Your cart is currently empty!

Tag: Price

Tesla Stock Price Prediction

Tesla Stock Price Prediction: Bear Flag Formation Developing (See the 4 hour Chart Below)

Tesla’s (TSLA) stock has been trading within a defined range recently, and the latest price action is printing a concerning technical pattern—a bear flag. Here’s a breakdown of what this means for the Tesla stock price prediction and its implications for traders and investors.

Why Tesla Stock Price Prediction Points to $360

- Bear Flag Pattern: Tesla forms a bearish continuation pattern.

- Anchored VWAP Cross: Indicates weakening bullish momentum as price crosses down.

- Price Target: A potential drop to $360 based on the bear flag projection.

- Upcoming Catalyst: Tesla’s earnings report in three days could act as a trigger for heightened volatility.

TSLA Stock Technical Analysis: Bear Flag Formation

Tesla stock price prediction to 360 as it prints a bear flag

- What Is Happening: On the 4-hour chart, Tesla has formed a bear flag pattern. This bearish setup follows a significant decline and features a consolidation phase that angles upward within a red channel.

- Key Signs:

- Price touched the upper boundary of the red channel twice, establishing a second touchpoint.

- A lower high has formed, signaling weakening bullish momentum.

Anchored VWAP Insights for Tesla Stock Analysis

- Key Level: The purple line represents the Anchored VWAP (Volume Weighted Average Price) from the start of 2025.

- What It Means: Price crossing below the Anchored VWAP shows the average buyer is now underwater, potentially adding selling pressure as investors exit positions.

Tesla Stock Forecast: Key Levels to Watch

- Bear Flag Target: $360 aligns with previous support zones and the measured move of the bear flag’s pole.

- Catalyst: Tesla’s earnings report in three days could provide the momentum needed to confirm this downside move.

- Key Technical Zones:

- Lower boundary of the bear flag for potential breakdown.

- Stops placed above the upper boundary for risk management.

TSLA Stock Price Prediction: Trade Strategy

- Bearish Setup:

- Entry: Consider short positions on a confirmed breakdown below the bear flag. Or follow the ForexLive.com TradeCompass for possible earlier entries, as you take quick partial profits (when the trade succeeds) and can hang on to ‘runners’ for a swing trade.

- Stops: Above the upper boundary of the channel.

- Target: Around $360, based on the measured move projection.

- Risk Management:

- Earnings volatility could impact this trade setup, so position sizing and proper stop placement are crucial.

ForexLive.com TradeCompass on Tesla Stock

Conclusion: Tesla Stock Forecast Remains Bearish

Tesla’s 4-hour chart is flashing warning signals with the bear flag formation. The crossing down of the Anchored VWAP adds another layer of bearish confirmation. While earnings could introduce surprises, technically, a move toward $360 seems probable. Traders should monitor these levels and prepare for potential volatility.

Disclaimer: This analysis reflects the author’s opinion and is not financial advice. For additional views and insights, visit ForexLive.com.

As we head into the second half of the year, many investors are closely watching the stock price of electric vehicle giant Tesla. After a rollercoaster ride in the first half of 2021, where the stock surged to record highs before experiencing a significant pullback, the question on everyone’s mind is: where will Tesla’s stock price go next?With the recent chip shortage impacting production and delivery timelines, as well as increased competition in the EV market from traditional automakers, some analysts are predicting a bearish outlook for Tesla. They believe that the stock price may continue to face pressure in the coming months, potentially dropping below current levels.

On the other hand, Tesla bulls remain optimistic about the company’s long-term growth prospects. With new factories in the works, innovative technology advancements, and a loyal customer base, they believe that Tesla’s stock price will bounce back and reach new highs before the end of the year.

Ultimately, predicting the future stock price of Tesla is a challenging task, as it is influenced by a multitude of factors. Whether you’re a bear or a bull, one thing is for certain – the stock price of Tesla is sure to keep investors on their toes in the months ahead. What are your predictions for Tesla’s stock price? #Tesla #StockPricePrediction #Investing #ElectricVehicles

Tags:

Tesla, stock price, prediction, Tesla stock, bearish forecast, market analysis, financial outlook, investment strategy, Tesla Inc, stock market trends, stock market news, stock market forecast.

#Tesla #Stock #Price #PredictionHomer Price – Paperback By McCloskey, Robert – VERY GOOD

Homer Price – Paperback By McCloskey, Robert – VERY GOOD

Price : 4.08

Ends on : N/A

View on eBay

Homer Price – Paperback By McCloskey, Robert – VERY GOODLooking for a fun and entertaining read for your child? Look no further than “Homer Price” by Robert McCloskey. This classic children’s book follows the adventures of a young boy named Homer Price in a small town in Ohio.

With its charming illustrations and witty storytelling, “Homer Price” is sure to captivate young readers and keep them entertained for hours on end. From donut-making machines gone awry to mysterious visitors at the town’s diner, Homer’s adventures are full of humor and heart.

This paperback edition of “Homer Price” is in very good condition, making it the perfect addition to any child’s bookshelf. Don’t miss out on this timeless tale that has delighted readers for generations. Order your copy today!

#Homer #Price #Paperback #McCloskey #Robert #GOOD,ages 3+Johnson says price tag on Trump mass deportation plan is ‘small investment’ to ‘restore’ security, safety

House Speaker Mike Johnson, R-La., on Sunday denied that President-elect Trump’s mass deportation plan could cost trillions of dollars, though said that there is no better investment than restoring the safety and security of the country.

Johnson made the remarks during an appearance on NBC’s “Meet the Press” when he was asked about the border crisis and grocery prices, the two issues that Trump says helped him win the election.

“I cannot think of a better dollar for dollar investment than to restore the security and the safety of the country,” Johnson said. “We’ve had a wide-open border for four years and millions upon millions of illegal persons. We have dangerous illegals in the country, criminals who have already committed crimes here, violent crimes against American citizens.”

The speaker cited crime and “the untold humanitarian cost in terms of trafficking and fentanyl deaths” in the U.S. as important reasons to tackle border security, saying, “getting rid of that criminal element … is something the American people want us to do.”

IMMIGRATION HAWKS URGE CONGRESS, TRUMP TO ‘BEGIN IMMEDIATELY’ ON MASS DEPORTATION PLEDGE

President Trump tours a section of the border wall in San Luis, Arizona, on June 23, 2020. (AP Photo/Evan Vucci, File)

“The number one job of the federal government is protecting the citizenry,” he said. “And when you have a wide-open border, you don’t have safety, security or even sovereignty, for that matter. President Trump is going to follow through on his campaign promises and the promises that we all made on the campaign trail. It costs money to do that. But there is a small investment in terms of what it costs us.”

House Speaker Mike Johnson appeared on NBC’s “Meet the Press” on Sunday and said Trump’s mass deportation plan was a “small investment” to restore safety and security to the country. (Getty Images, File)

When asked whether the plan would come with a price tag in the trillions of dollars, Johnson rejected the notion.

“It won’t cost trillions of dollars. I think we don’t yet know the dollar figure,” he said. “But I will tell you that the American people are going to support that effort. And we’re going to begin with the most dangerous elements. And you’re going to see a dramatic change in the country because of it.”

Johnson did not provide an estimated cost for the deportation plan.

BIDEN HAD NO IDEA HE SIGNED NATURAL GAS EXECUTIVE ORDER, JOHNSON SAYS

Regarding grocery prices, Johnson said those costs would unquestionably come down under Trump with the return to “fiscal sanity” and “common sense.”

Johnson said that Congress and the Trump administration will “turn the economic engines back on” like during the first Trump term when lawmakers “reduced the tax burden on the American people, but even more importantly, the regulatory burden.”

“That’s going to be a major theme of the upcoming administration in this Congress, because if you release the red tape, you unleash the free market again. And that’s good for everybody,” he said.

In a recent statement, Homeland Security Secretary Kirstjen Nielsen defended President Trump’s controversial mass deportation plan, calling the estimated $114 billion price tag a “small investment” in order to “restore security and safety to our country.”Nielsen emphasized that the administration’s priority is to crack down on illegal immigration and remove those who have entered the country unlawfully. She argued that the cost of deporting millions of undocumented immigrants is necessary in order to protect American citizens and uphold the rule of law.

Critics of the plan have raised concerns about the financial burden it would place on taxpayers and the humanitarian implications of forcibly removing millions of individuals from their homes. However, supporters of the mass deportation plan believe that it is a necessary step towards securing the country’s borders and preventing further illegal immigration.

President Trump has made immigration enforcement a key pillar of his administration’s agenda, and it appears that his administration is willing to invest significant resources in order to achieve its goals. Whether the benefits of the mass deportation plan will justify its high cost remains to be seen.

Tags:

- Johnson

- Trump

- Mass deportation

- Security

- Safety

- Immigration

- Border control

- National security

- Homeland security

- Political news.

#Johnson #price #tag #Trump #mass #deportation #plan #small #investment #restore #security #safety

Winner of Over 175 GOTY Awards Drops to Lowest-Ever Price on Steam

Summary

- The Red Dead Redemption 2 PC version is discounted 75% on Steam, dropping to its lowest-ever price of $14.99.

- Numerous other Rockstar titles have all also received steep Steam discounts in late January 2025.

- The ongoing offers are all available until February 6.

Red Dead Redemption 2 is 75% off on Steam, dropping to its lowest-ever price on Valve’s storefront. The critically acclaimed game has been discounted alongside a bunch of other Rockstar titles as part of a Steam sale that will run until early February 2025.

The PC version of Red Dead Redemption 2 has seen frequent sales since its December 2019 release. However, the last time it reached a new all-time low was in November 2022, when Rockstar first offered a 67% discount.

Related

Red Dead Redemption 2 and GTA 5 Are Still Selling Very Well

Both Grand Theft Auto 5 and Red Dead Redemption 2 continue to sell strongly across multiple regions, building on Rockstar’s legacy of success.

The developer-publisher has at last launched a better offer in January 2025, discounting the Red Dead Redemption 2 PC port by 75% on Steam. The deal brings the game’s price down to $14.99 / €14.99 for the first time ever. The Ultimate Edition of the critically acclaimed title has also found a new low as part of the ongoing sale, as it’s currently available for $17.99, 80% below its regular price. The higher-tier edition includes one exclusive Red Dead Redemption 2 outfit, a gun talisman, and a horse, as well as a unique treasure hunt and some other minor content additions.

All Rockstar Games Currently on Sale on Steam

With over 175 Game of the Year awards to its name, Red Dead Redemption 2 is one of the most acclaimed titles ever made. This ongoing deal hence presents a compelling opportunity for PC gamers who enjoy open-world action adventures and haven’t yet experienced the game to see what all the fuss is about without breaking the bank.

Rockstar’s ongoing sale has also seen the company discount the long-awaited PC port of the first Red Dead Redemption, which finally made its way to Steam in October 2024, 14 and a half years following its original release. The PC version of the 2010 game was the target of some vocal fan criticism over its introductory price of $49.99. However, it can currently be picked up for $39.99. Meanwhile, Grand Theft Auto: The Trilogy – The Definitive Edition is presently available at 60% off, or $23.99.

In addition to Red Dead Redemption 2, Max Payne 2: The Fall of Max Payne has hit a new all-time low price in the ongoing sale, while Max Payne 3 is discounted by 70%, matching its best-ever deal. Rockstar’s current Steam deals will all be available until February 6.

Exciting news for gamers! The highly acclaimed game that has won over 175 Game of the Year awards is now available at its lowest-ever price on Steam. If you’ve been wanting to experience this epic adventure, now is the perfect time to grab it at a discounted rate.With stunning graphics, immersive gameplay, and a gripping storyline, this game has captivated players around the world and continues to be a fan favorite. Don’t miss out on this incredible deal to own a piece of gaming history.

Hurry and head to Steam to take advantage of this amazing offer before it’s too late. Happy gaming! #GOTYWinner #SteamSale #EpicAdventure

Tags:

- GOTY Awards

- Steam sale

- Best game deals

- Video game discounts

- Gaming deals

- Lowest price on Steam

- Award-winning game sale

- Game of the year discounts

- Steam game sale

- Best game discounts

#Winner #GOTY #Awards #Drops #LowestEver #Price #Steam

Seattle Seahawks NFL Fisher Price Little People NIB Seal Collectors Volume Prici

Seattle Seahawks NFL Fisher Price Little People NIB Seal Collectors Volume Prici

Price : 20.00

Ends on : N/A

View on eBay

Are you a Seattle Seahawks fan and a collector of Fisher Price Little People? Then you won’t want to miss out on this rare find – a NIB (New in Box) Seattle Seahawks NFL Fisher Price Little People set. This exclusive collectors volume features all your favorite Seahawks players in adorable Little People form.Whether you’re a die-hard Seahawks fan or just love collecting unique sports memorabilia, this set is sure to be a standout addition to your collection. With the seal intact and the box in pristine condition, this NIB set is a must-have for any serious collector.

Don’t miss out on this opportunity to own a piece of Seahawks history in a fun and playful way. Get your hands on this Seattle Seahawks NFL Fisher Price Little People NIB Seal Collectors Volume now before it’s gone!

#Seattle #Seahawks #NFL #Fisher #Price #People #NIB #Seal #Collectors #Volume #Prici,ages 3+Planet Labs PBC (NYSE:PL) Looks Just Right With A 31% Price Jump

Planet Labs PBC (NYSE:PL) shares have continued their recent momentum with a 31% gain in the last month alone. The last month tops off a massive increase of 138% in the last year.

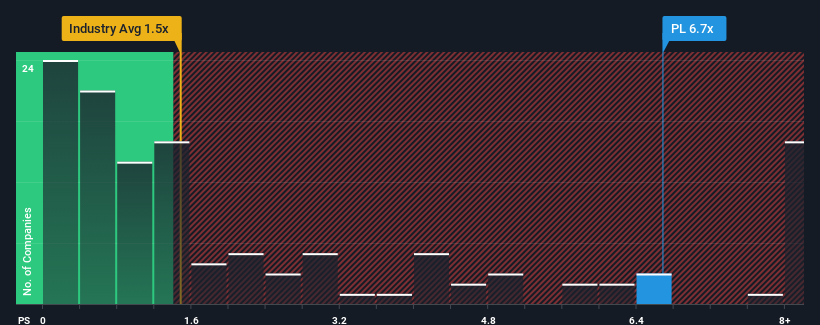

Following the firm bounce in price, you could be forgiven for thinking Planet Labs PBC is a stock to steer clear of with a price-to-sales ratios (or “P/S”) of 6.7x, considering almost half the companies in the United States’ Professional Services industry have P/S ratios below 1.4x. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Planet Labs PBC

NYSE:PL Price to Sales Ratio vs Industry January 25th 2025 How Has Planet Labs PBC Performed Recently?

With revenue growth that’s superior to most other companies of late, Planet Labs PBC has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn’t the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Planet Labs PBC will help you uncover what’s on the horizon.

What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Planet Labs PBC would need to produce outstanding growth that’s well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 94% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 11% as estimated by the eleven analysts watching the company. That’s shaping up to be materially higher than the 7.3% growth forecast for the broader industry.

With this in mind, it’s not hard to understand why Planet Labs PBC’s P/S is high relative to its industry peers. Apparently shareholders aren’t keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Planet Labs PBC’s P/S?

The strong share price surge has lead to Planet Labs PBC’s P/S soaring as well. While the price-to-sales ratio shouldn’t be the defining factor in whether you buy a stock or not, it’s quite a capable barometer of revenue expectations.

As we suspected, our examination of Planet Labs PBC’s analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company’s future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It’s always necessary to consider the ever-present spectre of investment risk. We’ve identified 2 warning signs with Planet Labs PBC, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocksHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Planet Labs PBC (NYSE:PL) saw a significant 31% increase in its stock price recently, and it seems like the perfect move for this innovative space technology company.With a mission to provide high-resolution satellite imagery and data to help solve some of the world’s most pressing challenges, Planet Labs has been making waves in the industry. The company’s constellation of satellites captures daily images of the Earth’s surface, providing valuable insights for a wide range of industries, from agriculture to disaster response.

Investors seem to be taking notice of Planet Labs’ potential, as evidenced by the recent surge in its stock price. The company’s unique technology and commitment to sustainability make it a promising investment opportunity for those looking to support cutting-edge innovation in the space sector.

If you’re looking for a stock that offers both growth potential and a positive impact on the world, Planet Labs PBC might just be the right fit for your portfolio. Keep an eye on this exciting company as it continues to reach new heights in the space industry.

Tags:

Planet Labs PBC, NYSE:PL, stock price, 31% increase, stock market, investment, Planet Labs news, stock analysis, financial news, NYSE, trading, stock performance, stock price jump, Planet Labs stock.

#Planet #Labs #PBC #NYSEPL #Price #Jump‘It’s Going To Happen’—Bitcoin Price Braces For Huge Trump Earthquake

Bitcoin and crypto prices have swung wildly over the last week as U.S. president Donald Trump begins his second term—teasing huge crypto plans.

Unlock over $3,000 in NFT, web3 and crypto perks — Apply now!

The bitcoin price has reclaimed $100,000 per bitcoin, climbing as traders predict a so-called “God candle” could be about to hit the market.

Now, after Trump’s crypto czar declared a new age has “just begun,” a presidential pardon for Silk Road founder Ross Ulbricht has sent expectations soaring that Trump will follow through on his campaign promise to create a U.S. bitcoin reserve.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

U.S. president Donald Trump has said he wants to create a bitcoin stockpile—potentially blowing up … [+]

“If Ross Ulbricht got the pardon, we are definitely getting the strategic bitcoin reserve,” crypto YouTuber and influencer Anthony Pompliano posted to X. “Trump will create history with the stroke of his pen.”

In December, Trump confirmed he plans to establish a U.S. bitcoin strategic reserve. “We’re gonna do something great with crypto because we don’t want China, or anybody else … but others are embracing it, and we want to be ahead,” Trump told CNBC.

“Yes, I think so,” Trump said in response to a question about whether the U.S. will create a bitcoin strategic reserve similar to its oil reserve.

In July, then Republican candidate Donald Trump promised to create a “strategic national bitcoin reserve” and predicted bitcoin could eclipse gold’s $16 trillion market capitalization during an appearance at the Bitcoin 2024 conference.

Ulbricht, the founder of the dark web marketplace Silk Road who went by The Princess Bride movie-inspired moniker Dread Pirate Roberts and helped popularize the use of bitcoin for online transactions, has been given a full pardon by Trump, fulfilling a campaign promise.

Following the announcement, Tesla billionaire and Trump adviser Elon Musk said he’d asked if Roger Ver, an influential bitcoin and crypto developer, may receive a similar pardon over tax evasion charges.

The odds of Trump creating a U.S. bitcoin stockpile on the Polymarket prediction platform shot up following Ulbricht’s pardon, who was serving multiple life sentences without the possibility of parole following his 2015 conviction.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has surged over the last year, climbing to a fresh all-time high this week after … [+]

“Odds for the [strategic bitcoin reserve] just skyrocketed, it’s going to happen,” David Bailey, the chief executive of Bitcoin Magazine publisher Bitcoin Inc who organized the bitcoin conference Trump spoke at last year, posted to X.

Trump’s launch of a controversial and widely-mocked memecoin over the weekend had somewhat dampened the spirits of the bitcoin and crypto community ahead of his inauguration on Monday, however, Ulbricht’s pardon has reenergized bullish bitcoin speculators who believe Trump will create a crypto “golden age.”

“Welcome home, Ross. Bitcoiners stand with you,” Jack Mallers, the chief executive of bitcoin wallet company Strike, posted to X.

As the world watches in anticipation of the upcoming US presidential election, the Bitcoin market is also gearing up for a potential earthquake in price. With the possibility of a second term for President Trump or a victory for Joe Biden, the cryptocurrency market is bracing for significant fluctuations.Bitcoin, which has seen a steady rise in price over the past few months, is expected to be impacted by the outcome of the election. A win for Trump could potentially lead to increased economic uncertainty and market volatility, causing the price of Bitcoin to soar as investors seek alternative assets. On the other hand, a Biden victory could bring about more stability and regulation in the market, potentially leading to a drop in Bitcoin price.

Despite the uncertainty surrounding the election, one thing is for sure—Bitcoin is going to be affected. Whether it’s a drastic increase or decrease in price, the cryptocurrency market is preparing for a seismic shift. So hold on tight, because it’s going to happen.

Tags:

- Bitcoin price

- Trump

- Earthquake

- Cryptocurrency news

- Market analysis

- Financial predictions

- Bitcoin volatility

- Trump administration impact

- Economic implications

- Investing in Bitcoin

#HappenBitcoin #Price #Braces #Huge #Trump #Earthquake

Attorney General Bonta Files Charges Against a Southern California Real Estate Agent for Price Gouging Eaton Fire Victims | State of California – Department of Justice

In addition, DOJ has sent 500 price gouging warning letters to hotels and landlords

LOS ANGELES — California Attorney General Rob Bonta today announced the filing of charges against a real estate agent for attempting to price gouge a couple who lost their home in the Los Angeles Eaton Fire. This investigation began when a complaint was filed with the California Department of Justice (DOJ) after the couple tried to rent a home after the Governor’s Emergency Order went into effect, which protects fire victims from price gouging. As part of Attorney General Bonta’s work to protect Californians following the Southern California wildfires, DOJ has also sent 500 warning letters – and counting – to hotels and landlords who have been accused of price gouging. In addition, the office has more active criminal investigations into price gouging underway.

“As I have said repeatedly, the price gouging must stop. Today, we are making good on our promise to hold price gougers accountable, with more to come,” said Attorney General Bonta. “I have been urging the public to report any such incidents to local authorities, or to my office at oag.ca.gov/report or by reaching out to our hotline at (800) 952-5225. The response has been astonishing and we have sent out 500 warning letters. Today, I am proud to announce that we have filed a case charging price gouging. May this announcement serve as a stern warning to those who would seek to further victimize those who have lost everything. DOJ is aggressively and relentlessly pursuing those who are trying to make a quick buck off of someone else’s pain.”

The investigation revealed that the couple applied to rent a home but after the application was received, they were informed that the price increased by 38%. They decided to not rent the house due to the increase in price. Due to the price being raised over the 10% limit laid out in Penal Code section 396, a charge was filed that carries potential penalty of a $10,000 maximum fine and the possibility of 12 months in jail.

Working alongside our District Attorneys, City Attorneys, and other law enforcement partners, DOJ has opened active investigations into price gouging as it continues to ramp up deployment of resources to Los Angeles County to investigate and prosecute price gouging, fraud, scams, and unsolicited low-ball offers on property during the state of emergency. DOJ has been working diligently to tackle this unlawful and unscrupulous conduct since a state of emergency was declared on January 7, 2025, and to further those efforts, the launch of a website dedicated to its response: oag.ca.gov/LAFires.

California law – specifically, Penal Code section 396 – generally prohibits charging a price that exceeds, by more than 10%, the price a seller charged for an item before a state or local declaration of emergency. For items a seller only began selling after an emergency declaration, the law generally prohibits charging a price that exceeds the seller’s cost of the item by more than 50%. This law applies to those who sell food, emergency supplies, medical supplies, building materials, and gasoline. The law also applies to repair or reconstruction services, emergency cleanup services, transportation, freight and storage services, hotel accommodations, and long- and short-term rental housing. Exceptions to this prohibition exist if, for example, the price of labor, goods, or materials has increased for the business.Violators of the price gouging statute are subject to criminal prosecution that can result in a one-year imprisonment in county jail and/or a fine of up to $10,000. Violators are also subject to civil enforcement actions including civil penalties of up to $2,500 per violation, injunctive relief, and mandatory restitution. The Attorney General and local prosecutors can enforce the statute.

TIPS FOR REPORTING PRICE GOUGING, SCAMS, FRAUD AND OTHER CRIMES:

- Visit oag.ca.gov/LAfires or call our hotline at: (800) 952-5225.

- Include screenshots of all correspondence including conversations, text messages, direct messages (DMs), and voicemails

- Provide anything that shows what prices you were offered, when, and by whom.

- If you’re on a site like Zillow, you can also send screenshots of the price history and a link to the listing.

- Include first and last names of the realtors, listing agents, or business owners you spoke to. Be sure to include phone numbers, email addresses, home and business addresses, websites, social media accounts.

- Don’t leave out any information that can help us find and contact the business or landlord.

Californians who believe they have been the victim of price gouging should report it to their local authorities or to the Attorney General at oag.ca.gov/LAfires. To view a list of all price gouging restrictions currently in effect as a result of proclamations by the Governor, please see here.

A copy of the complaint can be found here.

Attorney General Bonta Files Charges Against a Southern California Real Estate Agent for Price Gouging Eaton Fire VictimsThe State of California Department of Justice announced today that Attorney General Rob Bonta has filed charges against a Southern California real estate agent for allegedly price gouging victims of the devastating Eaton Fire.

According to the complaint filed in Los Angeles County Superior Court, the real estate agent is accused of jacking up the prices of rental properties in the aftermath of the fire, taking advantage of desperate residents who were left homeless by the disaster.

Attorney General Bonta stated, “Price gouging is illegal and unconscionable, especially in times of crisis when communities are already facing so much devastation. We will not tolerate anyone taking advantage of vulnerable individuals in their time of need.”

The charges against the real estate agent include violations of California’s price gouging laws, which prohibit businesses from increasing prices by more than 10% after a state of emergency has been declared.

If convicted, the real estate agent could face significant fines and penalties. The Department of Justice is urging anyone who may have been a victim of price gouging in the wake of the Eaton Fire to come forward and report their experience.

Stay tuned for updates on this developing story as the case progresses through the legal system.

Tags:

- Attorney General Bonta

- Charges filed

- Southern California

- Real estate agent

- Price gouging

- Eaton Fire victims

- State of California

- Department of Justice

- Legal action

- Criminal charges

#Attorney #General #Bonta #Files #Charges #Southern #California #Real #Estate #Agent #Price #Gouging #Eaton #Fire #Victims #State #California #Department #Justice

Electronic Arts price target lowered to $140 from $165 at Oppenheimer

Oppenheimer lowered the firm’s price target on Electronic Arts (EA) to $140 from $165 and keeps an Outperform rating on the shares. The firm notes that on January 22, EA released preliminary Q3 bookings and cut FY25 bookings guidance by 7.5%, the worst cut since FY19. Management attributes the weaker outlook primarily to Global Football, expected to show mid-single digit declines in FY25. Dragon Age sales also disappointed, falling short of management expectations by 50%. Oppenheimer also points out that the drastic cut to Global Football’s near-term outlook does not provide a hard reset that investors looked for. Relative to a Battlefield delay, declines in Global Football are more alarming, it argues. However, based on a pre-market price of about $122, the firm believes the 12- to 18-month risk/reward profile still looks favorable.

Electronic Arts (EA) investors may be feeling a bit uneasy after Oppenheimer recently lowered their price target for the gaming giant from $165 to $140. This news comes as a surprise to many, as Electronic Arts has been a powerhouse in the gaming industry for years.Oppenheimer cited concerns over potential delays in game releases and increased competition in the industry as reasons for the price target reduction. Despite this setback, many analysts still believe in the long-term potential of Electronic Arts and see this as a buying opportunity for investors.

It will be interesting to see how Electronic Arts responds to this news and if they can continue to innovate and create successful games in the future. Only time will tell if this price target adjustment will have a lasting impact on the company’s stock performance.

Tags:

Electronic Arts, EA, video game, gaming industry, stock market, Oppenheimer, price target, stock price, analysis, financial news, investment, electronic arts stock, EA stock, stock downgrade, market forecast, gaming company, video game developer

#Electronic #Arts #price #target #lowered #Oppenheimer