Your cart is currently empty!

Tag: Proposals

2025 Republican Policy Proposals: Immigration, Taxes and More

A document being circulated by the House Budget Committee outlines an ambitious Republican agenda to lower taxes, roll back green energy initiatives, reduce federal spending on health care, trim the safety net and limit federal support for higher education. It contains more than 200 items, with a heavy emphasis on spending cuts that could help pay for extending tax cuts.

Not everything on this list will become law — or even come up for a vote. Congressional Republicans are negotiating over the menu, and there are items certain to prove divisive among their members. They may also be limited by budget rules: Because they hope to pass most of their agenda through a so-called reconciliation process that will not require any Democratic votes in the Senate, only certain types of legislation can qualify. This week the White House also ordered a pause to funding for some of the programs Republicans are scrutinizing, though the effort was temporarily blocked by a judge.

But even with so much uncertainty, the document provides an unusually detailed look at the ideas being considered and provides some hints about what policies may come next.

Some important caveats:

• Be wary of the numbers. Some of the estimates are outdated; others come from analysts outside of government. Some haven’t been measured by anyone yet. Before anything becomes law, it will get a score — a formal cost estimate — from the Congressional Budget Office.

• Don’t add them up. Many provisions will interact with one another, meaning that if one were to pass, it could change the cost of another. This is particularly true of the Medicaid provisions, which would yield far less in budget savings than it appears if they were all adopted.

• There’s some repetition. The list compiles ideas from numerous House committees, and some have similar or even conflicting proposals.

Medicaid

Republicans are considering numerous options to reshape Medicaid, the country’s largest health insurance program, which covers 72 million poor and disabled Americans.

The largest proposal would limit the amount of federal payments to a flat fee for each enrolled person (instead of having the federal and state governments split the medical costs of beneficiaries).

Nearly all of those changes would reduce funding to state governments, and many are likely to be opposed by governors from both parties.

Medicaid per-capita caps

Limit the amount the federal governement pays to states for each Medicaid beneficiary.

$900 bil. savings

What to know Republicans included a similar policy in their unsuccessful efforts to repeal Obamacare in 2017. It would represent a huge cut for state governments, and is likely to be opposed by governors from both parties.

Equalize Medicaid match rate

Pay states a smaller percentage of bills for beneficiaries who became eligible through the Affordable Care Act.

$561 bil. savings

What to know Many of these policies would interact with one another, so adding together their savings is misleading.

Lower Medicaid matching floor

Pay states a smaller percentage of medical bills for beneficiaries in wealthier states.

$387 bil. savings

Limit Medicaid provider taxes

Restrict a technique that states use to earn more federal dollars for Medicaid.

$175 bil. savings

Repeal Biden Medicaid eligibility rule

Allow states to check eligibility more often, require more paperwork, and require in-person interviews.

$164 bil. savings

Reverse a rule for home-based care

The rule requires that 80 percent of payments made to home health agencies go to the workers themselves.

$121 bil. savings

Establish Medicaid work requirements

$100 bil. savings

Split Medicaid administrative fees with states

Make all such fees a 50-50 split, lowering federal payments for some.

$69 bil. savings

Reduce state-directed Medicaid payments

Cut a category of direct federal payments to state Medicaid programs.

$25 bil. savings

Repeal nursing home minimum staffing rule

$22 bil. savings

Taxes and trade

Chief among congressional Republicans’ priorities is an extension of the 2017 tax law, most of which is set to expire at the end of the year. A full extension is projected to cost about $4.6 trillion over the next 10 years by renewing tax rate cuts for individuals. Any other costs listed below would be on top of that amount.

The range of options includes several broad changes likely to be controversial, including a proposal to end the tax deduction for mortgage interest and another to eliminate the deduction for state and local taxes. But the more targeted options will generate far less revenue. It also includes several small tax changes, like requiring companies to pay tax for meals they provide to workers.

10 percent across-the-board tariff

On all imports

$1,900 bil. savings

What to know Many Republicans do not share Mr. Trump’s desire to enact new tariffs. Others have explored the possibility of passing them into law, though the president has the authority to implement them unilaterally.

Border adjustment tax

Destination-based tax on imports

$1,200 bil. savings

What to know Many economists like the idea, but a 2017 effort to pass a similar plan failed after companies opposed it.

Repeal SALT deduction

Eliminate the individual and business state and local tax deduction.

$1,000 bil. savings

What to know The document includes several conflicting approaches to this tax. This option is favored by some Republicans but would be a nonstarter for many others who represent high-tax states.

Eliminate the mortgage interest deduction

For primary homes

$1,000 bil. savings

What to know A repeal of this highly popular deduction would be unlikely to survive opposition from homeowners, lobbyists and some Republicans.

Eliminate income taxes on overtime

$750 bil. cost

What to know President Trump floated this option during his campaign.

Lower the corporate tax rate to 15 percent

The 2017 tax cuts lowered the corporate tax rate to 21 percent from 35 percent.

$522 bil. cost

What to know Mr. Trump has proposed this, but some Republicans worry that adding the expensive provision could endanger the overall legislation’s prospects.

Set a higher SALT deduction cap

Cap at $30,000 for married couples. The current cap, which is set to expire, is $10,000 per household.

$500 bil. cost

What to know Several blue-state Republicans are pushing for this increase, which President Trump says he supports.

Eliminate the estate tax

Estates less than $14 million are currently exempt, but that level is set to drop to $7 million next year.

$370 bil. cost

Repeal SALT deduction for businesses

$310 bil. savings

Limit SALT deduction to property taxes

With no cap

$300 bil. cost

Higher education

Numerous policies would target spending on higher education, like proposals to tax university endowments, cancel and tighten student loan programs, and reduce spending on hospitals that train medical residents. Some of the policies that would affect higher education are found in other categories, like the tax code or health care.

Change student loan repayment plans

Including elimination of Biden administration SAVE plan

$127.3 bil. savings

What to know One plan that would be cut, the SAVE plan created by the Biden administration, is on pause after legal challenges from states.

Limit Education Dept. regulatory authority

$30 bil. savings

Require payments from colleges

Require contributions to a grant program to participate in student loan programs

$18.1 bil. savings

Limit ability of students to discharge loans

In misconduct cases

$9.7 bil. savings

Limit ability of students to discharge loans

In cases where schools have closed

$4.9 bil. savings

Eliminate interest capitalization

For federal student loans

$3.8 bil. cost

Repeal 90/10 rule

Requirement that for-profit schools receive no more than 90 percent of their revenue from federal aid

$1.6 bil. cost

Allow students to rehabilitate loans twice

Currently, borrowers can rehabilitate loans once

$0.138 bil. cost

Reform standards for programs to participate in federal student aid

Expanding the gainful employment standard, for example

Unknown

Reform Public Service Loan Forgiveness

Including limiting eligibility

Unknown

What to know Mr. Trump proposed eliminating this program in his 2021 budget during his first term.

Immigration

Republicans in Congress have prioritized passing wide-ranging laws to limit immigration early in President Trump’s term. The items below are a sampling of what could be part of such a plan.

Many of those favored immigration policies would cost, rather than save, money. But there are also proposals that would generate revenue, like increasing fees for customs, airport screening and those charged to immigrants themselves.

Border wall funding

The document provides committee cost estimates for 734 miles of new wall, replacement barriers and additional barriers.

$35.8 bil. cost

Extend and increase customs fees

$25 bil. savings

Expand T.S.A. security passenger fees

$24.7 bil. savings

Increase immigration fees

$20 bil. savings

What to know The document says the House Judiciary Committee “is open to dialing up any and all immigration-related fees in their jurisdiction to hit a desired reconciliation target.”

Reinstate public charge rule

Limit green cards or visa eligibility for immigrants who are likely to need public assistance

$15 bil. savings

What to know The first Trump administration tried to impose this policy with regulation, but was thwarted by courts. Legislation would settle the issue.

Reimburse states for border security initiatives

The provision has not been scored, but an estimated range of $11 billion to $13 billion was provided.

$13 bil. cost

What to know The document says that this option “would focus on reimbursing Texas for Operation Lone Star and Stonegarden” but that it would “need to be written broadly” to comply with reconciliation rules.

Hire more border security personnel

The provision has not been scored, but the committee provided an estimate.

$12.7 bil. cost

Extend T.S.A. security passenger fees

$11.8 bil. savings

The Secure the Border Act

Border security funding and immigration restrictions

$6.1 bil. cost

What to know The House passed this sweeping bill in 2023.

Eliminate the Diversity Immigrant Visa program

For immigrants from countries with low immigration rates, sometimes called the green card “lottery”

$3.2 bil. savings

Improve technology at the border

The provision has not been scored, but the committee provided an estimate.

$2 bil. cost

Destroy invasive plants

Plants that grow along the Southwest border that “hinder detection of illicit activity.”

$0.25 bil. cost

Anti-poverty programs

Many of these options are aimed at scaling back food benefits provided through the Supplemental Nutrition Assistance Program (SNAP). The program expanded significantly during the pandemic, and the Biden administration enacted a lasting increase in benefits in 2021.

Cut food benefits

Reverse re-evaluation of the Thrifty Food Plan, which increased SNAP benefits

$274 bil. savings

What to know Republicans have criticized the Biden administration for changing the formula used to calculate benefits, which led to significant increases.

Eliminate Social Services Block Grant

$15 bil. savings

What to know This is one of several proposals that would cut federal funding to states.

Reduce TANF by 10 percent

Scale down the block grant that finances Temporary Assistance for Needy Families.

$15 bil. savings

Restrict SNAP eligibility

End states’ ability to raise the eligibility for food assistance.

$10 bil. savings

What to know This option was a target of Mr. Trump during his first administration.

Stricter school meal requirements

Require income documentation to access free meals

$9 bil. savings

End link between SNAP and energy program

“Heat and Eat” program results in higher SNAP benefits

$7 bil. savings

Eliminate TANF contingency fund

Remove additional funding to states experiencing hardship

$6 bil. savings

Use the chained C.P.I.-U for poverty programs

The more conservative inflation measure would result in fewer families considered poor

$5 bil. savings

Sliding scale for S.S.I. benefits

This change would reduce supplemental security income payments to large families.

$5 bil. savings

Expand SNAP work requirements

$5 bil. savings

Energy

There are proposals to reverse all the green energy tax credits enacted during the Biden administration, and several smaller proposals to end individual programs. The document acknowledges that full repeal may not be popular and notes that scaled-down options are available “based on political will.”

Other proposals would expand leases of federal lands for drilling and mining, and ease regulations on facilities that ship fuels overseas or across the country in pipelines.

Repeal all green energy tax credits

Credits created and expanded in the Inflation Reduction Act.

$796 bil. savings

What to know This option includes full repeal of all the new tax credits and other regulatory changes. Some of the options below would eliminate narrower sets of these provisions. The effects of some of these programs in Republican districts mean that full repeal may not be politically viable.

Repeal some green energy tax credits

Includes programs to encourage nuclear energy and electric vehicles.

$404.7 bil. savings

Repeal E.P.A. rules on pollution from cars

Biden administration rules requiring reductions in car tailpipe emissions and increases in fuel efficiency

$111.3 bil. savings

What to know President Trump has signed an executive order promising to repeal these rules through the regulatory process. That would achieve the same policy outcome, but it would prevent Congress from claiming the budgetary savings.

Close electric vehicle credit leasing loophole

$50 bil. savings

Repeal other green energy tax credits

Includes credits for making buildings and homes more energy efficient

$17.3 bil. savings

Speed up permitting for drilling and mining

$7.5 bil. savings

What to know These provisions passed the House last year as part of a larger budget package that did not become law.

Redirect some of the Oil Spill Liability Trust Fund

$5 bil. savings

Expand offshore oil and natural gas leasing

$4.2 bil. savings

Expand onshore oil and natural gas leasing

$0.5 bil. savings

Restore noncompetitive oil and gas leasing

$0.16 bil. savings

Other health care

President Trump has vowed not to cut Medicare, but the House Budget Committee’s menu includes numerous technical changes that would lower spending on particular services. Many of these options would cut payments to hospitals.

There are also several vague proposals to reform insurance markets established under the Affordable Care Act.

Change Medicare payments for uncompensated care

Reduce and reorganize special payments made to hospitals that treat uninsured patients

$229 bil. savings

Equalize Medicare payments for doctors’ visits

Pay medical practices the same price whether they are independent or owned by a hospital.

$146 bil. savings

What to know This item appears twice on the list. A law passed during the Obama administration equalized some of these payments, but this policy would go further.

Block grant graduate medical education funding

Cap and reform how Medicare pays hospitals that train medical residents

$75 bil. savings

Recapture overpayments for Obamacare plans

Ask individuals to pay back more tax credits if they end up earning more than expected.

$46 bil. savings

Eliminate Medicare payments for bad debt

Stop payments to hospitals for unpaid bills by their patients

$42 bil. savings

What to know Numerous items on this list would reduce federal payments to hospitals.

Restrict more immigrants from federal health programs

$35 bil. savings

Repeal Obamacare “family glitch” rule

Make family members ineligible for Obamacare tax credits when their spouse’s workplace doesn’t offer them affordable insurance.

$35 bil. savings

Expand Medicare benefits

Provisions would include expanded coverage for telehealth visits, obesity treatments and cancer screening.

$20 bil. cost

What to know The Biden administration also wanted to expand treatment for obesity. A regulation proposed last year would require Medicare and Medicaid to cover obesity drugs.

Limit Medicare drug negotiations on some drugs

$20 bil. cost

Change geographic adjustments to Medicare payments

The shift would lower payments to urban hospitals.

$15 bil. savings

Financial services

Congress is considering ways to make financial regulators more accountable to its preferences. Two separate proposals would change the funding structure for the Consumer Financial Protection Bureau so that Congress would be allowed to adjust and authorize its budget every year.

Change funding for financial regulators

Require Congress to authorize annual funding for groups like the F.D.I.C. and C.F.P.B.

$47 bil. savings

What to know Two proposals would make funding for financial regulators subject to annual spending bills instead of mandatory. This would make it easier for Congress to change the agencies’ budgets.

Repeal F.D.I.C. orderly liquidation authority

A special bankruptcy procedure for large financial institutions

$22 bil. savings

Increase and extend “G-fees”

Guarantee fees charged by Freddie Mac and Fannie Mae

$14 bil. savings

Change funding for the C.F.P.B.

Require Congress to authorize annual funding for the Consumer Financial Protection Bureau.

$9 bil. savings

What to know The agency’s funding structure was the subject of a recent Supreme Court case.

Reform Fannie Mae and Freddie Mac

$5 bil. savings

Reduce Fed dividend payments to big banks

$3 bil. savings

Eliminate Office of Financial Research

$0.946 bil. savings

Eliminate SEC Reserve Fund

$0.475 bil. savings

Eliminate SEC’s ability to carry over unspent funds

Unknown

Government and work force

Numerous policies would weaken pay, benefits and civil service protections for the federal work force, consistent with President Trump’s vows to attack what he often calls the “deep state.” One proposal would make it easier to pay federal workers to retire early.

Raise federal employee retirement contributions

$44 bil. savings

Convert federal workers’ health benefits program to a voucher system

Give workers a tax-free cash allowance to buy health insurance instead of paying a share of health premiums.

$18 bil. savings

Eliminate supplemental retirement payments

To federal workers

$13 bil. savings

Change retirement benefit calculation

The change would reduce pension amounts for most federal workers.

$4 bil. savings

Audit federal employee family members

Who receive health benefits

$2.1 bil. savings

Change Federal Reserve pay and benefits scale

Move employees to basic government pay and benefits scale

$1 bil. savings

Reduce federal retirement contributions for workers with full civil service protections

The plan would allow workers to keep the current contribution if they agreed to become “at will” employees, who can be more easily fired.

Unknown

Charge federal labor unions

For use of agency resources and time

Unknown

Charge federal employees who appeal an employment action

Unknown

Increase “buyout” payments to federal workers who retire early and allow early retirement after fewer years of service.

The plan could encourage more federal workers to leave their jobs.

Unknown

Other programs

One proposal would cut funding to the Internal Revenue Service, a policy change that would increase the deficit by reducing tax compliance.

Electromagnetic spectrum auction

$70 bil. savings

Repeal I.R.S. enforcement funding

From the Inflation Reduction Act

$46.6 bil. cost

What to know Taking back $20 billion previously allocated to the I.R.S. for enforcement is expected to result in $60 billion in lost tax payments.

Eliminate flood insurance subsidies

For the National Flood Insurance Program

$11 bil. savings

Change funding for the Essential Air Service

Use annual appropriations instead of foreign overflight fees to fund a program that supports air service to small communities

$3 bil. savings

Increase timber sales

$2 bil. savings

Rescind natural resources funds

Funds in the Inflation Reduction Act, mostly for climate resilience

$1.943 bil. savings

Increase fees on vessels that enter U.S. ports

Would restore a policy that expired in 2002

$0.6 bil. savings

Repeal science funding

Funds in the Inflation Reduction Act, including for alternative fuel and low-emission aviation and weather forecasting

$0.232 bil. savings

Revoke funding directed to the Presidio Trust

From the Inflation Reduction Act

$0.2 bil. savings

Rescind savings from terminated program

Unknown

In 2025, the Republican Party is presenting a new set of policy proposals aimed at addressing key issues facing our country. From immigration reform to tax policies, here are some of the key proposals being put forward by the GOP:1. Immigration Reform: The Republican Party is advocating for a comprehensive immigration reform package that includes securing our borders, implementing a merit-based immigration system, and providing a pathway to legal status for undocumented immigrants already living in the United States. This plan aims to both strengthen national security and address the needs of our workforce.

2. Tax Reform: In 2025, the GOP is proposing a series of tax reforms aimed at simplifying the tax code, lowering tax rates for individuals and businesses, and promoting economic growth. This includes reducing the number of tax brackets, eliminating certain deductions, and incentivizing investment and job creation.

3. Healthcare: The Republican Party is committed to repealing and replacing the Affordable Care Act with a market-based healthcare system that empowers individuals and families to make their own healthcare decisions. This plan includes expanding access to health savings accounts, allowing for the purchase of health insurance across state lines, and promoting price transparency in the healthcare industry.

4. Education: The GOP is advocating for policies that promote school choice, empower parents to make educational decisions for their children, and increase access to vocational and technical training programs. This includes expanding charter schools, implementing education savings accounts, and promoting apprenticeships and workforce development initiatives.

Overall, the Republican Party’s policy proposals for 2025 aim to promote economic growth, strengthen national security, and empower individuals and families to achieve their full potential. These proposals represent a vision for a brighter future for all Americans.

Tags:

- 2025 Republican policy proposals

- Immigration policy

- Tax reform

- Republican party platform

- Conservative policy agenda

- Future of the GOP

- Immigration reform plan

- Tax policy changes

- Republican legislative agenda

- GOP policy initiatives

#Republican #Policy #Proposals #Immigration #Taxes

Rural Kansans depend on Medicaid at beginning and end of life. D.C. proposals threaten program. • Kansas Reflector

In the public debate over Medicaid expansion in Kansas, a critical fact often gets lost: Large numbers of residents already depend on the program.

What’s more, despite racist stereotypes, those benefiting from the program live mostly in rural areas.

A new report from Georgetown University’s Center for Children and Families sketches the present system and makes clear the threat of potential Medicaid cuts from Congress. A menu of potential spending reductions from U.S. House Budget Committee chair Rep. Jodey Arrington slashes $2.3 trillion — yes, that’s with a “t” — from the program covering low-income Americans, Politico reported.

“Medicaid is really the backbone of so many aspects of our health care system, from birth to long-term care, and many stops in between,” said Joan Alker, executive director and cofounder of the center. According to surveys, “this is literally the last thing voters want — voters of all political parties.”

As lawmakers in Washington, D.C., prepare a massive tax cut and spending bill, it seemed worthwhile to learn about what Medicaid means to rural areas. It also seemed worthwhile to learn about what it means for Kansas. Again: The program already covers Kansans of all ages. Alker and Benjamin Anderson, the president and chief executive officer of Hutchinson Regional Healthcare System, joined me on the Kansas Reflector podcast to sort through the issues.

Anderson told me the program is absolutely vital.

“A disproportionate share of seniors, of moms and and children in our area receive health care through Medicaid, and some of them represent the working poor,” he said. “We are a state that has not expanded Medicaid, but children in in Kansas, it is a significant source of access for them. And so, when parents have a sick kid who can’t access health care, those parents can’t work, and when they can’t work, then we see economic impacts for that as well. It’s an essential partner, specifically around maternal child health, and then also with caring for seniors.’ ”

The report, based on information from the Census Bureau’s 2023 American Community Survey, stresses several key findings to bolster that perspective:

- Of kids in small towns and rural communities, almost 41% receive coverage through Medicaid. In metro areas, 38% do.

- Of adults under age 65 in small towns and rural communities, about 18% receive coverage through Medicaid. In metro areas, the figure is 16%.

- In areas with large numbers of tribal residents (American Indian or Alaska Native), those of all ages are likelier to be covered by the program.

In Kansas, 32.3% of kids in rural areas are covered by Medicaid or CHIP, compared to 28.7% of metro-area kids. Also, 11.9% of seniors in rural areas are covered by Medicaid, while 11.3% of seniors in metro areas are covered.

“From birth to seniors, Medicaid is a vital source of health insurance to our residents, covering more Kansans in rural communities,” said April Holman, executive director of the Alliance for a Healthy Kansas, on the report. “Additionally, this report makes clear that Medicaid is an important stable revenue source for hospitals and providers in rural Kansas, ensuring that we can access health care when and where we need it.”

Anderson spoke about his experience at Kearny County Hospital in Lakin. More than half of the births at the hospital were covered by Medicaid. Without that safety net, mothers wouldn’t have had access to prenatal care. Without prenatal care? Untold numbers of mothers and babies would suffer.

The effects on the elderly are similarly far reaching.

“They essentially deplete their resources before the end of their life,” Anderson said. “And these are people that diligently save, but people are living longer than they have, and just circumstances come up where that’s happened. And Medicaid is the backstop for skilled nursing. When we start compromising that infrastructure, and they can’t get into skilled nursing, they end up in our emergency department. There is well-documented evidence that among those vulnerable populations, over 50% of the health care spent in that person’s life is in their last six months. If we think we’re going to save by cutting this, we have a rude awakening coming.”

Taking a broader view, that means that Medicaid cuts have a negative multiplier effect, Alker said. If the federal government carves trillions out of the program, states will be forced to fill the gap. No one wants to see old people or children dying in the streets. But that means other services will suffer.

“This is going to impact education. It’s going to impact transportation, roads, law enforcement, everything in the state’s budget, because states will be left holding the bag,” she told me. “And it’s an absolutely untenable situation. They simply can’t manage their way out of this.”

Anderson characterized himself as a right-of-center conservative concerned about the deficit. But given his knowledge of the health care sector, he said, these types of cuts simply won’t have their intended effect.

“We’re only going to send people into the (emergency department) and spend more federal money in Medicare to offset it,” he said.

“There are ways to incentivize work,” he added. “There are ways to incentivize healthy families. This ain’t it, to use a west Kansas phrase.”

My discussion with Alker and Anderson proves a point that I’ve made repeatedly. Officials in Kansas and Washington, D.C., have to find ways to separate partisanship from policy. While Medicaid might not be perfect — we chatted about various reforms that could strengthen the program — it serves an invaluable role in the same rural communities that voted for the new president.

We all have a duty to care for those in need during their darkest hours. That duty transcends creed or party. It goes to the very core of what makes us human.

Clay Wirestone is Kansas Reflector opinion editor. Through its opinion section, Kansas Reflector works to amplify the voices of people who are affected by public policies or excluded from public debate. Find information, including how to submit your own commentary, here.

Rural Kansans depend on Medicaid at beginning and end of life. D.C. proposals threaten program. • Kansas ReflectorThe Medicaid program plays a crucial role in providing healthcare coverage for rural Kansans, particularly during the most vulnerable times in their lives. From prenatal care to end-of-life services, Medicaid ensures that individuals in rural communities have access to the necessary medical support they need.

However, recent proposals in Washington D.C. threaten to dismantle the Medicaid program, putting the health and well-being of rural Kansans at risk. As policymakers debate the future of Medicaid, it is essential to consider the impact on those who rely on this program for essential healthcare services.

Rural Kansans deserve access to quality healthcare, regardless of their income or zip code. Medicaid is a lifeline for many in these communities, and any cuts or changes to the program could have devastating consequences. It is imperative that we advocate for the protection and expansion of Medicaid to ensure that all Kansans, especially those in rural areas, have access to the care they need to live healthy and fulfilling lives.

Tags:

SEO Friendly Tags:

– Rural Kansans

– Medicaid

– D.C. proposals

– healthcare

– healthcare access

– Kansas Reflector

– rural healthcare

– Medicaid program

– healthcare policy

– healthcare legislation

#Rural #Kansans #depend #Medicaid #beginning #life #D.C #proposals #threaten #program #Kansas #ReflectorStudent Loan Debt to Increase Under Republican Proposals: What to Know

Republican lawmakers in Congress have proposed sweeping cuts to federal spending, with student loan forgiveness a key area being targeted.

Why It Matters

Former President Joe Biden‘s reforms to student loan debt and forgiveness came under intense scrutiny from Republicans during his tenure as president. Biden’s plans allowed the Department of Education to approve some $180 billion in student loan debt forgiveness.

Americans owe some $1.6 trillion in student loans as of June 2024—some 42 percent more than what they owed a decade earlier, according to the Pew Research Center.

What To Know

GOP Congress members are aiming to pass a significant reconciliation bill that would extend or expand key provisions of the 2017 Tax Cuts and Jobs Act, signed into law during Trump’s first presidency.

This legislation, which reduced corporate, individual, and estate taxes, includes many provisions that are due to expire at the end of this year. According to the U.S. Department of Treasury’s Office of Tax Analysis, extending these tax cuts could cost an estimated $5 trillion.

To help cover these costs, Republican lawmakers on the House Budget Committee have singled out federal spending programs that could be cut, with several of Biden’s student debt reduction and elimination policies on the chopping block.

Stock image: Mortarboard laid on U.S. dollar bills.

GETTY

SAVE Plan

A priority for spending cuts in House Budget Committee’s recently published memo is the SAVE (Saving on a Valuable Education) program—the income-driven repayment plan that lower borrowers’ payments, limits buildup of interest, and allows borrowers to be eligible loan forgiveness eventually.

The GOP has proposed a full repeal of the SAVE plan, which Republicans say would pocket $127.3 billion over 10 years. The proposal aims to replace the SAVE plan and all other current income-driven repayment (IDR) plans with a repayment option that would not offer time-based student loan forgiveness.

Loan Eliminations

Republican proposals aim to eliminate Biden’s broadened access to two additional student loan forgiveness initiatives: the Closed School Discharge program, permitting borrowers to seek relief if their educational institution shuts down during their enrollment; and Borrower Defense to Repayment, which can cancel debt for those misled or defrauded by their school.

The memo also signals plans to “eliminate” parent PLUS loans, which are offered to parents of dependent undergraduate students, and grad PLUS loans, which are offered to graduate students and students.

Debt Forgiveness and Grants

Plans to restrict the Education Department’s authority to create or expand regulations for new student loan forgiveness programs are also included in the memo, including a cap on nonrepayable Pell Grants for undergraduates of low-income families and “limiting eligibility” for the Public Service Loan Forgiveness (PSLF) program.

Interest Subsidies

Elsewhere, student loan interest deductions—which allow qualifying borrowers to deduct up to $2,500 a year in interest from their income tax returns—are also facing the chop.

What People Are Saying

Kevin Thompson, a finance expert and the founder and CEO of 9i Capital Group, told Newsweek: “The outlook for student loan forgiveness is not promising. Any cuts to the program mean reduced funds for forgiveness and increased debt burdens for students.”

Student Borrower Protection Center Executive Director Mike Pierce said in a statement on Friday: “These dangerous cuts will cause chaos across the economy—causing monthly student loan payments to spike for millions of working families and making paying for college more expensive and risky.

“On the heels of an election where the American people made it clear that they want policymakers to take action to bring down everyday costs—from eggs and gas to medical, credit card, and student debt—the MAGA movement is showing us who they really care about, and it’s not working people.”

What Happens Next

The SAVE plan is currently facing legal battles that could thwart it before Republican budget proposals do. Republican attorneys general from Kansas and Missouri, who spearheaded the legal challenges against SAVE, said that President Joe Biden was attempting to bypass the Supreme Court‘s June 2023 decision blocking his broad student debt cancellation plan.

Student Loan Debt to Increase Under Republican Proposals: What to KnowIf you are a student or recent graduate with student loan debt, you may want to pay attention to the latest proposals put forth by Republicans that could potentially increase the amount of debt you owe.

One of the key proposals is to eliminate the Public Service Loan Forgiveness program, which allows borrowers who work in public service jobs to have their remaining loan balance forgiven after making 120 qualifying payments. This could be a significant blow to those who have chosen careers in fields such as education, healthcare, and government.

Another proposal is to eliminate the subsidized federal student loan program, which currently allows low-income students to borrow money without accruing interest while they are in school. This could result in more students graduating with higher levels of debt due to interest accruing while they are still in school.

Additionally, the proposals include changes to income-driven repayment plans, which could result in higher monthly payments for borrowers who are struggling to make ends meet.

It is important for students and graduates to stay informed about these proposals and to advocate for policies that will help alleviate the burden of student loan debt. Contact your representatives in Congress and let them know how these proposals could impact you and your future.

In the meantime, be sure to explore all available options for managing your student loan debt, such as income-driven repayment plans, loan consolidation, and loan forgiveness programs. Stay informed, stay proactive, and don’t let student loan debt hold you back from achieving your goals.

Tags:

student loan debt, Republican proposals, education finance, college loans, student debt crisis, financial aid, higher education costs, government policy, student loan repayment options

#Student #Loan #Debt #Increase #Republican #Proposals

Winning Strategies for Developing Proposals and Managing Grants (Winning Strat..

Winning Strategies for Developing Proposals and Managing Grants (Winning Strat..

Price : 17.83

Ends on : N/A

View on eBay

Winning Strategies for Developing Proposals and Managing GrantsDeveloping proposals and managing grants are crucial tasks for organizations seeking funding for their projects. In order to secure funding and effectively manage grants, it is essential to have winning strategies in place. Here are some key strategies to consider:

1. Understand the funding opportunity: Before developing a proposal, it is important to thoroughly understand the funding opportunity, including the funder’s priorities, requirements, and evaluation criteria. This will help ensure that your proposal is aligned with the funder’s goals and stands out among other submissions.

2. Develop a strong project concept: A compelling project concept is essential for a successful proposal. Clearly articulate the problem or need that your project addresses, as well as your proposed solution and expected outcomes. Make sure to demonstrate the potential impact of your project and how it aligns with the funder’s priorities.

3. Write a persuasive proposal: A well-written proposal is key to securing funding. Make sure your proposal is clear, concise, and compelling, with a strong narrative that showcases the value of your project. Use data, evidence, and examples to support your arguments and make a strong case for why your project should be funded.

4. Establish a realistic budget: Developing a realistic budget is crucial for managing grants effectively. Make sure your budget is detailed, accurate, and aligned with the scope of your project. Consider all necessary expenses, including personnel, supplies, and overhead costs, and make sure to justify each line item in your budget.

5. Develop a strong monitoring and evaluation plan: Monitoring and evaluation are essential for managing grants effectively and demonstrating the impact of your project. Develop a robust monitoring and evaluation plan that outlines how you will track progress, measure outcomes, and report on results. Make sure to regularly review and analyze data to make informed decisions and improve the effectiveness of your project.

By implementing these winning strategies, organizations can increase their chances of securing funding, effectively managing grants, and achieving their project goals. With careful planning, strong communication, and a focus on impact, organizations can develop successful proposals and effectively manage grants to create positive change in their communities.

#Winning #Strategies #Developing #Proposals #Managing #Grants #Winning #Strat., Data Management

Research Data Visualization and Scientific Graphics: for Papers, Presentations and Proposals (Peer Recognized)

Price: $12.95

(as of Dec 15,2024 15:03:31 UTC – Details)From the Publisher

This book is…

For the busy scientist

A no-nonsense guide packed with actionable advice for creating data visualizations and scientific illustrations.

For research papers

Self-explanatory data visualizations and crisp scientific illustrations get research papers noticed and cited.

For academic presentations

Convincing presentation slides and visual poster designs aid in delivering memorable scientific presentations.

For research proposals

Visualization of scientific ideas helps scientists like you write research proposals that get funded.

Part I: Eight data visualization progressions

Data visualization allows you to understand the research results yourself and then be able to convincingly communicate them to others – but only if it’s done right. In the first part of the book, you will learn eight bulletproof progressions for turning research data into charts that tell a story.

Part II: Designing scientific graphics

Graphics are often more efficient than words when explaining research methods and displaying scientific concepts. In the second part of the book you will see both good and bad examples of graphics and learn eleven visual features for creating convincing graphics.

What’s included with the book purchase

Two downloadable cheat sheets

Download two high-resolution printable cheat sheets that summarize the advice from this book. Pin them to your office wall and rely on them as a guide whenever you are creating a chart or a graphic.

Data visualization tools

Use the right tools for the right job. I provide a comparison of different data visualization apps and useful online resources via a complementary website.

Scientific graphic design tools

Charcoal is certainly one way to create scientific illustrations, but there are other tools available. A list of the best tools for creating graphics is included at the accompanying online resource.

The author – Martins Zaumanis

I am obsessed with finding ways to communicate science visually but I don’t expect you to become crazy about it. Quite the opposite: I developed a lean and efficient approach for you to create clear data charts and convincing scientific illustrations. No artistic talent needed.

ASIN : B099TSBPYK

Publisher : Independently published (July 22, 2021)

Language : English

Paperback : 105 pages

ISBN-13 : 979-8541959321

Item Weight : 5.4 ounces

Dimensions : 6 x 0.24 x 9 inches

Research Data Visualization and Scientific Graphics: for Papers, Presentations and Proposals (Peer Recognized)In the world of academia and research, the presentation of data is crucial in conveying the findings of a study effectively. Research data visualization and scientific graphics play a key role in presenting complex data in a clear and concise manner, making it easier for readers to understand and interpret the results.

Whether you are preparing a paper for publication, a presentation for a conference, or a proposal for funding, utilizing high-quality data visualization techniques can greatly enhance the impact of your work. By creating visually appealing and informative graphics, you can engage your audience and communicate your findings more effectively.

In this post, we will explore the importance of research data visualization and scientific graphics in academic writing and research communication. We will discuss the best practices for creating compelling visuals, as well as the tools and resources available to help you create professional-looking graphics for your papers, presentations, and proposals.

Stay tuned for expert tips and insights on how to elevate your research with data visualization and scientific graphics that are peer recognized and make a lasting impression on your audience.

#Research #Data #Visualization #Scientific #Graphics #Papers #Presentations #Proposals #Peer #Recognized

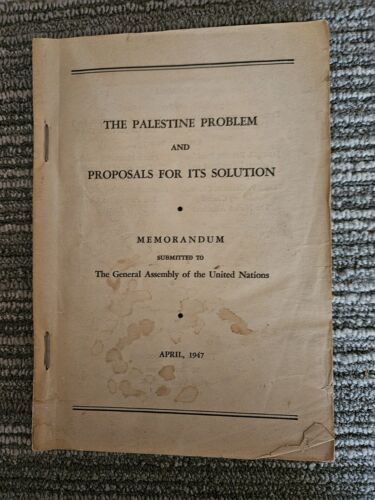

The Palestine Problem And Proposals For Its Solution, By The United Nations…

The Palestine Problem And Proposals For Its Solution, By The United Nations…

Price : 97.00

Ends on : N/A

View on eBay

The Palestine Problem And Proposals For Its Solution, By The United NationsThe ongoing conflict in Palestine has been a source of tension and violence for decades, resulting in the loss of thousands of lives and the displacement of countless families. The United Nations has long been involved in efforts to find a peaceful solution to this conflict, but progress has been slow and difficult.

One proposal put forth by the United Nations is the two-state solution, which would involve the creation of an independent Palestinian state alongside Israel. This proposal has been endorsed by the international community as a way to address the aspirations of both the Palestinian and Israeli people and to ensure security and stability in the region.

Another proposal is the implementation of a comprehensive peace plan that addresses the core issues at the heart of the conflict, including borders, security, refugees, and Jerusalem. This plan would require both parties to make difficult compromises in order to achieve a lasting peace.

The United Nations also supports efforts to improve the living conditions of Palestinians in the occupied territories, including providing humanitarian assistance and promoting economic development. These efforts are crucial in addressing the root causes of the conflict and building trust between the two sides.

Ultimately, the United Nations believes that a just and lasting solution to the Palestine problem can only be achieved through dialogue, negotiation, and compromise. The international community must continue to work together to support the efforts of both parties to reach a peaceful resolution to this long-standing conflict.

#Palestine #Problem #Proposals #Solution #United #Nations..

Million Dollar Consulting Proposals: How to Write a Proposal That’s Accepted Every Time

Price:$27.95– $16.29

(as of Nov 23,2024 05:57:59 UTC – Details)

ASIN : 111809753X

Publisher : Wiley; 1st edition (November 29, 2011)

Language : English

Paperback : 224 pages

ISBN-10 : 9781118097533

ISBN-13 : 978-1118097533

Item Weight : 2.31 pounds

Dimensions : 5.9 x 0.8 x 9 inchesCustomers say

Customers find the book extremely useful, informative, and helpful. They describe it as a great tool and real reference material. Readers also mention that the book is fantastic to read, well-written, and easy to understand.

AI-generated from the text of customer reviews

Are you tired of submitting consulting proposals only to be met with rejection or silence? Do you want to learn how to write a million-dollar consulting proposal that is accepted every time? Look no further! In this post, we will discuss the key components of a winning consulting proposal and provide tips on how to increase your chances of success.1. Understand your client’s needs: Before you even start writing your proposal, take the time to thoroughly understand your client’s needs and objectives. What are they looking to achieve? What challenges are they facing? By demonstrating a clear understanding of their situation, you will show that you are the right person for the job.

2. Showcase your expertise: Your proposal should highlight your expertise and experience in the relevant industry or field. Provide examples of past projects or clients that demonstrate your ability to deliver results. This will instill confidence in your potential client and show that you are capable of handling their project.

3. Provide a detailed plan: Lay out a clear and detailed plan of how you will approach the project, including timelines, deliverables, and milestones. This will show your client that you have thought through the project thoroughly and are prepared to execute it effectively.

4. Emphasize the value you will provide: Clearly outline the value that you will bring to the client’s business. How will your services help them achieve their goals or solve their problems? Make sure to quantify the benefits whenever possible, whether it’s in terms of cost savings, revenue growth, or efficiency improvements.

5. Be professional and concise: Your proposal should be well-written, professional, and concise. Avoid using jargon or technical language that may be confusing to your client. Keep the proposal focused on the key points and make sure it is easy to read and understand.

By following these tips and crafting a well-thought-out consulting proposal, you can increase your chances of success and win more business. Remember, a successful proposal is not just about selling your services – it’s about demonstrating your understanding of the client’s needs and showing how you can add value to their business. Good luck!

#Million #Dollar #Consulting #Proposals #Write #Proposal #Accepted #Time