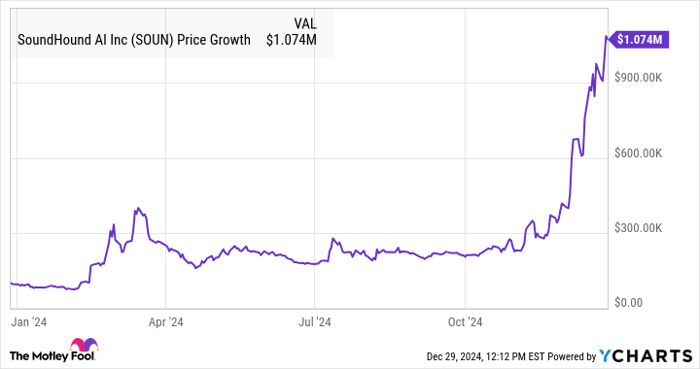

It was just over a year ago in the final week of December 2023 that I wrote an article on SoundHound AI (NASDAQ: SOUN), discussing whether the voice artificial intelligence (AI) solutions provider could help investors become millionaires in the long run.

I had assumed that an investment of $100,000 in SoundHound stock at the end of December 2023 could be worth $530,000 by the end of 2030. However, the stock has significantly outpaced those expectations, jumping more than 1,000% in the past year as of this writing and turning a $100,000 investment into more than a million dollars.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

SOUN data by YCharts

While that’s impressive, investors should note that SoundHound is now trading at a whopping 109 times sales. That’s way higher than its price-to-sales ratio of 12 a year ago, which was justifiable at that time thanks to the outstanding growth that it was clocking. So, investors looking to add another potential millionaire-maker stock to their portfolios may want to look elsewhere considering SoundHound’s expensive valuation.

Let’s take a closer look at the prospects of two other AI-focused stocks that seem like solid candidates for investors looking to build a million-dollar portfolio. These stocks may not deliver SoundHound-like returns in a short period, but they could deliver robust gains over the long term and can become a part of a diversified portfolio.

1. Marvell Technology

The demand for application-specific integrated circuits (ASICs) deployed in data centers for handing AI workloads is growing at a remarkable pace, and this explains why Marvell Technology (NASDAQ: MRVL) has been witnessing a significant jump in its data center revenue in recent quarters.

When the company released its fiscal 2025 third-quarter results (for the three months ended Nov. 2, 2024), it reported a terrific 98% year-over-year increase in data center revenue to $1.1 billion. This impressive growth was enough to offset the weakness in other segments such as enterprise networking and carrier infrastructure, helping Marvell boost its overall top line by 7% from the prior-year period to $1.51 billion.

The demand for Marvell’s custom AI processors is so strong that the company believes it could significantly exceed its $1.5 billion revenue estimate from the sales of these chips for the current fiscal year. More importantly, management also points out that its AI business is tracking ahead of the fiscal 2026 revenue target of $2.5 billion.

That’s not surprising because of a couple of reasons. First, the size of the custom AI processor market is set to grow rapidly in the coming years. Marvell’s peer Broadcom recently pointed out that the addressable market for custom processors and networking chips could be worth $60 billion to $90 billion after three years.

Second, Marvell seems to be cornering a bigger share of this market. While Broadcom is the dominant player in ASICs, Marvell is the second-largest company in this segment with an estimated market share of 13% to 15%. On its December 2024 earnings conference call, Marvell management remarked that it currently has two different customers for its custom AI processors and networking chips, along with “other programs going into production next year, and then we have our third large customer coming in the future.”

So, there is a good chance that Marvell may be able to corner a bigger share of the custom AI chip market going forward. Assuming the company’s share of this space increases to even 20% after three years and the addressable opportunity hits $75 billion (based on the midpoint of Broadcom’s range), Marvell’s AI revenue could jump to $7.5 billion. That would be a significant increase from the $1.5 billion AI revenue that Marvell is anticipating in the current fiscal year.

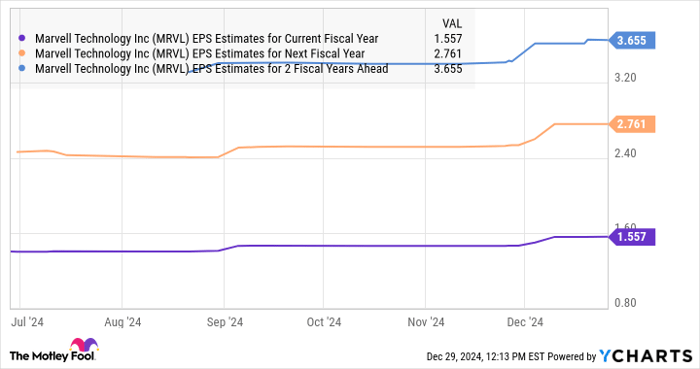

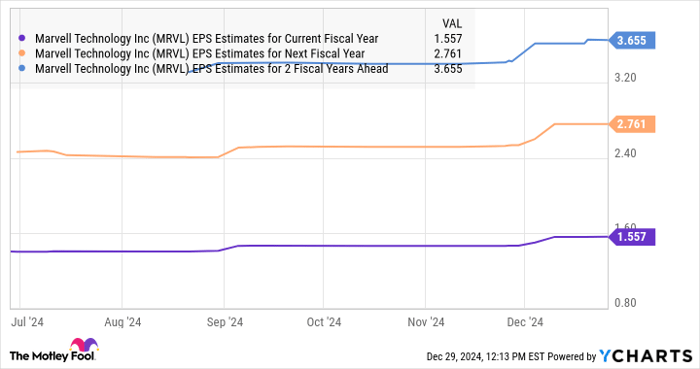

Based on this impressive growth opportunity, analysts are expecting Marvell’s earnings to jump by a solid 77% in the next fiscal year to $2.76 per share, up significantly from just 3% growth expected in the current fiscal year. That’s expected to be followed by another solid performance after a couple of fiscal years.

MRVL EPS Estimates for Current Fiscal Year data by YCharts

The market could reward this growth with outstanding gains going forward, making Marvell an ideal pick for investors looking to build a diversified million-dollar portfolio. And given that it is trading at 42 times forward earnings as compared to the U.S. tech sector’s average earnings multiple of 51, investors are getting a good deal on this AI stock right now.

2. Cloudflare

Though Cloudflare (NYSE: NET) has been primarily known for providing cloud-based services to customers that help them secure their internet connections while also improving their performance and reliability, it is now looking to leverage its existing infrastructure to move into the cloud AI services space.

The company is equipping its data center locations with graphics processing units (GPUs) to help them develop and deploy AI applications with the help of popular large language models (LLMs) without having to invest in expensive hardware. The fact that Cloudflare’s data center network spans 330 cities in more than 120 countries means that it can scale up its AI network significantly.

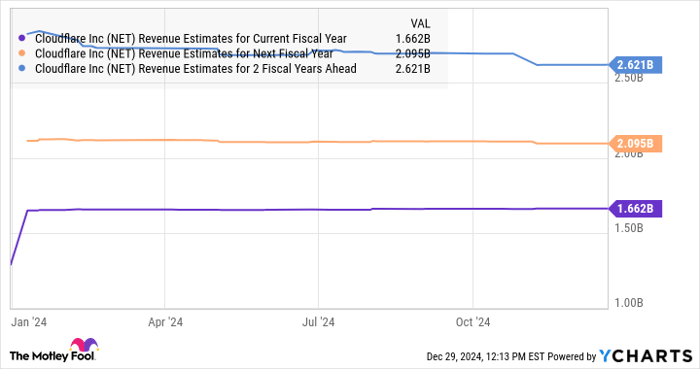

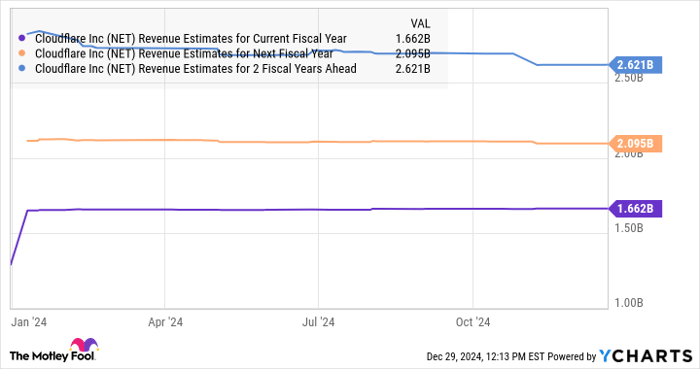

Cloudflare’s AI offerings are gaining traction among customers and driving solid growth in the company’s revenue, as pointed out by management on the November 2024 earnings conference call. The company raised its fiscal 2024 guidance to just over $1.66 billion from the earlier expectation of just over $1.65 billion, which would translate to 28% sales growth for the current fiscal year.

At the same time, stronger spending by Cloudflare’s customers on its offerings, driven by the addition of new products related to AI, explains why its earnings are expected to grow at a much faster pace of 51% in fiscal 2024. The number of large paying customers with an annualized revenue of more than $100,000 increased 28% year over year to 3,265 last quarter. The dollar-based net retention rate of 110% suggests that existing customers increased their spending on Cloudflare’s offerings, as this metric compares the spending by customers in a quarter to the spending by those same customers in the year-ago period.

Moreover, the company’s paying customer base also increased by 22% year over year. That could pave the way for stronger growth at Cloudflare, especially considering that the company pegs its total addressable market at an impressive $222 billion in 2027. Cloudflare’s revenue forecast for the current year suggests that it is scratching the surface of a big market opportunity, and its potential growth for the next couple of years suggests that it is expected to maintain healthy growth levels.

NET Revenue Estimates for Current Fiscal Year data by YCharts

As such, Cloudflare looks like an ideal growth stock for investors looking to construct a million-dollar portfolio. Of course, the stock does seem richly valued considering its sales multiple of 24, but the huge market opportunity that it is sitting on and its massive data center network could help it justify that valuation in the long run.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $355,269!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,404!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $489,434!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cloudflare. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

The first stock to consider is Tesla (TSLA). This electric vehicle company has been a market leader in the EV industry and continues to innovate with new technologies such as autonomous driving and energy storage. With a strong track record of growth and a visionary CEO in Elon Musk, Tesla has the potential to deliver substantial returns for investors.

Another stock worth considering is Amazon (AMZN). As one of the largest e-commerce companies in the world, Amazon has consistently delivered impressive financial results and continues to expand into new markets such as cloud computing and artificial intelligence. With a proven business model and a dominant market position, Amazon is well-positioned for long-term growth.

In conclusion, while SoundHound AI may be an intriguing investment opportunity, Tesla and Amazon offer more potential for investors to become millionaires. It’s important to do your own research and consider your risk tolerance before making any investment decisions.

Tags:

SoundHound AI, millionaire-maker stocks, investing, stock market, financial advice, high-growth stocks, wealth building, investment opportunities, stock market analysis, stock market tips, millionaire mindset

#Forget #SoundHound #Buy #MillionaireMaker #Stocks

You must be logged in to post a comment.