Your cart is currently empty!

Tag: Rental

Investor With $200K From Selling Rental Property Seeks Advice On SCHD, QQQM And VOO – Can He Reach $1 Million In 10 Years With 70% Growth?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investing involves balancing risk, reward and personal goals and for many, index funds like SCHD, QQQM and VOO have become an important part of their portfolios.

Whether it’s SCHD’s focus on high-yield dividend-paying enterprises, VOO’s all-around coverage of the S&P 500 or QQQM’s focus on tech companies, these index funds provide investors with diversified exposure to the stock market.

Choosing which fund to invest in usually depends on the investor’s goals, but what happens when you’re at a crossroads and don’t know where to allocate a significant sum? That’s exactly the impasse one Reddit member found himself in.

Don’t Miss:

The poster, who’s been investing for several years, is selling a rental property he bought for $110,000. Now, with the rental evaluated at $245,000, he thinks he will remain with $200,000 to invest after accounting for all the expenses related to selling the house.

While the rental property generated $1,100 monthly, the management and maintenance issues made him want to give up renting the property. His goal? To transition to the stock market, focus on growth and dividend-paying investments.

“Just been seeing the popularity of SCHD, QQQM and VOO a lot and wondering if I could get a million in 10 years or less. I’m sure I can handle some risk but I was wondering if I should be dividend-heavy or growth-heavy for my goals,” he said.

Trending: Coinbase’s latest promo gets you up to $200 in crypto (Seriously!) — Here’s everything you need to know to take advantage of this offer.

Besides the rental profits, the investor has $40K in a HYSA and has been maxing out his Roth IRA in the last three years. Now, he’s turned to Reddit’s r/dividends community to seek guidance on whether his strategy is a good one or whether he should consider a better one.

Let’s explore the strategies Reddit investors shared in the thread.

Is $1 Million in 10 Years Possible With The VOO, QQQM, SCHD Strategy? Reddit’s Advice

Balance Risk and Investment Objectives

Many commenters highlighted the imperative need to assess the investor’s willingness to take risk, especially when considering his five-to-ten-year time horizon.

Are you an investor who recently sold a rental property and now has $200K to invest? Are you considering putting your money into SCHD, QQQM, and VOO in the hopes of reaching $1 million in 10 years with a 70% growth rate?If so, you’re not alone. Many investors are looking for ways to grow their wealth quickly and effectively. However, investing in the stock market comes with risks and uncertainties, especially when aiming for such ambitious goals.

Before making any investment decisions, it’s important to do your research and consider your risk tolerance. SCHD, QQQM, and VOO are all popular exchange-traded funds (ETFs) with different investment strategies and risk profiles. SCHD focuses on high-quality dividend-paying companies, QQQM tracks the performance of the Nasdaq 100 Index, and VOO mirrors the S&P 500 Index.

While these ETFs have the potential for growth, it’s important to remember that past performance is not indicative of future results. A 70% growth rate over 10 years is certainly possible, but it’s also a very aggressive target that may not be achievable. It’s crucial to have a diversified investment portfolio and to consider factors such as market volatility, economic conditions, and your own financial goals.

Consulting with a financial advisor can help you create a personalized investment plan that aligns with your risk tolerance and financial objectives. They can provide guidance on asset allocation, risk management, and investment strategies to help you reach your long-term financial goals.

Investing in SCHD, QQQM, and VOO can be a solid foundation for your investment portfolio, but it’s essential to approach it with caution and realistic expectations. With proper planning and a disciplined approach, you may be able to grow your $200K into $1 million in 10 years, but it’s important to be prepared for potential challenges along the way.

Tags:

- Investor seeking advice

- $200K from selling rental property

- SCHD, QQQM, VOO

- Reaching $1 million in 10 years

- 70% growth

- Investment advice

- Portfolio growth strategy

- Long-term investment goals

- Wealth building strategies

- Financial planning for investors

#Investor #200K #Selling #Rental #Property #Seeks #Advice #SCHD #QQQM #VOO #Reach #Million #Years #Growth

Some price-gouging rules could be keeping high-end homes off L.A.’s rental market

In Los Angeles’ high-end rental market, it’s long been common to find homes advertised for $10,000 a month or more.

But in the wake of this month’s devastating wildfires in Pacific Palisades and Altadena, new listings above that amount are effectively barred by state law, just as a crush of wealthy, displaced families are looking for places to go.

The price limit is keeping off the market homes that prospective landlords would otherwise offer to displaced families, say local real estate agents and brokers, tightening even further the vise people are facing in their search for housing. More than 11,000 homes have been confirmed destroyed in the fires and reports of widespread price gouging and bidding wars have followed as the little available rental inventory gets snapped up quickly.

Palisades residents looking for rental homes elsewhere in Los Angeles comparable to the ones they’ve lost would have been squeezed for options below the limit even before the fires. Last year, two dozen four-bedroom homes in an oceanfront Manhattan Beach neighborhood rented for a median price of $16,000 a month, according to data from the multiple listing service.

“These people are used to a certain quality of life,” said Tyler Morant, a Manhattan Beach real estate agent. “They’re going to markets that have that quality of life. But these laws are working to prevent a lot of this supply from coming online.”

At issue is California’s price-gouging law, which limits rent increases after natural disasters. For properties that had been leased or listed in the previous year, landlords are barred from hiking rents by more than 10%.

The law includes a separate restriction for properties that haven’t been on the market previously. Potential landlords cannot charge more than a certain percentage above a federal rent payment standard. While the amount varies by neighborhood and a unit’s number of bedrooms, the maximum allowable price in Los Angeles County for any newly listed property is $9,554 a month, according to a Times calculation of the federal data.

Nearly 1,400 homes and apartments in the county were listed on Zillow for rent Wednesday above that amount. If the units had been on the market within the past year and hadn’t raised prices by more than 10%, they’re likely allowed at that price under the law. If they’re new offerings, they may not be.

That’s the case even if the prices are higher for previously listed properties. In Tarzana, a landlord is asking $17,500 a month to rent a 3,000-square-foot home with a pool and a view of the Santa Monica Mountains, a 9.4% increase from the price at which it was offered in December, according to Zillow. Eleven miles away in Chatsworth, a 3,350-square-foot English Tudor-style house is on the market for the first time on Zillow for $11,900 a month.

Violators of the price-gouging law could face criminal penalties that include up to a year in county jail and civil fines of up to $2,500 per incident. California Atty. Gen. Rob Bonta announced Wednesday the first price-gouging charges related to the fires, accusing a La Cañada Flintridge real estate agent of raising the list price on a rental home by 38%. Amid bidding wars, the attorney general has warned landlords that accepting unsolicited offers to pay more than 10% over the asking price would qualify as price gouging.

Several clients and acquaintances of Morant, including empty nesters with other places to stay and property owners with empty vacation homes, told him in the past couple of weeks that they were considering putting their homes on the rental market. But he’s advising them against doing so because of the financial and legal risks.

“We’re telling them it’s not worth it,” Morant said.

Before 2018, there were no price limitations in state law for homes that hadn’t been on the rental market prior to a natural disaster.

After the Tubbs fire destroyed 5,000 homes in Sonoma County, the district attorney fielded complaints that she couldn’t do anything to reign in new rentals advertising sky-high prices. Lawmakers wanted to tackle the issue.

Interest groups involved in negotiating a price standard for new listings settled on 170% of the rent designated by the U.S. Department of Housing and Urban Development for a particular unit size and neighborhood, said Deb Carlton, an executive vice president with the California Apartment Assn., who was part of the discussions. The HUD figure, which is based on Census data for typical apartment rents in an area, is used to ensure landlords cannot overcharge low-income residents with housing choice vouchers. The revision to the law, which also tightened up pricing restrictions for properties already on the market, passed both houses of the Legislature with only a handful of votes against it.

“Nobody ever anticipated we’d have extremely wealthy people in need of large homes,” Carlton said.

When natural disasters occur and a surge in demand follows, the government should encourage the offering of housing previously used as vacation homes or Airbnbs or left vacant as long-term rentals, said Shane Phillips, manager of the Randall Lewis Housing Initiative at the UCLA Lewis Center for Regional Policy Studies.

He estimated that potential landlords could be holding back “in the high hundreds to the low thousands” of homes due to the price limitations on new listings. That amount is too small to affect L.A.’s overall rental market but does make it harder for displaced people to find houses, he said.

“Every home does count,” Phillips said. “It does matter. And no matter how fancy it is, someone from the Palisades can afford it.”

A spokesperson for Bonta said the attorney general’s office will continue to enforce the price-gouging law and deferred questions about policy implications to Gov. Gavin Newsom and state lawmakers.

“Broadly speaking, we continue to believe that, especially during a state of emergency, we should be doing everything in our power to house our fellow Californians,” the spokesperson said.

Price-gouging rules in Los Angeles could be hindering high-end homes from entering the rental market. According to reports, strict regulations and limitations on rent increases are deterring property owners from listing their luxury properties for rent.While these rules are meant to protect tenants from exorbitant rent hikes, they may inadvertently be limiting the availability of high-end rental options in the city. Property owners fear that they will not be able to recoup their investment if they are unable to adjust rents to market rates.

As a result, many luxury homes remain vacant or are only available for short-term rentals, such as Airbnb listings. This not only limits the housing options for residents but also contributes to the overall housing shortage in Los Angeles.

Some experts argue that there needs to be a balance between protecting tenants and ensuring a healthy rental market. By revisiting price-gouging rules and finding a middle ground, more high-end homes could potentially become available for long-term rentals, benefiting both property owners and tenants in the process.

Tags:

- Los Angeles rental market

- Price-gouging rules

- High-end homes

- Rental market regulations

- L.A. housing market

- Luxury rentals

- Pricing regulations

- Real estate market trends

- Rent control laws

- Housing affordability in Los Angeles

#pricegouging #rules #keeping #highend #homes #L.A.s #rental #market

New Orleans suspect set fire at rental property

The driver behind the deadly terrorist New Years’ attack in New Orleans set fire to his rental property in an effort to destroy bomb-making evidence prior to the attack, the FBI and the Bureau of Alcohol, Tobacco, Firearms (ATF) said.

In a joint statement on Friday, the agencies revealed that they believe 42-year-old Shamsud-Din Jabbar set a small fire in the hallway of his rented Airbnb before the attack, and “strategically placed accelerants throughout the house in his effort to destroy it and other evidence of his crime.” But they said the fire burned itself out before spreading to other rooms.

The smoldering of the fire allowed the FBI to recover evidence from the rented Airbnb, including “pre-cursors for bomb-making material and a privately made device suspected of being a silencer for a rifle,” the agencies said.

LAS VEGAS, NEW ORLEANS ATTACKS NOT CONNECTED: POLICE

The FBI and the ATF also revealed new information on Jabbar’s movements prior to driving a high-speed vehicle down the popular Bourbon Street in the early hours of New Year’s Day.

WHAT WE KNOW ABOUT VICTIMS OF NEW ORLEANS TERRORIST ATTACK

Jabbar had also placed two improvised explosive devices, or IEDs, along Bourbon Street, authorities said. He did not manage to detonate the two explosives prior to his death.

“The FBI assesses that during his attack on Bourbon Street, Jabbar intended to use a transmitter, that was found in the F150 truck, to detonate the two IED’s he placed on Bourbon Street,” the agencies said.

The Federal Bureau of Investigation released photos of surveillance footage that shows Shamsud-Din Jabbar an hour before he drove a truck down Bourbon Street, New Orleans, early Jan. 1, 2025. (Federal Bureau of Investigation via AP)

In the latest update, the agencies said that all evidence recovery along Bourbon Street and at the Airbnb rental on Mandeville Street used by Jabbar has been completed.

CLICK HERE TO GET THE FOX NEWS APP

“Evidence collected from multiple sites is being evaluated to further the investigation,” the agencies said.

In a shocking turn of events, a suspect in New Orleans has been accused of setting fire to a rental property in the city. The incident has left many residents concerned about the safety of their own homes and properties.According to authorities, the suspect allegedly started the fire at the rental property in an act of arson. The motive behind the crime is still unclear at this time, but the damage caused by the fire is extensive.

This incident serves as a stark reminder of the dangers of arson and the devastating impact it can have on communities. It is essential for residents to remain vigilant and report any suspicious activity to authorities to prevent similar incidents from occurring in the future.

As the investigation into this crime continues, our thoughts are with the owners of the rental property and all those affected by this senseless act of destruction. We hope that the suspect is swiftly brought to justice and held accountable for their actions.

Tags:

- New Orleans suspect

- Rental property arson

- Fire at rental property

- New Orleans crime

- Suspect sets fire

- Arson investigation

- Louisiana rental property

- Criminal activity in New Orleans

- Suspect arrested for arson

- Fire damage in New Orleans

#Orleans #suspect #set #fire #rental #property

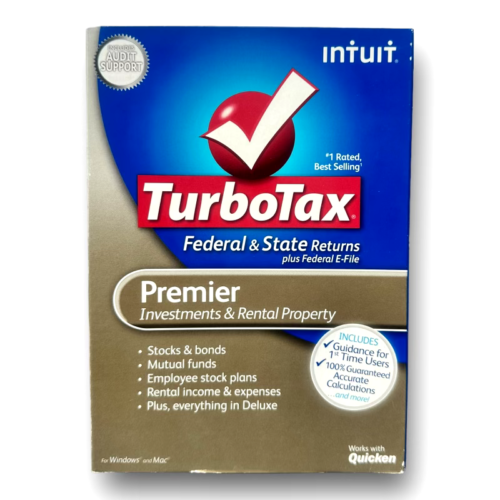

Intuit TurboTax Premier 2012: Investment And Rental Property; Fed & State

Intuit TurboTax Premier 2012: Investment And Rental Property; Fed & State

Price : 26.99

Ends on : N/A

View on eBay

Are you a savvy investor or property owner looking to maximize your tax deductions and ensure accurate tax filing? Look no further than Intuit TurboTax Premier 2012! This comprehensive software is designed for individuals with investments and rental properties, providing expert guidance and support for both federal and state tax filings.With TurboTax Premier 2012, you can easily navigate complex tax laws and regulations related to investments and rental properties. The software offers step-by-step guidance to help you identify all eligible deductions and credits, ensuring you get the maximum refund possible.

Whether you have stocks, bonds, mutual funds, rental properties, or other investments, TurboTax Premier 2012 has you covered. The software is equipped with tools to help you accurately report income, expenses, and depreciation related to your investments and rental properties.

Don’t let the complexity of investment and rental property taxes overwhelm you. Invest in Intuit TurboTax Premier 2012 and take the stress out of tax season. With its user-friendly interface and expert guidance, you can file your taxes confidently and accurately. Say goodbye to tax-related headaches and hello to a smooth, hassle-free tax filing experience with TurboTax Premier 2012!

#Intuit #TurboTax #Premier #Investment #Rental #Property #Fed #State

Intuit TurboTax Premier 2015: Federal & State, Investments & Rental Property

Intuit TurboTax Premier 2015: Federal & State, Investments & Rental Property

Price : 99.99

Ends on : N/A

View on eBay

Are you ready to tackle your taxes like a pro? Look no further than Intuit TurboTax Premier 2015! This comprehensive software package is designed for individuals with investments and rental property, making it the perfect solution for those with more complex tax situations.With TurboTax Premier, you can easily file both your federal and state taxes with confidence. The software guides you through the process step-by-step, helping you maximize your deductions and credits along the way. Plus, TurboTax Premier includes expert help and advice from CPAs and Enrolled Agents, ensuring that you get the most out of your tax return.

Whether you have stocks, bonds, mutual funds, rental properties, or other investments, TurboTax Premier has you covered. The software automatically imports your investment information from financial institutions, making it easy to accurately report your income and deductions. Plus, TurboTax Premier offers guidance on how to handle capital gains and losses, so you can make the most of your investments.

Don’t let tax season stress you out – invest in Intuit TurboTax Premier 2015 and take control of your finances today!

#Intuit #TurboTax #Premier #Federal #State #Investments #Rental #Property

Intuit Quicken Rental Property Manager 2.0 Management Software Windows 2000 XP

Intuit Quicken Rental Property Manager 2.0 Management Software Windows 2000 XP

Price : 29.99

Ends on : N/A

View on eBay

Intuit Quicken Rental Property Manager 2.0: The Ultimate Management Software for Windows 2000 and XPAre you a property manager looking for a comprehensive software solution to streamline your rental property management tasks? Look no further than Intuit Quicken Rental Property Manager 2.0. This powerful software is designed specifically for Windows 2000 and XP users, providing all the tools you need to efficiently manage your rental properties.

With Intuit Quicken Rental Property Manager 2.0, you can easily track rental income and expenses, create detailed reports, and stay on top of maintenance tasks. The software also allows you to organize tenant information, track lease terms, and generate rent reminders. Plus, you can quickly generate tax reports and easily export data to popular accounting software programs.

Whether you own a single rental property or manage a large portfolio, Intuit Quicken Rental Property Manager 2.0 is the perfect solution for all your property management needs. Try it out today and see how it can help you save time and streamline your operations.

#Intuit #Quicken #Rental #Property #Manager #Management #Software #Windows

Intuit TurboTax Premier 2016: Federal & State, Investments & Rental Property

Intuit TurboTax Premier 2016: Federal & State, Investments & Rental Property

Price : 99.99

Ends on : N/A

View on eBay

Are you ready to tackle your taxes like a pro this year? Look no further than Intuit TurboTax Premier 2016. With this comprehensive software, you can easily navigate through your federal and state tax returns, as well as handle investments and rental property income with ease.TurboTax Premier 2016 is designed to help you maximize your deductions and credits, ensuring you get the biggest refund possible. The software guides you through complex tax situations, such as reporting investment income, rental property expenses, and more. Plus, with its easy-to-use interface and step-by-step guidance, you can feel confident that you’re filling out your tax return correctly.

Don’t let tax season stress you out – let Intuit TurboTax Premier 2016 take the guesswork out of filing your taxes. Get started today and see how easy it can be to get your finances in order.

#Intuit #TurboTax #Premier #Federal #State #Investments #Rental #Property

Intuit TurboTax Premier 2009: Federal & State, Investments & Rental Property

Intuit TurboTax Premier 2009: Federal & State, Investments & Rental Property

Price : 99.99

Ends on : N/A

View on eBay

Are you a savvy investor or a property owner looking to maximize your tax deductions this year? Look no further than Intuit TurboTax Premier 2009! This comprehensive tax software is designed to help you navigate the complexities of filing your federal and state taxes, especially if you have investments or rental property.With TurboTax Premier 2009, you can easily import your investment information from financial institutions, track your rental income and expenses, and ensure you’re taking advantage of all the deductions and credits available to you. Plus, with step-by-step guidance and expert help available, you can feel confident that you’re getting the most out of your tax return.

Don’t wait until the last minute to file your taxes – get Intuit TurboTax Premier 2009 today and take the stress out of tax season!

#Intuit #TurboTax #Premier #Federal #State #Investments #Rental #Property

Intuit TurboTax Premier 2011: Federal & State, Investments & Rental Property

Intuit TurboTax Premier 2011: Federal & State, Investments & Rental Property

Price : 99.99

Ends on : N/A

View on eBay

Are you a homeowner or investor looking for a reliable and easy way to file your taxes this year? Look no further than Intuit TurboTax Premier 2011! With its comprehensive features for federal and state taxes, investments, and rental property, you can trust that your taxes will be done accurately and efficiently.TurboTax Premier 2011 offers step-by-step guidance to help you maximize your deductions and credits, ensuring you get the biggest refund possible. It also provides expert advice on investment income and rental property expenses, so you can feel confident in your tax filing process.

Don’t let tax season stress you out – let Intuit TurboTax Premier 2011 take the guesswork out of filing your taxes. Try it out today and see why it’s the #1 choice for homeowners and investors alike.

#Intuit #TurboTax #Premier #Federal #State #Investments #Rental #Property