Your cart is currently empty!

Tag: NVDA

Is NVIDIA Corporation (NVDA) the Unstoppable Tech Stock to Buy Right Now?

We recently published a list of 10 Unstoppable Tech Stocks to Buy Right Now. In this article, we are going to take a look at where NVIDIA Corporation (NASDAQ:NVDA) stands against other unstoppable tech stocks to buy right now.

The technology sector continues to be driven by rapid innovation and the adoption of cutting-edge technologies. Advances in technology are significantly impacting lives, industries, and economies worldwide, with the integration of AI and ML revolutionizing workflows, enhancing productivity, and creating new revenue opportunities. Organizations around the globe are undergoing digital transformation to stay competitive, streamline operations, improve customer engagement, and drive innovation in their products and services.

With substantial growth potential, the technology sector has consistently outperformed other sectors. In 2024, the S&P 500 Information Technology Sector Index rose by approximately 37%, outpacing the broader S&P 500 Index by an impressive 11.5%. This performance has led to skyrocketing market capitalizations for tech sector companies, prompting caution regarding high valuations. Following the market downturn triggered by DeepSeek’s emergence, JJ Kinahan, CEO of IG North America, stated in an interview with BNN Bloomberg that while the market had reached incredibly high levels, macroeconomic concerns such as inflation and high interest rates persist. He also suggests that developments related to DeepSeek provided an excuse for profit-taking with a ‘reset’ occurring in tech stocks. Now the focus should shift to earnings and the actual benefits derived from those substantial investments.

On a positive note, in his report on December 13, Adam Benjamin, Sector Portfolio Manager at Fidelity Investments, highlighted that the sector benefited in 2024 from outstanding results in the semiconductor industry, reflecting major corporate investments in AI infrastructure. He remains optimistic for 2025, as evident from his positive outlook:

“The outlook for the sector in 2025 and beyond may be bright, as tech companies continue to innovate and digitization and automation become increasingly important in our lives. I believe the next phase of development could present opportunities for software firms, as the application layer begins to roll out generative AI agents across end markets, and as the full benefits of AI begin to be realized. Progress may not be linear, though, and investors must be mindful of stock valuations and the timing and potential impact of further technological advances in the field, as well as the broader macroeconomic environment.”

When it comes to investing in tech stocks, NVIDIA Corporation (NVDA) is often at the top of many investors’ lists. With its strong track record of innovation and growth, NVDA has become a powerhouse in the semiconductor industry. But is NVIDIA truly the unstoppable tech stock to buy right now?There are several factors that make NVIDIA a compelling investment opportunity. Firstly, the company has a dominant position in the high-performance computing and artificial intelligence markets. Its GPUs are widely used in data centers, gaming, and autonomous vehicles, giving NVIDIA a strong competitive edge.

Additionally, NVIDIA has a strong history of revenue growth, with its revenue increasing by over 50% in the past year alone. This growth is expected to continue as demand for its products continues to rise.

Furthermore, NVIDIA has a solid balance sheet with ample cash reserves and minimal debt, making it a stable and financially sound company.

However, it’s important to note that investing in any stock carries risks. While NVIDIA has shown strong growth potential, the tech industry is constantly evolving and competition is fierce. Additionally, there is always the risk of market fluctuations and economic uncertainties that could impact the stock price.

Overall, NVIDIA Corporation (NVDA) has proven itself to be a strong player in the tech industry with solid growth potential. While it may not be completely unstoppable, it is certainly a tech stock worth considering for long-term investors looking to capitalize on the continued growth of the semiconductor industry.

Tags:

NVIDIA Corporation, NVDA, tech stock, buy now, investing, unstoppable growth, semiconductor industry, gaming industry, artificial intelligence, stock market, technology sector

#NVIDIA #Corporation #NVDA #Unstoppable #Tech #Stock #BuyNvidia Stock Plunges 17% As NVDA Suffers Biggest Market Cap Loss Ever—Driven By DeepSeek

Topline

Nvidia set a dubious Wall Street record Monday, as the stock at the forefront of the U.S.-led artificial intelligence revolution got a scare from DeepSeek, the Chinese AI company which developed a ChatGPT rival at a fraction of the reported cost of its American peers.

Nvidia stock had a historically bad Monday.

Key Facts

Shares of Nvidia plunged 17% by close, suffering its worst daily percentage loss since March 2020, when stocks briefly crashed at the start of the COVID-19 pandemic.

Nvidia lost $589 billion in market capitalization Monday, which is by far the single greatest one-day value wipeout of any company in history, more than doubling the $279 billion market cap lost by none other than Nvidia on Sept. 3, 2024 (Meta’s $251 billion loss Feb. 3, 2022 is the third-biggest daily loss).

The slide knocked Nvidia from its position as the world’s most valuable company, sending its valuation from $3.5 trillion to $2.9 trillion, less than Apple’s and Microsoft’s.

Nvidia headlined broader U.S. stock losses, as the benchmark S&P 500 fell 1.5% and the tech-concentrated Nasdaq dropped 3.1%, and other major AI technology providers including fellow chip designers Arm and Broadcom plus data storer Oracle all tanked at least 10%.

In an afternoon statement, a Nvidia spokesperson called DeepSeek’s model an “excellent AI advancement” which is “fully export control compliant” while still requiring “significant numbers” of Nvidia’s graphics processing units (GPUs).

Why Nvidia Stock Fell

The release of DeepSeek’s large-language model, which shook confidence in U.S. dominance in generative AI, may initially not seem like a negative catalyst for Nvidia, considering DeepSeek’s model was trained on Nvidia’s GPUs, like most other advanced AI programs. But the Chinese company said it spent just $5.6 million on Nvidia technology to develop its large-language model, and though experts speculate this is a gross underestimate, it still upsets the core thesis behind Nvidia stock’s meteoric rise. Nvidia’s net profits soared from $4.8 billion in 2022 to an estimated $66.7 billion in 2024 thanks in large part to demand for its GPUs, which fetch up to $25,000 apiece, from American tech giants like Facebook parent Meta, Tesla and ChatGPT maker OpenAI. If big U.S. tech companies “can learn from DeepSeek to design AI systems with cheaper GPUs…it might not be a happy development for Nvidia,” remarked Ed Yardeni of Yardeni Research in a note to clients.

Surprising Fact

Nvidia’s nearly $600 billion market cap loss Monday is larger than the individual market values of all but 13 American companies, more than the market cap of titans like health insurer UnitedHealth, oil giant Exxon Mobil and retailer Costco.

Forbes Valuation

Nvidia CEO Jensen Huang got $21 billion poorer Monday, as his net worth fell from $124.4 billion to $103.1 billion, according to Forbes estimates. Huang is Nvidia’s largest individual shareholder with a 3% stake in the Silicon Valley firm.

Further Reading

Nvidia Stock Plunges 17% As NVDA Suffers Biggest Market Cap Loss Ever—Driven By DeepSeekIn a shocking turn of events, Nvidia’s stock has plummeted by 17% in one day, resulting in the company’s biggest market cap loss ever. This dramatic decline was reportedly driven by DeepSeek, a new AI technology developed by a rival company that threatens to disrupt Nvidia’s dominance in the market.

Investors are reeling from the news, as Nvidia’s stock had been on a steady upward trajectory for years. The sudden drop has wiped out billions of dollars in market value, leaving many shareholders scrambling to make sense of the situation.

DeepSeek’s potential to revolutionize the AI industry has sent shockwaves through the tech world, with many speculating that Nvidia may struggle to compete against this new threat. As the dust settles, all eyes will be on how Nvidia responds to this unprecedented challenge and whether they can regain their footing in the market.

Stay tuned for more updates on this developing story.

Tags:

- Nvidia stock

- NVDA

- Market cap loss

- DeepSeek

- Stock market

- Tech industry

- Nvidia news

- Market volatility

- Investment

- Stock price fluctuations

#Nvidia #Stock #Plunges #NVDA #Suffers #Biggest #Market #Cap #Loss #EverDriven #DeepSeek

Musk and Scale AI’s CEO Suggest that DeepSeek Has More NVDA Chips than Expected

During a January 23 CNBC interview, Alexandr Wang, the CEO of Scale AI, said that DeepSeek has approximately 50,000 H100 Nvidia (NVDA) chips. However, due to U.S. export controls, DeepSeek cannot publicly discuss this information. Wang also stated that although DeepSeek may have more chips than expected, it will still face limitations due to chip controls and export restrictions. Elon Musk, the CEO of EV maker Tesla (TSLA), seemed to agree with Wang’s assessment after he responded with “Obviously” to a post sharing Wang’s interview.

Shares of Nvidia plunged in today’s trading after DeepSeek revealed that its AI model is able to outperform the best models from U.S. companies at only a fraction of the cost. However, if the firm is not disclosing how many chips it actually has, then the cost of its AI model might actually be much higher than the stated $5.7 million.

Nevertheless, investors got spooked and sold off their chip stock holdings due to fears that demand for GPUs could decline as a result of DeepSeek’s advancements. Still, Cantor and UBS analysts argue that this could actually increase demand for GPUs.

Is NVDA a Good Stock to Buy?

Turning to Wall Street, analysts remain bullish on NVDA stock, with a Strong Buy consensus rating based on 36 Buys and three Holds assigned in the past three months. After a 90% rally in its share price over the past year, the average NVDA price target of $177.56 per share implies an upside potential of 49.8% from current levels.

Elon Musk, CEO of Tesla and SpaceX, and Alexandr Wang, CEO of Scale AI, recently hinted that their joint venture, DeepSeek, may have more NVIDIA chips than initially anticipated.In a recent tweet, Musk mentioned that the DeepSeek team was “pleasantly surprised” by the number of NVIDIA chips they were able to secure for their project. Wang also chimed in, noting that the increased chip count would allow DeepSeek to push the boundaries of AI and machine learning even further.

The news has sparked excitement among tech enthusiasts, as NVIDIA’s chips are known for their high performance and efficiency in powering AI applications. With more chips at their disposal, DeepSeek could potentially accelerate the development of groundbreaking technologies in various industries, from autonomous vehicles to robotics.

Stay tuned for more updates on DeepSeek’s progress and the impact of the increased NVIDIA chip count on their projects. The future of AI is looking brighter than ever!

Tags:

- Musk

- Scale AI

- DeepSeek

- CEO

- NVDA chips

- Elon Musk

- Artificial intelligence

- Technology

- Semiconductor industry

- Deep learning

- Neural networks

- Tech news

- Innovation

- Silicon Valley

- Hardware advancements

#Musk #Scale #AIs #CEO #Suggest #DeepSeek #NVDA #Chips #Expected

Is NVIDIA Corporation (NVDA) Among Billionaire Chris Rokos’ Top Stock Picks?

We recently published a list of Billionaire Chris Rokos’ Top 15 Stock Picks. In this article, we are going to take a look at where NVIDIA Corporation (NASDAQ:NVDA) stands against other Billionaire Chris Rokos’ top stock picks.

Chris Rokos is a highly regarded British hedge fund manager and the founder of Rokos Capital Management, one of the most successful global macro hedge funds in the world. With a reputation for astute market predictions and exceptional returns, Rokos has established himself as a leading figure in the financial industry. His career trajectory reflects both his expertise in macroeconomic analysis and his ability to manage risk effectively in volatile markets. Chris Rokos was born in 1970 and grew up in the United Kingdom. A brilliant student from an early age, he attended Eton College, one of the UK’s most prestigious schools. He later studied at Pembroke College, Oxford, graduating with a degree in mathematics. Rokos’ strong analytical skills, honed during his academic career, became a foundation for his success in the world of finance.

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

After university, Rokos joined Goldman Sachs as an investment banker, where he gained valuable experience in financial markets. In 1993, he moved to UBS and later joined the fledgling hedge fund Brevan Howard Asset Management in 2002, a move that would mark a turning point in his career. As one of the co-founders of Brevan Howard, Rokos played a pivotal role in the firm’s rise to prominence. He specialized in global macro trading, focusing on interest rates, currencies, and government bonds. Rokos was one of the firm’s star traders, reportedly generating over $4 billion in profits for the fund during his tenure. Rokos left Brevan Howard in 2012, taking a sabbatical from trading.

In 2015, Rokos launched Rokos Capital Management with approximately $3 billion in assets under management (AUM) from institutional investors. The firm focuses on global macroeconomic strategies, leveraging Rokos’ expertise in trading interest rates and currencies. Rokos Capital Management has grown its 13F assets to over $6 billion by the end of the third quarter of 2024, making it one of the largest hedge funds in Europe. Despite challenging market conditions, Rokos has delivered strong returns, often outpacing peers in the industry. For instance, in 2022, the fund gained 50%, benefiting from rising interest rates and inflation volatility.

Is NVIDIA Corporation (NVDA) Among Billionaire Chris Rokos’ Top Stock Picks?Billionaire investor Chris Rokos is known for his successful track record in the financial industry, particularly in the hedge fund sector. With a keen eye for lucrative investment opportunities, Rokos has built a reputation for making savvy investment decisions that yield impressive returns.

One stock that has caught the attention of Rokos is NVIDIA Corporation (NVDA), a leading technology company known for its graphics processing units (GPUs) and artificial intelligence capabilities. NVDA has been a popular choice among investors due to its strong performance in the semiconductor industry and its potential for future growth.

Given Rokos’ history of picking winning stocks, many are curious to know if NVDA is among his top stock picks. While Rokos has not publicly disclosed his current holdings, it is possible that NVDA could be on his radar given its strong fundamentals and growth prospects.

Investors looking to follow in Rokos’ footsteps may want to consider adding NVDA to their portfolios, as the company continues to innovate and expand its market presence. With the rise of artificial intelligence and the increasing demand for high-performance computing solutions, NVDA could be well-positioned for long-term success.

As always, investors should conduct their own research and consider their risk tolerance before making any investment decisions. While Rokos’ endorsement of NVDA could provide a vote of confidence for the stock, it is important to remember that past performance is not indicative of future results.

Tags:

NVIDIA Corporation, NVDA, Chris Rokos, Top Stock Picks, Billionaire Investor, Stock Market, Investment Strategies, Tech Industry, Wealth Management

#NVIDIA #Corporation #NVDA #Among #Billionaire #Chris #Rokos #Top #Stock #Picks

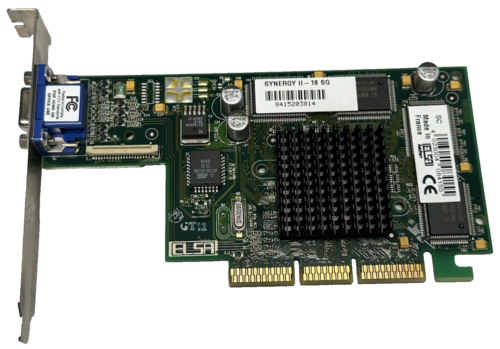

ELSA Synergy II-16 Ver 3.01.00 Nvidia corp. AGP VGA 16Mb for industrial pc NVDA

ELSA Synergy II-16 Ver 3.01.00 Nvidia corp. AGP VGA 16Mb for industrial pc NVDA

Price : 139.97

Ends on : N/A

View on eBay

Introducing the ELSA Synergy II-16 Ver 3.01.00 Nvidia corp. AGP VGA 16Mb for industrial PC NVDA!Are you looking for a reliable and high-performance graphics card for your industrial PC? Look no further than the ELSA Synergy II-16 Ver 3.01.00 Nvidia corp. AGP VGA 16Mb. This graphics card is designed to provide exceptional graphics performance, making it perfect for industrial applications that require high-quality visuals.

With its Nvidia corp. AGP VGA 16Mb, the ELSA Synergy II-16 Ver 3.01.00 delivers smooth and crisp graphics that will enhance your viewing experience. Whether you’re running complex simulations, analyzing data, or simply need a reliable graphics card for your industrial PC, the ELSA Synergy II-16 Ver 3.01.00 is the perfect choice.

Upgrade your industrial PC with the ELSA Synergy II-16 Ver 3.01.00 Nvidia corp. AGP VGA 16Mb and experience the power of Nvidia graphics technology. Trust in ELSA’s reputation for quality and performance, and take your industrial PC to the next level with the ELSA Synergy II-16 Ver 3.01.00.

#ELSA #Synergy #II16 #Ver #3.01.00 #Nvidia #corp #AGP #VGA #16Mb #industrial #NVDA

Rare Authentic Palantir T-Shirt from the 2012 Hackweek $PLTR $NVDA #nvidia #ai

Rare Authentic Palantir T-Shirt from the 2012 Hackweek $PLTR $NVDA #nvidia #ai

Price : 150.00

Ends on : N/A

View on eBay

Are you a fan of rare tech memorabilia? Look no further than this authentic Palantir t-shirt from the 2012 Hackweek event! This one-of-a-kind shirt features the iconic Palantir logo and is a must-have for any collector or fan of the company.Palantir, known for its data analytics and AI technology, has become a powerhouse in the tech industry. This shirt is a piece of history from their Hackweek event, where employees come together to collaborate and innovate.

But that’s not all – this shirt also features the Nvidia logo, another tech giant known for its graphics processing units and AI technology. This makes it a unique and valuable piece for any tech enthusiast.

Don’t miss your chance to own this rare and authentic Palantir t-shirt. Get it now before it’s gone! #PLTR #NVDA #nvidia #ai #techmemorabilia

#Rare #Authentic #Palantir #TShirt #Hackweek #PLTR #NVDA #nvidia