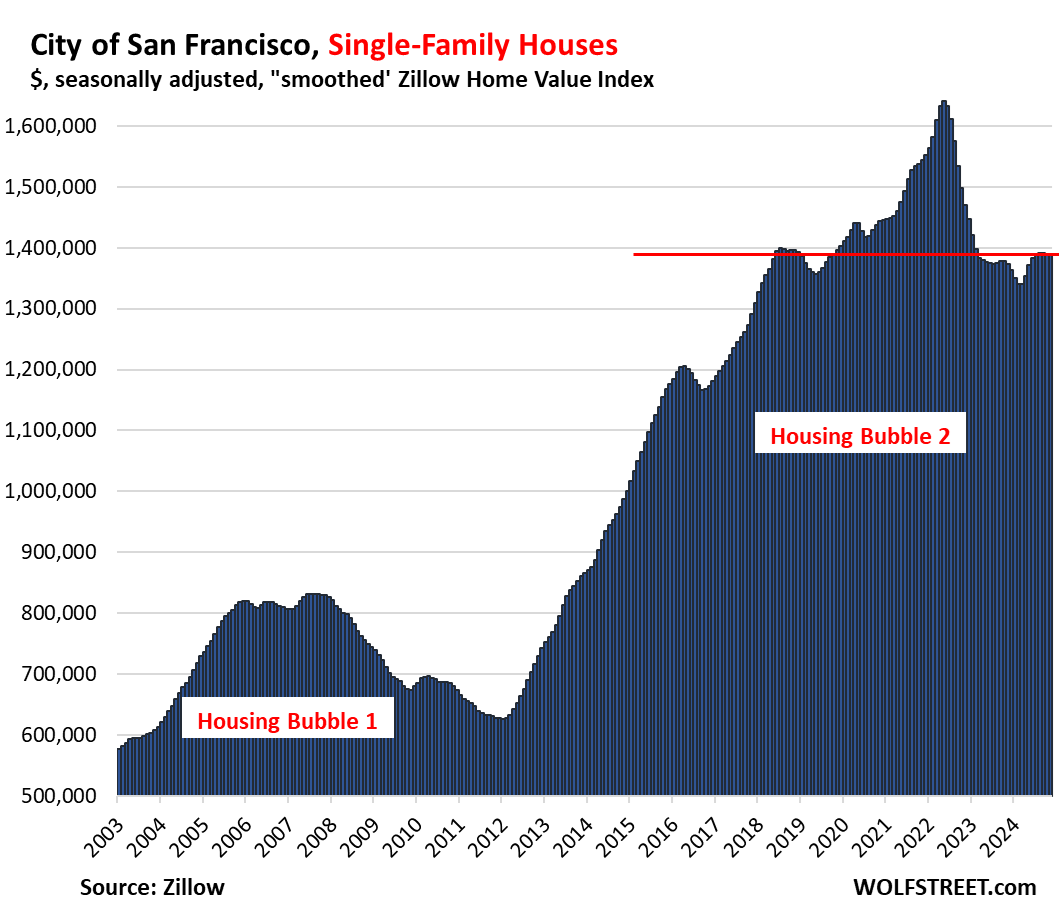

Housing Bust 2 reverses part of the “Housing Crisis” when people with good incomes could no longer afford to live in the City.

The big decline in tech employment in San Francisco and the northern part of Silicon Valley that we’ll get to in a moment has put its stamp on home prices in the city of San Francisco.

Unsustainable home-price spikes are, well, unsustainable.

Single-family house prices: -15.4% from the peak. In the city of San Francisco, prices of mid-tier single-family houses in November have dropped by 15.4% from the peak in May 2022, to $1.39 million, seasonally adjusted, and are back where they’d first been in 2019. October and November were down a tad from the prior three months.

“Mid-tier” to reduce the effects of shifts in the mix; “seasonally adjusted” to reduce the effects of seasonality; and “smoothed” (three-month average) to reduce monthly zigzags, as per data from the Zillow Home Value Index (ZHVI).

Slowly undoing the “Housing Crisis.” In the decade from 2012 to May 2022, ZHVI for single-family houses had spiked by 160%, triggering what was locally called the “Housing Crisis,” where middleclass employees with good incomes could no longer afford to live in the City.

Since May 2022, prices have now reversed about 25% (-$253,000) of the 10-year price spike (+$1.013 million), thereby beginning to alleviate the “Housing Crisis” that has caused so much damage to the City’s economic fabric.

This spike in house prices from 2012 to 2022 made San Francisco too expensive, forced employers in the City to pay huge salaries, driving up their primary costs, which pushed many of them to places where housing costs and wages were a lot lower.

And the City lost people, and it lost jobs, especially jobs in tech and finance. And home prices began to careen down, but it’s a slow bumpy process.

Condo & co-op prices: -14.7% from the peak. Condos and Co-ops account for about half of the home sales in San Francisco. Nearly all new construction over the past two decades has been multifamily (condo and rentals), and there is a lot of new condo supply coming on the market in central locations.

In the city of San Francisco, prices of mid-tier condos, seasonally adjusted and as three-month average, have dropped by 14.7% from the peak in May 2022, to $986,000, and are back where they’d first been in 2015.

From the beginning of 2012 through May 2022, over those 10 years, condo prices doubled. But since May 2022, prices have now reversed about 30% (-$170,000) of the 10-year price spike (+$576,000), thereby beginning to alleviate the Housing Crisis.

Jobs in San Francisco & Northern Part of Silicon Valley.

San Francisco and the northern part of Silicon Valley – the counties of San Francisco and San Mateo which make up the San Francisco-Redwood City-South San Francisco Metropolitan Division – have been among the epicenters of tech jobs in the US, and the epicenter of tech job booms and busts.

We’re going to look at payroll jobs from the Establishment Survey by the Bureau of Labor Statistics. The metro-level data was released on December 20. These jobs are tracked by business location to which the employee is assigned, regardless of where the employee lives. If a worker commutes from the East Bay to an office in San Francisco, it counts as a job in this Metropolitan Division. Same with remote employees.

Jobs in tech and social media are largely in two industries: “Information” and “Professional, Scientific, and Technical Services.”

Information: Over the past four months through November, payrolls in this industry roughly remained unchanged at 105,300, the lowest level since January 2020, down by 20%, or by 26,200 employees, from the peak in August 2022.

The drop has now undone the entire hiring boom that occurred during the pandemic – a hiring boom that occurred even as other industries (Leisure & Hospitality, Retail, Healthcare, etc.) were gutted by massive layoffs.

During the Dotcom Bust, the Information industry in the metropolitan division lost 46% of its jobs, beginning in late 2000 and hitting a low in mid-2006, and then it remained low for another four years, before taking off again.

The industry accounted for 9.1% of total payrolls in this metropolitan division in November. In overall US payrolls, jobs in Information account for only about 2% of overall employment.

Jobs in Information are at facilities where people primarily work on web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

Professional, Scientific, and Technical Services: Employment has remained roughly unchanged since April, maybe a sign it bottomed out. At about 213,500 employees in November, payrolls have dropped by 7% from the peak in June 2022.

This big broad industry accounted for 18.4% of total employment in the two-county area. It includes many sectors outside tech and social media: Legal advice and representation; accounting, bookkeeping, and payroll services; architectural, engineering, and specialized design services; computer services; consulting services; research services; advertising services; photographic services; translation and interpretation services; veterinary services; and other professional, scientific, and technical services.

During the Dotcom Bust, the industry lost 28% of its jobs in the metropolitan division until it bottomed out in late-2003. But given how much broader the sector is, it didn’t drop nearly as much as Information, and recovered much faster.

Combined, Information and Professional, Scientific, and Technical Services shed 42,100 payroll jobs since the peak in mid-2022.

The AI-related hiring boom – though the number of AI jobs is relatively small – has had a strange and mixed effect, with many companies announcing layoffs out of one side of their mouth, and AI-related hiring plans out of the other side of their mouth. And maybe it has now caused tech jobs in the area to stabilize.

Total private-sector payrolls have dropped to 1.014 million jobs, first seen in mid-2018. Since mid-2022, they’ve dropped by 3.5%, or by 36,500 jobs. Since the peak in February 2020, they’ve dropped by 5.7%, or by 60,900 jobs.

The plunge in payrolls during the pandemic was driven by Leisure & Hospitality, Retail, Healthcare, and some other industries that have now largely recovered.

During the Dotcom Bust, the two-county area lost 17% of its private-sector payroll jobs, a depression-type decline, compared to which the current decline is relatively moderate:

Employment at nonbank mortgage lenders nationwide collapsed by 37% this time around, to the lowest level since 1997. Read… Housing Bubble & Bust #1 and #2 as Seen through Employment in Mortgage Lending

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

For years, tech companies in the Bay Area have been on a hiring spree, gobbling up talent at astronomical rates and driving up housing prices to unprecedented levels. But now, as the tech industry faces uncertainty and layoffs due to the economic fallout from the COVID-19 pandemic, the bubble has burst.

With companies like Uber, Airbnb, and Lyft laying off thousands of employees and slashing budgets, the once red-hot housing market in San Francisco has cooled significantly. Homeowners who once enjoyed sky-high property values are now facing steep declines, while renters are finally seeing some relief in the form of lower prices.

As the tech industry struggles to adapt to the new normal, it remains to be seen how long this downward trend in housing prices will last. But for now, it’s clear that the days of exorbitant real estate prices in San Francisco are over.

Tags:

San Francisco house prices, San Francisco condo prices, San Francisco real estate, San Francisco housing market, tech jobs in San Francisco, Silicon Valley tech jobs, San Francisco economy, San Francisco housing prices 2019, San Francisco condo prices 2015

#San #Francisco #House #Prices #Drop #Condo #Prices #Tech #Jobs #City #Silicon #Valley #Evaporate #Drunken #Hiring #Binge