Your cart is currently empty!

Tag: Ripping

Ontario premier ‘ripping up contract’ with Musk’s Starlink in response to tariffs

The leader of Canada’s most populous province of Ontario says he’s ripping up a contract with Elon Musk’s Starlink internet services in response to Donald Trump’s sweeping tariffs on Canada, as well as banning American companies from provincial contracts

TORONTO — The leader of Canada’s most populous province of Ontario said Monday he’s ripping up a contract with Elon Musk’s Starlink internet services in response to U.S. President Donald Trump’s sweeping tariffs on Canada.

Ontario Premier Doug Ford, who said he is also banning American companies from provincial contracts, signed a $100-million Canadian (US$68 million) with Musk’s company in November to deliver high-speed internet to remote residents in rural and northern Ontario.

“We’ll be ripping up the province’s contract with Starlink. Ontario won’t do business with people hellbent on destroying our economy,” Ford said in a post on X.

Ford said starting Tuesday and until U.S. tariffs are removed, Ontario will ban American companies from provincial contracts.

“Canada didn’t start this fight with the U.S., but you better believe we’re ready to win it,” said Ford, who called an election for his province last week.

In a bold move, Ontario Premier Doug Ford announced today that he will be “ripping up” the contract with Elon Musk’s Starlink satellite internet service in response to new tariffs imposed on Canadian exports.The decision comes as a response to the recent announcement by the United States to impose tariffs on Canadian steel and aluminum products, a move that has sparked outrage and concern among Canadian politicians and industry leaders.

Premier Ford stated that the tariffs are “unfair and unjust” and that he will not stand idly by while Ontario businesses and workers are harmed by these punitive measures. He also emphasized that he will not allow Musk’s company to profit off the backs of hardworking Ontarians while their livelihoods are threatened by the tariffs.

The decision to terminate the contract with Starlink is sure to have far-reaching consequences, as the satellite internet service was seen as a potential solution to rural connectivity issues in the province. However, Premier Ford remains steadfast in his commitment to defending Ontario’s interests and standing up to what he sees as unjust trade practices.

This move is just the latest in a series of aggressive actions taken by the Ontario government in response to the tariffs, and it is unclear what the future holds for the province’s relationship with Musk’s company. Only time will tell how this decision will impact Ontario’s internet infrastructure and the broader economic implications of the tariffs.

Tags:

- Ontario Premier

- Ripping up contract

- Musk’s Starlink

- Tariffs

- Ontario government

- Technology news

- Space technology

- Elon Musk

- Canadian politics

- Satellite internet.

#Ontario #premier #ripping #contract #Musks #Starlink #response #tariffs

Ford ‘ripping up’ Ontario’s $100M contract with Elon Musk’s Starlink in wake of U.S. tariffs

Progressive Conservative Leader Doug Ford is “ripping up” Ontario’s nearly $100 million contract with Elon Musk’s Starlink in the wake of U.S. tariffs on virtually all Canadian goods, he said in a statement Monday.

The contract, signed in November, was meant to provide high-speed internet access through Starlink’s satellite service to 15,000 eligible homes and businesses in rural, remote and northern communities by June of this year.

“Ontario won’t do business with people hellbent on destroying our economy,” Ford said in the statement.

Ford said Ontario will ban American companies from provincial contracts until U.S. tariffs are removed.

“U.S.-based businesses will now lose out on tens of billions of dollars in new revenues. They only have President Trump to blame,” he said.

On Saturday, U.S. President Donald Trump imposed 25 per cent tariffs on virtually all goods from Canada and a lower 10 per cent tariff on Canadian energy products

Musk, an adviser to Trump, is overseeing the U.S. Department of Government Efficiency (DOGE) in co-operation with the president’s administration.

Ford has faced criticism for the contract, with Ontario Liberal Leader Bonnie Crombie calling on him to end the deal last week.

“If he were serious about standing up to Trump, he would cancel his sweetheart deal with Elon Musk,” Crombie previously said in a news release.

Ford defended the contract at the time, saying there was a transparent bidding process and it was part of the government’s plan to get everyone in the province high-speed internet.

Starlink growing quickly in Canada

According to a news release from Infrastructure Ontario in January 2024, only two satellite internet service providers could meet the province’s needs.

Those were Musk’s SpaceX, which runs Starlink, and Xplore Inc., a Canadian rural internet service provider. Both providers were invited to participate in a bidding process, the release said, with SpaceX ultimately winning out.

Starlink surpassed Xplornet, operated by Xplore Inc., as the leading satellite-based provider of rural and remote internet access service in Canada in 2022, according to a report by the Global Media and Internet Concentration Project in December.

As of 2024, Starlink has around 400,000 subscribers in Canada, the report said.

In a shocking turn of events, Ford announced today that they will be “ripping up” their $100 million contract with Elon Musk’s Starlink in Ontario. This decision comes in the wake of new U.S. tariffs that have significantly increased the cost of importing Starlink’s satellite technology.The contract, which was originally signed in hopes of providing high-speed internet to rural areas in Ontario, has now become financially unfeasible for Ford due to the added costs of the tariffs. In a statement released by the company, Ford expressed their disappointment in having to cancel the contract, but emphasized that they must prioritize the financial well-being of their business.

This move is sure to have significant implications for both Ford and Starlink, as they now must find alternative solutions to provide internet access to underserved communities in Ontario. It remains to be seen how this decision will impact the future of Elon Musk’s ambitious satellite internet project.

Stay tuned for more updates on this developing story.

Tags:

- Ford contract cancellation with Starlink

- Ontario $100M deal scrapped by Ford

- Elon Musk’s Starlink contract terminated by Ford

- Ford’s decision to end contract with Starlink

- U.S. tariffs impact on Ford-Starlink deal

- Ontario contract cancellation with Elon Musk’s Starlink

- Ford’s move to rip up $100M Starlink contract

- Implications of Ford’s decision on Starlink deal

- Ford’s response to U.S. tariffs on Starlink contract

- Ontario’s contract with Starlink terminated by Ford

#Ford #ripping #Ontarios #100M #contract #Elon #Musks #Starlink #wake #U.S #tariffs

An Expert’s Warning: If Your Tax Refund Is Over $1,000, the IRS May Be Ripping You Off

Getting a sizable tax refund every year can feel like receiving a bonus. But it’s usually a sign that you’re overpaying the IRS.

If you receive a tax refund of over $1,000, you might have paid too much in taxes throughout the year to the government. With inflation still too high and many of us living paycheck-to-paycheck or leaning on credit to get by, that tax refund might have been more helpful throughout the year.

As an accountant and accredited financial counselor, I see this problem far too often with my clients. The good news is, you can adjust how much you’re paying in taxes throughout the year by updating your tax withholding amount on your employer’s W-4 form. The start of a new year is the perfect time to review your tax withholdings and make any adjustments to keep more money in your pocket each paycheck.

Here’s what I tell my clients to help them determine how much to withhold and why overpaying isn’t always the best idea.

How to avoid overpaying and underpaying the IRS

Tax overpayment happens when too much is withheld from your paycheck or when estimated tax payments exceed what you owe. This often occurs when an employee claims too few exemptions on their Employee’s Withholding Certificate, otherwise known as a W-4 form.

If it’s been over five years since you last updated your W-4, there’s a chance you could be overpaying. This is especially true if you’ve had life events that could afffect your taxes overall, such as kids, marriage or divorce. If federal taxes are withheld from your paycheck, I suggest reviewing your W-4 form and updating it if you’d like more in your take-home pay. For example, if you’re currently claiming “0” exemptions on your W-4, claiming “1” will reduce the amount of money withheld for taxes, so you’ll see more in your paycheck.

Changing your exemptions might not always make sense. You may not want to pay the government too little and owe money in taxes each year. I always recommend that my clients use an estimated tax tool to help them estimate how much they should pay throughout the year — like the IRS Tax Withholding Estimator. This tool guides you through different prompts to estimate your tax liability based on your personal situation. It also shows you how adjusting your withholdings could affect your paycheck. I encourage you to reach out to an accountant if you have any questions about your withholdings.

If you’re self-employed or have a side hustle, this estimator tool still works. For self-employment income, I suggest entering your earnings after deducting expenses for a more accurate picture of what you owe. That can help you stay on track with estimated quarterly taxes, too.

You may still get a tax refund

You can still get a tax refund without overpaying the IRS. Tax refunds come from two main sources: overpaid taxes and refundable credits. If you’re eligible for refundable credits — tax credits that can increase your tax refund — you can still see a small boon during tax season.

One of the most popular refundable credits is the Earned Income Tax Credit. For example, if your adjusted gross income was $18,591 or less in 2024, you could qualify for up to $632 in refunds — even without a dependent. There are other refundable credits, such as the Child Tax Credit, the American Opportunity Tax Credit and the Premium Tax Credit.

Does overpaying the IRS ever make sense?

Deciding whether you want more money in your paycheck or a lump sum during tax season is a personal decision. Just make sure you know the tradeoffs.

For example, if saving money is a challenge for you, you might opt to overpay the IRS so you’ll have a built-in savings cushion each year. Although it may not be the most efficient way to save, that big refund check can help you meet your savings goals. The tradeoff is that you’re not earning any interest by loaning that money to the federal government throughout the year. Instead, if you had fewer taxes withdrawn from your paycheck and put that same money into a high-yield savings account each pay period, you’d earn interest, growing your savings even more.

However, if you’re worried about owing taxes or if you have a side hustle, you might prefer overpaying to help offset your tax bill.

Ask a tax expert for advice

If you’re unsure how much you should be withholding from your paychecks, or what it could mean for your tax refund, talk to an accountant or tax professional. You can also sign up for free local workshops to learn more about taxes. Check with your local library, community college or community centers. The more you know about how your taxes affect your filing, the more comfortable you may feel about making adjustments.

Tax season is upon us, and for many Americans, that means eagerly awaiting their tax refund. But for some, that refund may be too good to be true.According to tax experts, if your tax refund is over $1,000, the IRS may be ripping you off. This may come as a shock to many, but it’s important to understand why this could be happening.

One possible reason for an excessively large tax refund is that you are having too much money withheld from your paychecks throughout the year. While a large refund may seem like a windfall, it actually means that you are giving the government an interest-free loan for the entire year.

Another reason for a large refund could be that you are missing out on valuable tax deductions and credits that could lower your tax liability. By not taking advantage of these deductions, you are essentially overpaying your taxes and giving the government more money than necessary.

So what can you do to avoid being ripped off by the IRS? First, review your tax withholding allowances to ensure that you are not overpaying throughout the year. Additionally, make sure to take advantage of all available tax deductions and credits to lower your tax liability.

In conclusion, if your tax refund is over $1,000, it may be a sign that the IRS is taking more money from you than necessary. By being proactive and adjusting your withholding and taking advantage of tax breaks, you can avoid being ripped off and keep more of your hard-earned money in your pocket.

Tags:

tax refund, IRS, tax refund over $1,000, IRS warning, tax refund scam, tax refund fraud, tax refund investigation, IRS investigation, tax refund tips, tax refund advice, tax refund expert, tax refund specialist

#Experts #Warning #Tax #Refund #IRS #Ripping

Honey’s deal-hunting browser extension is accused of ripping off customers and YouTubers

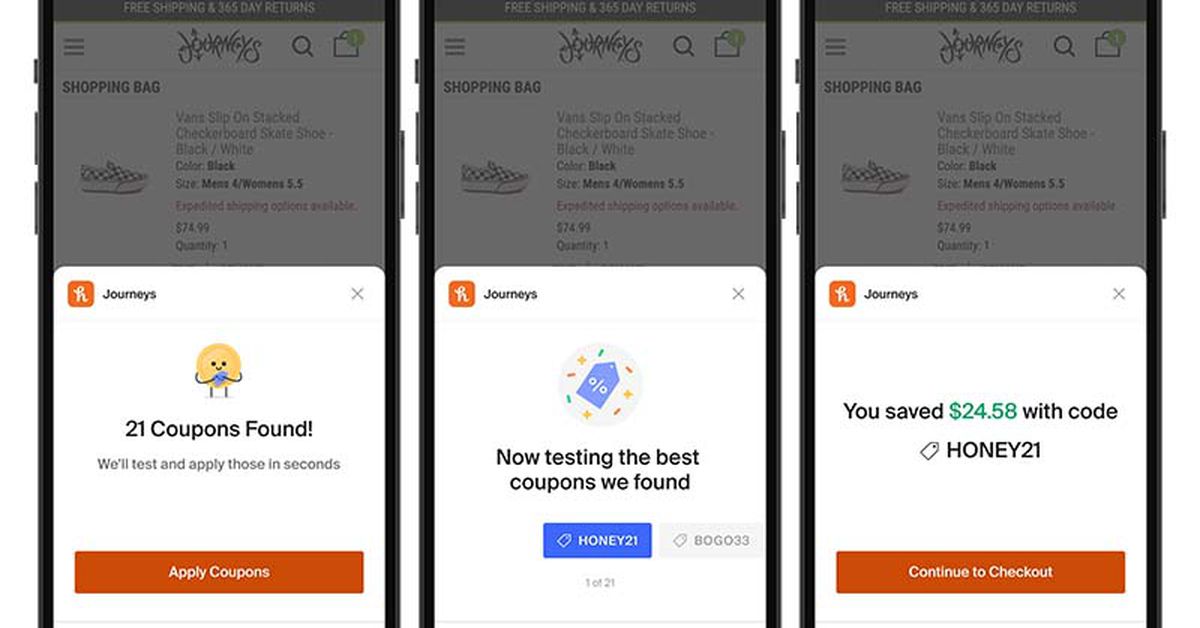

The PayPal Honey browser extension is, in theory, a handy way to find better deals on products while you’re shopping online. But in a video published this weekend, YouTuber MegaLag claims the extension is a “scam” and that Honey has been “stealing money from influencers, including the very ones they paid to promote their product.”

Honey works by popping up an offer to find coupon codes for you while you’re checking out in an online shop. But as MegaLag notes, it frequently fails to find a code, or offers a Honey-branded one, even if a simple internet search will cover something better. The Honey website’s pitch is that it will “find every working promo code on the internet.” But according to MegaLag’s video, ignoring better deals is a feature of Honey’s partnerships with its retail clients.

MegaLag also says Honey will hijack affiliate revenue from influencers. According to MegaLag, if you click on an affiliate link from an influencer, Honey will then swap in its own tracking link when you interact with its deal pop-up at check-out. That’s regardless of whether Honey found you a coupon or not, and it results in Honey getting the credit for the sale, rather than the YouTuber or website whose link led you there.

Paypal VP of corporate communications Josh Criscoe said in an email to The Verge that “Honey follows industry rules and practices, including last-click attribution.”

MegaLag isn’t the first to make such claims. A 2021 Twitter post advises using Honey’s discount codes in a different browser to avoid it taking the affiliate credit. A Linus Media Group employee also explained in a 2022 forum reply that Linus Tech Tips dropped Honey as a sponsor over its affiliate link practices.

Honey’s convenience has resulted in the extension being recommended widely, including in almost 5,000 Honey-sponsored videos across about 1,000 YouTube channels, according to MegaLag. We’ve even recommended it here at The Verge; now we do not.

Here is Criscoe’s full statement:

Honey is free to use and provides millions of shoppers with additional savings on their purchases whenever possible. Honey helps merchants reduce cart abandonment and comparison shopping while increasing sales conversion.

In a shocking turn of events, popular money-saving browser extension Honey has come under fire for allegedly ripping off customers and YouTubers. The extension, which promises to help users find the best deals and discounts while shopping online, has been accused of secretly tracking users’ browsing history and selling their data to third-party companies.Many customers have reported that after installing Honey, they started receiving targeted ads and spam emails related to products they had recently searched for. Additionally, several YouTubers who promoted the extension have claimed that they were not properly compensated for their endorsements and that their viewers were misled about the true intentions of the company.

As more and more users come forward with their complaints, it is clear that Honey’s reputation is on the line. The company has denied any wrongdoing and insists that they are committed to protecting their users’ privacy. However, the damage may already be done, as many former supporters are now seeking alternative browser extensions to help them save money without compromising their personal information.

In light of these accusations, it is important for consumers to be vigilant about the apps and extensions they use, and to always read the fine print before agreeing to share any personal data. Honey’s downfall serves as a cautionary tale about the potential risks of trusting seemingly helpful tools without fully understanding how they operate.

Tags:

- Honey browser extension

- deal-hunting

- customer complaints

- YouTuber controversy

- online shopping tool

- money-saving app

- internet browser add-on

- Honey extension scam

- discount code tool

- browser extension controversy

#Honeys #dealhunting #browser #extension #accused #ripping #customers #YouTubers

8TEN Ripping Chainsaw Chain 18 Inch .063 .325 68 DL For Stihl 025 021 MS250 MS230 MS251 26RM3 68 (4 Pack)

Price:$50.99– $58.95

(as of Dec 26,2024 19:50:49 UTC – Details)

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.Learn more how customers reviews work on Amazon