Your cart is currently empty!

Tag: Undervalued

Lakers may land undervalued $15 million wing via trade with Rockets

Although acquiring a phenomenon would give the Los Angeles Lakers a significant boost, various role players could serve as valuable contributors to the Lake Show.

An undervalued Houston Rockets wing may join Los Angeles before the Feb. 6 trade deadline.

“(Cam) Whitmore was a consensus Top-10 Pick from NBA Draft media, but there were some off-court concerns / medicals that caused him to fall all the way to Pick 20,” The Wrightway Sports Network’s Alamedad wrote Thursday.

“Recently, this has reared it’s head as Whitmore has appeared to be frustrated at times with his role.”

“They (Lakers) drafted Dalton Knecht who could develop into that next star, as well as Bronny James who has quickly proven himself as a G-League star.”

“Adding Whitmore to this team who also has a young stud role player in Max Christie would truly set this team up with a solid set of role players.”

To receive Whitmore and a 2025 second-round pick, the Lakers would send a 2026 first-round pick to the Rockets in Alamedad’s trade proposal.

Although Whitmore isn’t the most prolific three-point shooter, he compensates by playing above the rim, moving well without the ball, and getting out in front of defenses in fast-break situations.

The Villanova product averages 9.6 points and 3.2 rebounds per contest this season in 16.6 minutes.

Whitmore would probably like to receive an expanded offensive role on Ime Udoka’s squad.

However, with the Rockets possessing the No. 2 seed in the Western Conference and performing above expectations, it’s reasonable to assume Udoka will keep things the way they are.

Landing Whitmore wouldn’t substantially improve Los Angeles’ title odds, but the move could help strengthen LeBron James and Anthony Davis’ supporting cast while only requiring the franchise to give up a first-round pick.

Alamedad’s trade idea could intrigue Rob Pelinka and the Lakers this season.

More NBA: Warriors predicted to cut ties with rejuvenated $109 million NBA champion via trade

The Los Angeles Lakers may be on the brink of acquiring an undervalued $15 million wing player in a potential trade with the Houston Rockets. With the NBA trade deadline looming, the Lakers are reportedly eyeing a deal that would bring in a talented player who has flown under the radar this season.While the player’s name has not been officially disclosed, reports suggest that he could provide the Lakers with much-needed depth and versatility on the wing. The Rockets are said to be open to moving the player as they look to reshape their roster for the future.

If the trade goes through, the Lakers could significantly bolster their lineup and improve their chances of making a deep playoff run. Stay tuned for more updates on this developing story as the trade deadline approaches. #Lakers #NBA #TradeDeadline #Rockets #WingPlayer

Tags:

- Lakers trade rumors

- NBA trade news

- Los Angeles Lakers

- Houston Rockets trade

- NBA trade rumors

- Undervalued wing player

- Lakers trade targets

- NBA trade deadline

- Lakers roster update

- NBA trade analysis

#Lakers #land #undervalued #million #wing #trade #Rockets

Is Ford Motor Company (F) the Most Undervalued Stock to Invest in for Under $20?

We recently published a list of 12 Most Undervalued Stocks to Invest in for Under $20. In this article, we are going to take a look at where Ford Motor Company (NYSE:F) stands against other most undervalued stocks to invest in for under $20.

As we know, nearly all sectors in the S&P 500 index saw gains in 2024, a year dominated by AI enthusiasm and a strong US economy. According to FactSet, the S&P 500 is anticipated to report earnings growth of 11.7% for Q4 2024, marking the highest YoY growth rate reported by the index since Q4 2021. According to an update (as of January 17), the Q4 2024 earnings season for the S&P 500 has seen a strong start. FactSet added that both, the percentage of S&P 500 companies publishing positive earnings surprises and the magnitude of earnings surprises, appear to be above recent averages.

As per Morningstar, the growth drivers identified last year that supported the broader market in 2024 are now receding. The rate of monetary policy easing has been slowing, inflation has been sticky, long-term rates are increasing and the broader US economy continues to slow. Amidst these uncertainties, what lies ahead?

Goldman Sachs’ investment strategy group anticipates the S&P 500 to end between 6,200-6,300 by year-end, demonstrating a total return of ~7% – 8%. The companies’ earnings growth is expected to be the critical driver of the S&P 500’s 2025 return, and Goldman forecasts that the index’s EPS will increase by ~10% to $265 this year. When this earnings growth gets combined with a 1.3% dividend yield and some sort of compression in the P/E ratio, the firm’s base case this year demonstrates high-single-digit total returns and the S&P 500 target range of 6,200 – 6,300.

As per Goldman Sachs, the US stocks have faced pressures as of now in January, due to factors including higher Treasury bond yields, after strong performance in 2024 pushed S&P 500 index at elevated valuations. As per the group, the yield on the 10-Y treasury note is expected to conclude the year lower compared to the current level. The firm recommends to remain invested in the US stock market, even though the broader market is historically expensive.

As per Goldman, the US stock market often delivers gains when there are economic expansions. The investment strategy group of the bank has placed 80% odds on the fact that the US economy will continue to expand in the current year. While the elevated valuation can expose the market to downside risks, the investment firm believes that the US equities will outperform intermediate-duration U.S. bonds and cash considering its economic growth forecast of 2.3%.

Ford Motor Company (F) has been making headlines recently, with its stock price sitting at under $20 per share. Many investors are starting to wonder if Ford is the most undervalued stock to invest in right now.With the global shift towards electric vehicles and the increasing demand for sustainable transportation options, Ford has been making strategic moves to capitalize on this trend. The company has announced plans to invest billions of dollars in electric and autonomous vehicles, as well as expand its presence in the electric vehicle market.

Additionally, Ford has a strong history of innovation and a loyal customer base, which could bode well for its future growth prospects. The company also has a solid balance sheet, with manageable debt levels and a healthy cash position.

While there are risks associated with investing in any stock, Ford’s current valuation and growth potential make it an attractive option for investors looking to capitalize on the future of transportation. With its stock price under $20, Ford may be one of the most undervalued stocks to consider investing in right now.

Tags:

Ford Motor Company, F stock, undervalued stocks, stock investing, under $20 stocks, Ford stock analysis, stock market analysis, value investing, Ford Motor Company stock performance, investment opportunities, affordable stocks, stock valuation.

#Ford #Motor #Company #Undervalued #Stock #Invest12 Undervalued Defensive Stocks for 2025

Artificial intelligence is the greatest investment opportunity of our lifetime. The time to invest in groundbreaking AI is now, and this stock is a steal!

The whispers are turning into roars.

Artificial intelligence isn’t science fiction anymore.

It’s the revolution reshaping every industry on the planet.

From driverless cars to medical breakthroughs, AI is on the cusp of a global explosion, and savvy investors stand to reap the rewards.

Here’s why this is the prime moment to jump on the AI bandwagon:

Exponential Growth on the Horizon: Forget linear growth – AI is poised for a hockey stick trajectory.

Imagine every sector, from healthcare to finance, infused with superhuman intelligence.

We’re talking disease prediction, hyper-personalized marketing, and automated logistics that streamline everything.

This isn’t a maybe – it’s an inevitability.

Early investors will be the ones positioned to ride the wave of this technological tsunami.

Ground Floor Opportunity: Remember the early days of the internet?

Those who saw the potential of tech giants back then are sitting pretty today.

AI is at a similar inflection point.

We’re not talking about established players – we’re talking about nimble startups with groundbreaking ideas and the potential to become the next Google or Amazon.

This is your chance to get in before the rockets take off!

Disruption is the New Name of the Game: Let’s face it, complacency breeds stagnation.

AI is the ultimate disruptor, and it’s shaking the foundations of traditional industries.

The companies that embrace AI will thrive, while the dinosaurs clinging to outdated methods will be left in the dust.

As an investor, you want to be on the side of the winners, and AI is the winning ticket.

The Talent Pool is Overflowing: The world’s brightest minds are flocking to AI.

From computer scientists to mathematicians, the next generation of innovators is pouring its energy into this field.

This influx of talent guarantees a constant stream of groundbreaking ideas and rapid advancements.

By investing in AI, you’re essentially backing the future.

The future is powered by artificial intelligence, and the time to invest is NOW.

Don’t be a spectator in this technological revolution.

Dive into the AI gold rush and watch your portfolio soar alongside the brightest minds of our generation.

This isn’t just about making money – it’s about being part of the future.

So, buckle up and get ready for the ride of your investment life!

Act Now and Unlock a Potential 10,000% Return: This AI Stock is a Diamond in the Rough (But Our Help is Key!)

The AI revolution is upon us, and savvy investors stand to make a fortune.

But with so many choices, how do you find the hidden gem – the company poised for explosive growth?

That’s where our expertise comes in.

We’ve got the answer, but there’s a twist…

Imagine an AI company so groundbreaking, so far ahead of the curve, that even if its stock price quadrupled today, it would still be considered ridiculously cheap.

That’s the potential you’re looking at. This isn’t just about a decent return – we’re talking about a 10,000% gain over the next decade!

Our research team has identified a hidden gem – an AI company with cutting-edge technology, massive potential, and a current stock price that screams opportunity.

This company boasts the most advanced technology in the AI sector, putting them leagues ahead of competitors.

It’s like having a race car on a go-kart track.

They have a strong possibility of cornering entire markets, becoming the undisputed leader in their field.

Here’s the catch (it’s a good one): To uncover this sleeping giant, you’ll need our exclusive intel.

We want to make sure none of our valued readers miss out on this groundbreaking opportunity!

That’s why we’re slashing the price of our Premium Readership Newsletter by a whopping 70%.

For a ridiculously low price of just $29.99, you can unlock a year’s worth of in-depth investment research and exclusive insights – that’s less than a single restaurant meal!

Here’s why this is a deal you can’t afford to pass up:

• Access to our Detailed Report on this Game-Changing AI Stock: Our in-depth report dives deep into our #1 AI stock’s groundbreaking technology and massive growth potential.

• 11 New Issues of Our Premium Readership Newsletter: You will also receive 11 new issues and at least one new stock pick per month from our monthly newsletter’s portfolio over the next 12 months. These stocks are handpicked by our research director, Dr. Inan Dogan.

• One free upcoming issue of our 70+ page Quarterly Newsletter: A value of $149

• Bonus Reports: Premium access to members-only fund manager video interviews

• Ad-Free Browsing: Enjoy a year of investment research free from distracting banner and pop-up ads, allowing you to focus on uncovering the next big opportunity.

• 30-Day Money-Back Guarantee: If you’re not absolutely satisfied with our service, we’ll provide a full refund within 30 days, no questions asked.

Space is Limited! Only 1000 spots are available for this exclusive offer. Don’t let this chance slip away – subscribe to our Premium Readership Newsletter today and unlock the potential for a life-changing investment.

Here’s what to do next:

1. Head over to our website and subscribe to our Premium Readership Newsletter for just $29.99.

2. Enjoy a year of ad-free browsing, exclusive access to our in-depth report on the revolutionary AI company, and the upcoming issues of our Premium Readership Newsletter over the next 12 months.

3. Sit back, relax, and know that you’re backed by our ironclad 30-day money-back guarantee.

Don’t miss out on this incredible opportunity! Subscribe now and take control of your AI investment future!

No worries about auto-renewals! Our 30-Day Money-Back Guarantee applies whether you’re joining us for the first time or renewing your subscription a year later!

- Lockheed Martin Corporation (LMT)

- Raytheon Technologies Corporation (RTX)

- Northrop Grumman Corporation (NOC)

- General Dynamics Corporation (GD)

- L3Harris Technologies, Inc. (LHX)

- BAE Systems plc (BAESY)

- Aerojet Rocketdyne Holdings, Inc. (AJRD)

- Huntington Ingalls Industries, Inc. (HII)

- Kratos Defense & Security Solutions, Inc. (KTOS)

- Mercury Systems, Inc. (MRCY)

- FLIR Systems, Inc. (FLIR)

- Teledyne Technologies Incorporated (TDY)

Tags:

defensive stocks, undervalued stocks, stock market, investment opportunities, financial analysis, defensive investing, long-term investments, stock picks, stock trends, defensive sector, value stocks, stock tips, stock recommendations

#Undervalued #Defensive #StocksIs Pfizer Inc. (PFE) the Undervalued Defensive Stock for 2025?

We recently published a list of 12 Undervalued Defensive Stocks for 2025. In this article, we are going to take a look at where Pfizer Inc. (NYSE:PFE)) stands against other undervalued defensive stocks for 2025.

The consumer defensive sector covers products that everyone needs almost every day. These stocks are able to sustain any economic environment, even economic slowdowns, as they are not highly dependent on the economic cycle. This differentiates them from cyclical stocks, as consumer defensive stocks can produce stable profits through the various stages of an economic cycle. These stocks can thus protect your portfolio in times of economic instability, as they generally produce reliable income from dividends. While consumer defensive stocks tend not to be susceptible to market instability, they also experience less growth during positive market cycles as compared to cyclical or higher-risk stocks. Some of the most common and pure-play industry groups considered defensive include healthcare, consumer staples, infrastructure, utilities, and others.

We recently published an article on the 10 Best Soaps and Cleaning Materials Stocks to Invest In and discussed what the consumer staples sector might look like in 2025. Here is an excerpt from the article:

On December 10, Ben Shuleva, Fidelity Sector Portfolio Manager, published a report on Fidelity Investments to discuss the outlook and expected nature of consumer staples in 2025. The consumer staples sector had a positive year in 2024. Shuleva is of the view that with sector dynamics returning to normal, 2025 is also expected to have a positive outlook for the sector. Solid consumer balance sheets, a strong economy, and support from the Fed may help the sector perform better than the broader market. Opportunities thus exist in consumer staples in 2025. Stable consumer demand, steady real wage growth, and healthy employment are further expected to support these opportunities.

Pfizer Inc. (PFE) has long been known as a stalwart in the pharmaceutical industry, consistently delivering strong financial performance and a steady dividend for investors. However, in recent years, the stock has been overlooked by many investors as other sectors have taken the spotlight.As we look ahead to 2025, could Pfizer be the undervalued defensive stock that investors have been overlooking? With a strong pipeline of drugs in development, including potential blockbuster treatments for cancer and rare diseases, Pfizer has the potential for significant growth in the coming years.

In addition, Pfizer’s strong balance sheet and history of solid cash flow generation make it a reliable defensive stock in times of market volatility. With a dividend yield of over 3% and a track record of consistent dividend growth, Pfizer could be an attractive option for income-focused investors.

Furthermore, with a PE ratio below the industry average and a price-to-sales ratio that is lower than its competitors, Pfizer appears to be trading at a discount compared to its peers.

While no stock is without risk, Pfizer’s strong fundamentals and potential for growth make it a compelling option for investors looking for a defensive stock in 2025. As always, investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Tags:

Pfizer Inc., PFE, undervalued stock, defensive stock, stock analysis, stock valuation, Pfizer stock forecast, Pfizer stock price, pharmaceutical industry, healthcare sector, Pfizer stock performance, investing in Pfizer, Pfizer stock news, Pfizer stock predictions.

#Pfizer #PFE #Undervalued #Defensive #Stock

Is Fujitsu Limited (TSE:6702) Potentially Undervalued?

Fujitsu Limited (TSE:6702) saw significant share price movement during recent months on the TSE, rising to highs of JP¥3,156 and falling to the lows of JP¥2,677. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Fujitsu’s current trading price of JP¥2,800 reflective of the actual value of the large-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Fujitsu’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

See our latest analysis for Fujitsu

What Is Fujitsu Worth?

According to our valuation model, Fujitsu seems to be fairly priced at around 0.96% above our intrinsic value, which means if you buy Fujitsu today, you’d be paying a relatively reasonable price for it. And if you believe the company’s true value is ¥2772.78, then there isn’t really any room for the share price grow beyond what it’s currently trading. What’s more, Fujitsu’s share price may be more stable over time (relative to the market), as indicated by its low beta.

What does the future of Fujitsu look like?

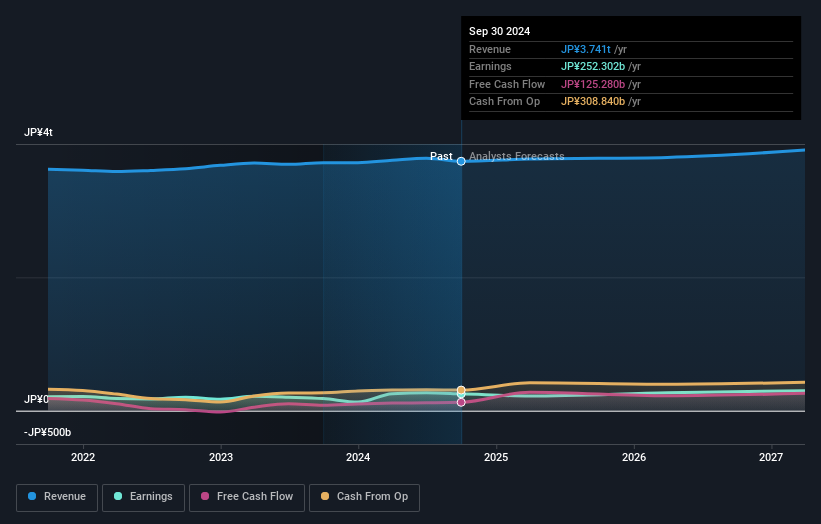

TSE:6702 Earnings and Revenue Growth January 1st 2025 Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Fujitsu’s earnings over the next few years are expected to increase by 27%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? It seems like the market has already priced in 6702’s positive outlook, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?

Are you a potential investor? If you’ve been keeping an eye on 6702, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the positive outlook is encouraging for the company, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

So while earnings quality is important, it’s equally important to consider the risks facing Fujitsu at this point in time. While conducting our analysis, we found that Fujitsu has 1 warning sign and it would be unwise to ignore this.

If you are no longer interested in Fujitsu, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Fujitsu Limited (TSE:6702) is a multinational information technology equipment and services company headquartered in Tokyo, Japan. With a market capitalization of over $20 billion, Fujitsu is a major player in the tech industry, providing a wide range of products and services including servers, storage systems, software, and consulting services.Despite its size and reputation, some investors believe that Fujitsu may be undervalued in the market. The company’s stock price has been relatively flat in recent years, trading at a price-to-earnings ratio below the industry average. This has led some analysts to speculate that Fujitsu’s true value may not be fully reflected in its current stock price.

One factor that may be contributing to Fujitsu’s undervaluation is its relatively low profit margins compared to its competitors. While the company has shown steady revenue growth in recent years, its profitability has been somewhat constrained by rising costs and competitive pressures in the industry. However, Fujitsu has been making efforts to improve its margins through cost-cutting initiatives and strategic partnerships, which could potentially drive future earnings growth.

Another potential catalyst for Fujitsu’s stock price is its strong position in key growth markets such as cloud computing, cybersecurity, and artificial intelligence. As these sectors continue to expand, Fujitsu is well-positioned to capitalize on the increasing demand for its products and services.

In conclusion, while Fujitsu Limited may not be a flashy tech stock, its solid fundamentals and growth prospects make it a potentially undervalued investment opportunity for long-term investors. As always, it’s important to conduct thorough research and due diligence before making any investment decisions.

Tags:

Fujitsu Limited, TSE:6702, undervalued stock, potential investment, stock market analysis, Fujitsu stock price, value investing, stock valuation, Japanese technology company, market trends, stock performance, financial analysis.

#Fujitsu #Limited #TSE6702 #Potentially #Undervalued