult.dashboard.stock_details.scripcode/ NSE – dashverdictresult.dashboard.stock_details.symbol

Market Cap – dashverdictresult.dashboard.priceinfo.mcap_class (Rs. dashverdictresult.dashboard.priceinfo.mcap cr)

Sector – dashverdictresult.dashboard.stock_details.ind_name

52 w H/L (Rs.) – dashverdictresult.dashboard.priceinfo.wk_high52/dashverdictresult.dashboard.priceinfo.wk_low52

Average vol (6M) – dashverdictresult.dashboard.priceinfo.vol

Nippon Life India Asset Management, one of the leading asset management companies in India, has been experiencing a significant decline in its stock price amid sector underperformance. The company, which is a subsidiary of Nippon Life Insurance Company of Japan, has been facing challenges in the Indian market as investors have been cautious about the overall performance of the asset management sector.Despite its strong track record and reputation, Nippon Life India Asset Management has not been immune to the challenges facing the industry. The company’s stock price has been on a downward trend, reflecting the overall sentiment of investors towards the asset management sector in India.

The sector underperformance can be attributed to various factors, including market volatility, regulatory changes, and competition from other asset management companies. Nippon Life India Asset Management has been working to address these challenges and improve its performance, but the road ahead remains uncertain.

Investors and analysts are closely monitoring the situation and assessing the company’s prospects in the coming months. Nippon Life India Asset Management will need to demonstrate its ability to adapt to market conditions and deliver strong performance to regain investor confidence and reverse the stock decline.

Overall, the sector underperformance has posed significant challenges for Nippon Life India Asset Management, and the company will need to navigate these challenges carefully to regain its position in the Indian asset management industry.

Tags:

- Nippon Life India Asset Management

- Stock decline

- Sector underperformance

- Nippon Life India

- Asset management

- Indian stock market

- Stock market decline

- Investment management

- Financial sector news

- Market analysis

#Nippon #Life #India #Asset #Management #Faces #Significant #Stock #Decline #Sector #Underperformance

Biden blocks Japan’s Nippon from taking over US Steel

New York

CNN

—

President Joe Biden said Friday he is blocking a $14.3 billion acquisition of US Steel by Japan’s Nippon Steel, marking a significant use of executive authority in the closing days of his administration.

“As I have said many times, steel production – and the steel workers who produce it – are the backbone of our nation,” he said in a statement. “A strong domestically owned and operated steel industry represents an essential national security priority and is critical for resilient supply chains.”

The move, which was first reported in the Washington Post and New York Times, is not a surprise but could have implications for future foreign investment in American companies. Biden has long said he opposed the deal, which was announced a year ago. President-elect Donald Trump also said he opposes the deal and that he also would block it once he takes office.

The deal has been politically charged since it was announced in December of 2023, stirring bipartisan political opposition to foreign control of a once key component of US industrial might which has fallen on hard times. Blocking the deal could be politically popular domestically but could scare away foreign investment in other US companies. It could also starve US Steel of investment it says it needs.

Late last month, the Committee for Foreign Investment in the United States, known colloquially as CFIUS, notified Biden that it had not reached a consensus about whether or not US Steel’s sale to Nippon would pose a national security risk, leaving the decision up to the president to determine whether or not to block the deal on national security grounds.

The United Steelworkers union has strongly opposed the deal since the moment it was announced, arguing that Nippon has not given it sufficient guarantees that it would protect unionized jobs at some of the company’s older mills staffed by union members.

But Biden’s opposition to the deal may not be the final say. US Steel and Nippon Steel issued a joint statement vowing to fight it in court.

“We are dismayed by President Biden’s decision,” said the statement. “The president’s statement and order do not present any credible evidence of a national security issue, making clear that this was a political decision. We are left with no choice but to take all appropriate action to protect our legal rights.”

The USW praised the decision.

“We have no doubt that it’s the right move for our members and our national security,” the union said in a statement.

US Steel and Nippon have argued throughout the process that the deal is necessary to provide needed investment in US Steel’s domestic steel operations. US Steel has claimed it could be forced to shut down the mills represented by the USW if it doesn’t get the $2.7 billion in investment planned by Nippon Steel as part of its proposed purchase. The companies’ joint statement Friday again repeated that argument.

“Blocking this transaction means denying billions of committed investment to extend the life of US Steel’s aging facilities and putting thousands of good-paying, family-sustaining union jobs at risk,” said the statement.

The union said Friday that the company can continue to profitably operate those mills without Nippon’s investment.

“We’re confident that with responsible management, US Steel will continue to support good jobs, healthy communities and robust national and economic security well into the future,” said the union.

The proposed purchase was bound to be unpopular. US Steel was once a symbol of American industrial might. It was the most valuable company in the world and the first to be worth $1 billion soon after its creation in 1901. It was also crucial to the US economy and the cars, appliances, bridges and skyscrapers that tangibly indicated that strength.

But it has suffered through decades of decline since its post-World War II height. It is no longer even the largest US steelmaker, and a relatively minor employer, with 14,000 US employees — 11,000 of whom are USW members. But it is still not a company that politicians who enjoy talking about American greatness want to see fall into foreign hands — particularly in the politically significant state of Pennsylvania. While it doesn’t employ nearly as many people as it used to, US Steel reports that it has nearly 18,000 retirees and beneficiaries drawing benefits from its pension funds. And there are hundreds of thousands whose parents, grandparents or even great-grandparents worked at US Steel at one point.

Demonstrating that blocking the deal appears political in nature, Trump opposed Nippon’s purchase of US Steel, but recently welcomed a $100 billion investment from Japan’s Softbank, including funds for investment in US artificial intelligence technology — arguably far more important for national security. If US Steel’s purchase by a Japanese company poses a national security threat, some foreign investors may think twice about spending resources on mergers and acquisitions or investments in American companies.

Multiple officials familiar with the review expressed concern to CNN that the decision would be seen as a watershed moment for the Committee on Foreign Investment in the United States, or CFIUS, which has the authority to evaluate mergers on national security grounds.

The conclusions of the Cabinet-level political appointees who comprise the Committee are informed by the work of roughly a hundred career staffers tasked with evaluating a deal on its merits without political influence. In the US Steel case, the majority of agencies concluded that the deal posed no national security risk, and officials expressed concern that the president’s own position — to keep the company from being foreign-owned even if it meant denying it a large infusion of capital from Nippon — was misguided.

“Bad decision,” one senior administration official said of Biden’s forthcoming move to block the deal. “Doesn’t actually protect union jobs and may kill the company.”

Jason Furman, a top economist official during the Obama administration, was even more outspoken in his criticism of the decision.

“President Biden claiming Japan’s investment in an American steel company is a threat to national security is a pathetic and craven cave to special interests that will make America less prosperous and safe,” Furman wrote in a post on X. “I’m sorry to see him betraying our allies while abusing the law.”

Furman, who is now an economic policy professor at Harvard University, served as the chairman of the Council of Economic Advisers under President Barack Obama. Furman is listed as a senior advisor at The Asia Group, a consulting firm.

Throughout the 19th and 20th centuries, workers flocked to Pittsburgh and other Rust Belt cities for well-paying factory jobs. Blast furnaces operated by US Steel and its American rivals cranked out steel slabs, beams and rails, along with massive profits and thick smog.

According to a story in the Pittsburgh Post-Gazette on the US Steel’s 100th anniversary in 2001, the company’s peak employment of 340,000 came in 1943, during World War II, when it played a critical role in Allied forces’ war efforts. The same article said the company’s steel output reached 35.8 million tons by 1953, as steelmakers in Europe and Japan were still struggling to recover from the war.

By comparison, US Steel shipped only 11.3 million tons of steel from its US operations in the 12 months ending in September, utilizing just less than two-thirds of the capacity of its older, union-represented steel mills.

After its peak, the company began to fall behind upstart competitors, both foreign and domestic. First, it fell behind competitors in Japan and Germany, which were forced to rebuild from scratch after World War II and use new technologies that required far less labor and energy.

US Steel and other American steelmakers eventually followed those foreign competitors to upgrade factories and equipment, but they still largely used the older methods to make steel by melting raw materials, such as iron ore, in giant blast furnaces.

Those “integrated” steelmakers soon lagged behind so-called “mini-mills,” nonunion competitors that use more efficient electric arc furnaces to turn old steel scrap from discarded cars and other products into new steel products.

One pioneer of this mini-mill technology, now Charlotte-based Nucor (NUE) has a market capitalization of $26.9 billion, compared to US Steel’s value of just over $7 billion.

US Steel “peaked out in 1916,” longtime steel industry analyst Charles Bradford told CNN in 2023, shortly after the company announced it would consider offers to buy it. “It’s been downhill ever sense. Peak output was in the 1970s. It’s done nothing for decades.”

Bradford said US Steel and other American integrated steelmaking rivals with storied names such as Bethlehem Steel, Inland Steel and LTV Steel underestimated the competitive challenge that they faced from overseas and mini-mills at home. Those rivals Bethlehem, Inland and LTV went bankrupt in the last 30 years and saw assets closed or sold to other companies.

Today, what’s left of those companies’ assets are part of Cleveland-Cliffs, a unionized integrated steelmaker that has also passed US Steel in capacity and output. Cleveland-Cliffs said it was prepared to buy any mills that US Steel would want to close, but such a move could run into its own antitrust problems due to opposition from steel customers, such as automakers that still depend upon steel made from raw materials rather than scrap.

Nippon said it does not intend to close the integrated mills, and that it will honor all labor contracts with the USW in addition to making the investment in plants where the union’s members work.

But the USW insists that Nippon’s plans would endanger those unionized jobs as well. It said Nippon intends to ultimately transfer production from integrated, union-represented mills in Pennsylvania and Indiana to US Steel’s own mini-mill operation in Texas.

US Steel (X) shares were down nearly 6% in Friday afternoon trading.

CNN’s Anna Cooban and Matt Egan contributed to this story.

This story has been updated with additional content.

In pictures: The history of US Steel

In a surprising move, President Joe Biden has blocked Japan’s Nippon Steel from taking over US Steel. The decision comes after months of deliberation and intense lobbying from both sides.The proposed acquisition would have seen Nippon Steel, one of Japan’s largest steel producers, take control of a significant portion of US Steel’s operations. However, concerns over national security and the potential impact on the domestic steel industry were raised by lawmakers and industry experts.

In a statement, President Biden cited the need to protect American jobs and ensure the country’s economic competitiveness as reasons for the decision. The move has been met with mixed reactions, with some praising the President for putting American interests first, while others criticize the decision as protectionist.

The blocking of the takeover has also raised questions about the future of international mergers and acquisitions in the steel industry, with many wondering if this could set a precedent for more stringent regulatory oversight in the future.

Overall, the decision to block Nippon Steel’s takeover of US Steel highlights the complex and often contentious nature of foreign investments in key industries, and underscores the delicate balance between economic growth and national security.

Tags:

- Biden administration

- Japan

- Nippon Steel

- US Steel

- Foreign investment

- National security

- Trade relations

- Steel industry

- Biden policy

- Regulatory approval.

#Biden #blocks #Japans #Nippon #Steel

![[Exc+8] Nikon Nippon Kogaku PC-Nikkor 35mm f2.8 Nikon F Mount from Japan](https://ziontechgroup.com/wp-content/uploads/2024/12/1734887700_s-l500.png)

[Exc+8] Nikon Nippon Kogaku PC-Nikkor 35mm f2.8 Nikon F Mount from Japan

[Exc+8] Nikon Nippon Kogaku PC-Nikkor 35mm f2.8 Nikon F Mount from Japan

Price : 188.93

Ends on : N/A

View on eBay

Are you in the market for a high-quality, vintage camera lens? Look no further than the Nikon Nippon Kogaku PC-Nikkor 35mm f2.8 lens for Nikon F Mount cameras. This lens is in excellent condition, with an Exc+8 rating, and is sure to take your photography to the next level.Made in Japan by the renowned manufacturer Nikon, this lens offers exceptional image quality and sharpness. Its 35mm focal length is versatile for a wide range of shooting situations, from landscapes to portraits. The f2.8 aperture allows for beautiful bokeh and low-light shooting capabilities.

Don’t miss out on this rare find from Japan. Upgrade your photography gear with the Nikon Nippon Kogaku PC-Nikkor 35mm f2.8 lens today!

#Exc8 #Nikon #Nippon #Kogaku #PCNikkor #35mm #f2.8 #Nikon #Mount #Japan

【NEAR MINT】 Nippon Kogaku Nikkor-S Auto 50mm f1.4 Lens JAPAN

【NEAR MINT】 Nippon Kogaku Nikkor-S Auto 50mm f1.4 Lens JAPAN

Price : 125.00

Ends on : N/A

View on eBay

Are you a photography enthusiast looking to add a vintage lens to your collection? Look no further than this 【NEAR MINT】 Nippon Kogaku Nikkor-S Auto 50mm f1.4 Lens from Japan!This classic lens is known for its sharpness and beautiful bokeh, making it a favorite among professional photographers and collectors alike. With a maximum aperture of f/1.4, this lens is perfect for low-light situations and creating stunning portraits with a creamy background blur.

This particular lens is in near mint condition, with no scratches or fungus on the glass and smooth focusing and aperture rings. It comes with both front and rear lens caps to keep it protected when not in use.

Don’t miss out on the opportunity to own this piece of photographic history. Contact us today to make it yours! #Nikon #NipponKogaku #VintageLens #Photography #Japan

#MINT #Nippon #Kogaku #NikkorS #Auto #50mm #f1.4 #Lens #JAPAN

Prinny 1 & 2 Nintendo Switch Nippon Ichi Software Action Sealed

Prinny 1 & 2 Nintendo Switch Nippon Ichi Software Action Sealed

Price :39.50– 37.52

Ends on : N/A

View on eBay

Attention all Prinny fans!We are excited to announce that Prinny 1 & 2: Exploded and Reloaded for the Nintendo Switch is now available for purchase! This action-packed game developed by Nippon Ichi Software is a must-have for any fan of the Prinny series.

Embark on a wild adventure as you control the lovable and mischievous Prinnies on their quest to retrieve the stolen desserts of the demon lord Etna. With challenging levels, insane bosses, and hilarious dialogue, Prinny 1 & 2 is sure to keep you entertained for hours on end.

What’s even better? Our copies are sealed and brand new, ensuring that you get the full gaming experience right from the start.

Don’t miss out on this epic release – grab your copy of Prinny 1 & 2 for the Nintendo Switch today and join the Prinny squad in their quest for justice! #Prinny #NintendoSwitch #NipponIchiSoftware #ActionGame #SealedCopy

#Prinny #Nintendo #Switch #Nippon #Ichi #Software #Action #Sealed

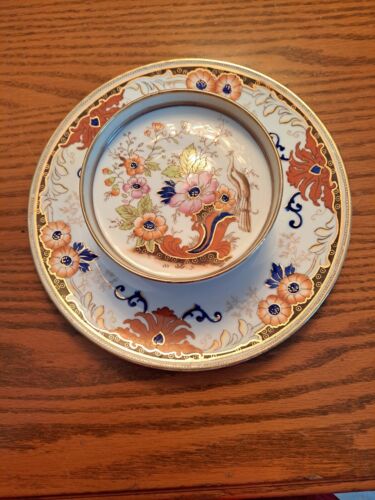

Nippon Hand Painted Ornate Peacock Floral Pattern Gold Trim Chip & Dip Platter

Nippon Hand Painted Ornate Peacock Floral Pattern Gold Trim Chip & Dip Platter

Price :59.99– 46.79

Ends on : N/A

View on eBay

Looking for a stunning and elegant serving platter for your next gathering? Look no further than this Nippon Hand Painted Ornate Peacock Floral Pattern Gold Trim Chip & Dip Platter! This exquisite platter features a beautiful peacock and floral design, hand-painted with intricate details that are sure to impress your guests.The gold trim adds a touch of luxury and sophistication to this already exquisite piece. Whether you’re serving chips and dip, veggies and hummus, or any other delicious snacks, this platter is sure to elevate your presentation and make a statement at your table.

Made in Japan, this Nippon platter is not only beautiful but also of excellent quality. Add a touch of elegance to your next gathering with this stunning piece. Don’t miss out on the opportunity to own this unique and eye-catching platter!

#Nippon #Hand #Painted #Ornate #Peacock #Floral #Pattern #Gold #Trim #Chip #Dip #Platter

【EXC+5】 Nikon Nippon Kogaku Nikkor-S Auto 5.8cm 58mm F1.4 Non Ai Lens Japan 4106

【EXC+5】 Nikon Nippon Kogaku Nikkor-S Auto 5.8cm 58mm F1.4 Non Ai Lens Japan 4106

Price : 199.99

Ends on : N/A

View on eBay

Are you looking for a high-quality vintage lens for your Nikon camera? Look no further than the Nikon Nippon Kogaku Nikkor-S Auto 5.8cm 58mm F1.4 Non Ai Lens! This lens is in excellent condition, with a rating of EXC+5.Made in Japan, this lens is known for its sharpness and beautiful bokeh, making it ideal for portrait photography and low-light shooting. The fast F1.4 aperture allows for stunning depth of field control, perfect for creating artistic images.

Don’t miss out on this rare find! Add the Nikon Nippon Kogaku Nikkor-S Auto 5.8cm 58mm F1.4 Non Ai Lens to your collection today.

#EXC5 #Nikon #Nippon #Kogaku #NikkorS #Auto #5.8cm #58mm #F1.4 #Lens #Japan

Prinny 1 & 2 Nintendo Switch Nippon Ichi Software Action Game with Case Japan 21

Prinny 1 & 2 Nintendo Switch Nippon Ichi Software Action Game with Case Japan 21

Price : 34.00

Ends on : N/A

View on eBay

Are you a fan of the quirky and lovable Prinnies from the Disgaea series? Then you won’t want to miss out on Prinny 1 & 2 for the Nintendo Switch! This action-packed game from Nippon Ichi Software features two classic titles in one convenient package.Take control of the adorable yet explosive Prinnies as they embark on challenging missions to redeem themselves and become true heroes. With fast-paced gameplay, colorful graphics, and a hilarious storyline, Prinny 1 & 2 is sure to keep you entertained for hours on end.

This Japan-exclusive edition even comes with a sleek case to protect your game cartridge when you’re on the go. Don’t miss your chance to add this must-have title to your collection – order Prinny 1 & 2 for the Nintendo Switch today!

#Prinny #Nintendo #Switch #Nippon #Ichi #Software #Action #Game #Case #Japan

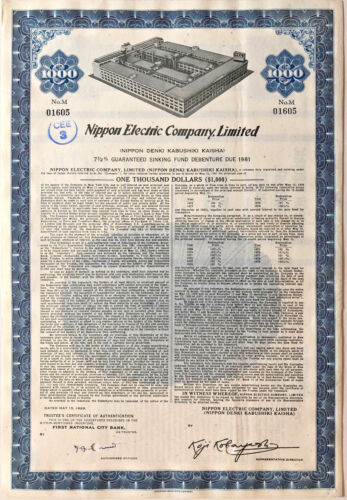

NEC Electronics Japan Electric bond certificate Nippon Denki Kabushiki Kaisha

NEC Electronics Japan Electric bond certificate Nippon Denki Kabushiki Kaisha

Price : 9.99

Ends on : N/A

View on eBay

NEC Electronics Japan Electric bond certificate Nippon Denki Kabushiki KaishaAre you a collector of rare and unique financial memorabilia? If so, you’ll want to add the NEC Electronics Japan Electric bond certificate from Nippon Denki Kabushiki Kaisha to your collection. This historic bond certificate represents a piece of Japan’s technological and industrial history, showcasing the legacy of NEC Electronics Japan Electric.

Featuring intricate designs and detailed engravings, this bond certificate is a true work of art that is sure to impress any collector. Whether you’re a seasoned collector or just starting out, this piece is a must-have for any enthusiast of Japanese electronics and industrial companies.

Don’t miss out on this opportunity to own a piece of Japan’s history. Add the NEC Electronics Japan Electric bond certificate from Nippon Denki Kabushiki Kaisha to your collection today!

#NEC #Electronics #Japan #Electric #bond #certificate #Nippon #Denki #Kabushiki #Kaisha