Price: $2.99

(as of Dec 24,2024 01:47:38 UTC – Details)

ASIN : B0BX6YXMKV

Publication date : February 28, 2023

Language : English

File size : 14918 KB

Simultaneous device usage : Unlimited

Text-to-Speech : Enabled

Screen Reader : Supported

Enhanced typesetting : Enabled

X-Ray : Not Enabled

Word Wise : Enabled

Print length : 151 pages

Page numbers source ISBN : B0BW2H5Q1V

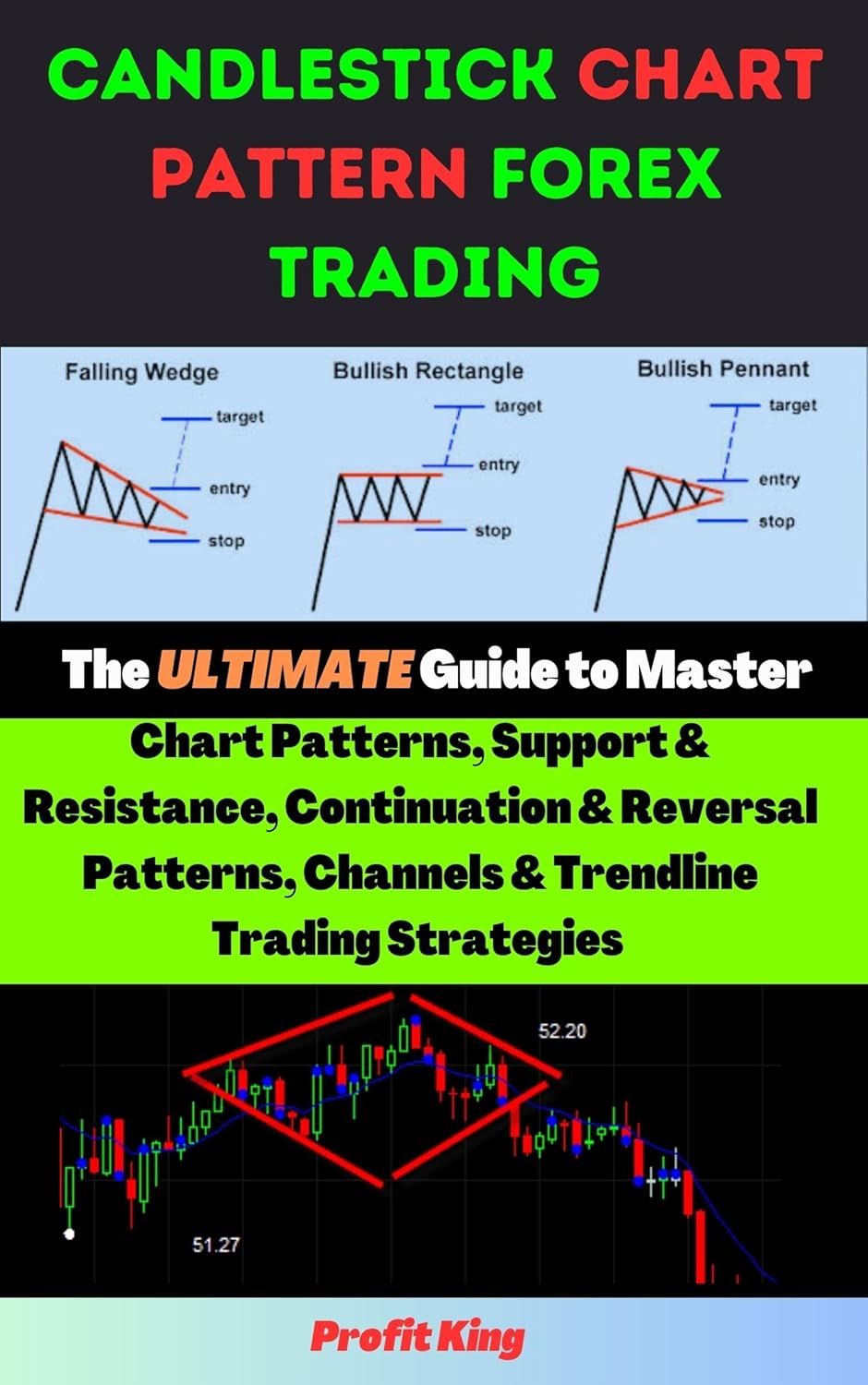

Chart patterns are important tools for forex traders to analyze market trends and make informed trading decisions. Understanding chart patterns can help traders identify potential entry and exit points, as well as predict future price movements.

In this beginner’s guide, we will cover the basics of chart patterns, including support and resistance levels, continuation and reversal patterns, channels, and trend lines. By mastering these concepts, traders can develop effective trading strategies and improve their chances of success in the forex market.

Support and resistance levels are key areas on a price chart where the price tends to bounce or reverse. Support is a level where buying interest is strong enough to prevent the price from falling further, while resistance is a level where selling interest is strong enough to prevent the price from rising further. By identifying these levels, traders can set stop-loss orders and take-profit targets to manage their risk.

Continuation patterns are chart patterns that suggest the current trend is likely to continue. These patterns include flags, pennants, and triangles, among others. Reversal patterns, on the other hand, indicate that the current trend is likely to reverse. These patterns include head and shoulders, double tops, and double bottoms, among others.

Channels and trend lines are tools used to identify the direction of the trend. Channels are formed by drawing parallel lines connecting the highs and lows of a price chart, while trend lines are diagonal lines that connect the highs or lows of a price chart. By analyzing these patterns, traders can determine whether the market is trending up, down, or sideways, and adjust their trading strategy accordingly.

In summary, mastering chart patterns is essential for successful forex trading. By understanding support and resistance levels, continuation and reversal patterns, channels, and trend lines, traders can develop effective trading strategies and improve their chances of success in the market. To help you remember these key concepts, we have created a chart pattern cheat sheet that you can refer to when analyzing price charts. Happy trading!

#Chart #Pattern #Forex #Trading #Beginners #Guide #Master #Chart #Patterns #Support #Resistance #Continuation #Reversal #Patterns #Channels #TrendLine #Strategies #Chart #Pattern #Cheat #Sheet, Technical Support