Donald Trump ran a pro-crypto campaign last year. He threw his support behind radical ideas like establishing a strategic Bitcoin (BTC -4.91%) reserve within the U.S. government, and he promised to make America the crypto capital of the world.

After he won on Nov. 5, most major cryptocurrencies surged in value. XRP (XRP -13.13%) is up by 511% since that date, and Bitcoin has climbed by 52%.

With Trump now in office, his administration can get to work on its pro-crypto agenda, which could create further value for XRP and Bitcoin. But which one is the better buy in 2025?

The case for XRP: A friendlier Securities and Exchange Commission

In 2020, the U.S. Securities and Exchange Commission (SEC) sued a company called Ripple for the way it distributed its cryptocurrency, XRP. Ripple created a unique payments network that allows global banks to settle transactions with one another directly and instantly, even if they use different infrastructure.

Ripple launched XRP in 2012 to standardize transactions within Ripple Payments. For example, a Japanese bank might send XRP to a German bank instead of sending yen, in order to eliminate currency exchange fees and other transaction costs.

XRP has a total supply of 100 billion tokens. Around 57.6 billion are in circulation, while the other 42.4 billion are held by Ripple, which gradually releases some each month to meet institutional demand. That is the basis for the SEC’s lawsuit: It argues XRP should be a registered financial security (like a stock or a bond) because it’s issued by a company, which would impose a very strict set of rules on Ripple’s business.

A truly decentralized cryptocurrency like Bitcoin doesn’t have that problem, because it has a capped supply and isn’t issued or controlled by any company. Hence, it doesn’t fit the description of a financial security.

The lawsuit was partly resolved in August 2024. A judge ruled that XRP might be a security only in specific circumstances, like when it’s issued to institutions, but it might not be a security when it’s used in transactions or traded on crypto exchanges.

Ripple was hit with a $125 million fine, and investors viewed the outcome as a win. However, the SEC appealed the decision, which could drag the company straight back to court.

That’s why investors view Trump’s election win as so instrumental. He nominated pro-crypto businessman Paul Atkins to run the SEC (pending Senate approval). Since he currently is the co-chairman of the Token Alliance, which is a crypto advocacy organization, he’s a clear supporter of the industry.

Ripple’s chief legal officer, Stuart Alderoty, said he’s cautiously optimistic that the SEC will voluntarily withdraw its case in 2025 once the new chairman is officially in the job (no date has been set for his confirmation hearing). That could be an upside catalyst for XRP.

Image source: Getty Images.

The case for Bitcoin: A reliable store of value

Bitcoin’s market capitalization of $2.1 trillion makes it the world’s largest cryptocurrency. Thanks to its decentralized structure, capped supply, and secure system of record (the blockchain), a growing number of investors consider it to be a good store of value akin to a digital version of gold. Hence, it continues to march to new highs.

The SEC approved dozens of Bitcoin exchange-traded funds (ETFs) last year, which allow investors to own the cryptocurrency in a safe, regulated manner. It also opened the door to a new pool of buyers like financial advisors and institutional investors, and demand has been significant so far, with Bitcoin ETFs now holding over $120 billion in assets.

And there could soon be another major buyer of Bitcoin: The U.S. government. Last year, Sen. Cynthia Lummis, a Wyoming Republican, introduced a bill that would have the Treasury Department establish a program to buy 200,000 bitcoins per year for five years, creating a stockpile of 1 million overall (roughly 5% of the total supply).

The bill didn’t have enough support, but as I mentioned, President Trump is in favor of establishing a Bitcoin reserve, so perhaps the proposal will soon be revisited.

Cathie Wood’s ARK Investment Management thinks many governments and companies will store Bitcoin on their balance sheets eventually, to hedge against economic headwinds like inflation. In fact, ARK lists eight factors in total that could send Bitcoin’s price as high as $1.48 million by 2030, representing 1,350% upside from where it trades as of this writing.

Becoming widely accepted as a digital version of gold is another one of the eight factors, and perhaps the most intriguing. The total value of all above-ground gold reserves currently stands at $18.6 trillion. Bitcoin’s market capitalization would have to grow by 830% to match that, translating to a price-per-coin of around $939,000. Therefore, that one factor alone would bring it within reach of ARK’s target.

The verdict

Most cryptocurrencies lack a true function. Despite its popularity, even Bitcoin is a speculative asset because investors buy it in the hope someone will pay a higher price for it in the future. It doesn’t generate earnings, so it’s only worth what an investor is willing to pay.

XRP does have a clear use within the Ripple Payments network, which should theoretically create value for the token. However, banks don’t have to use XRP in order to use Ripple Payments — they can transact using fiat currencies and still benefit from instant settlements. Therefore, like Bitcoin, XRP is very much a speculative asset.

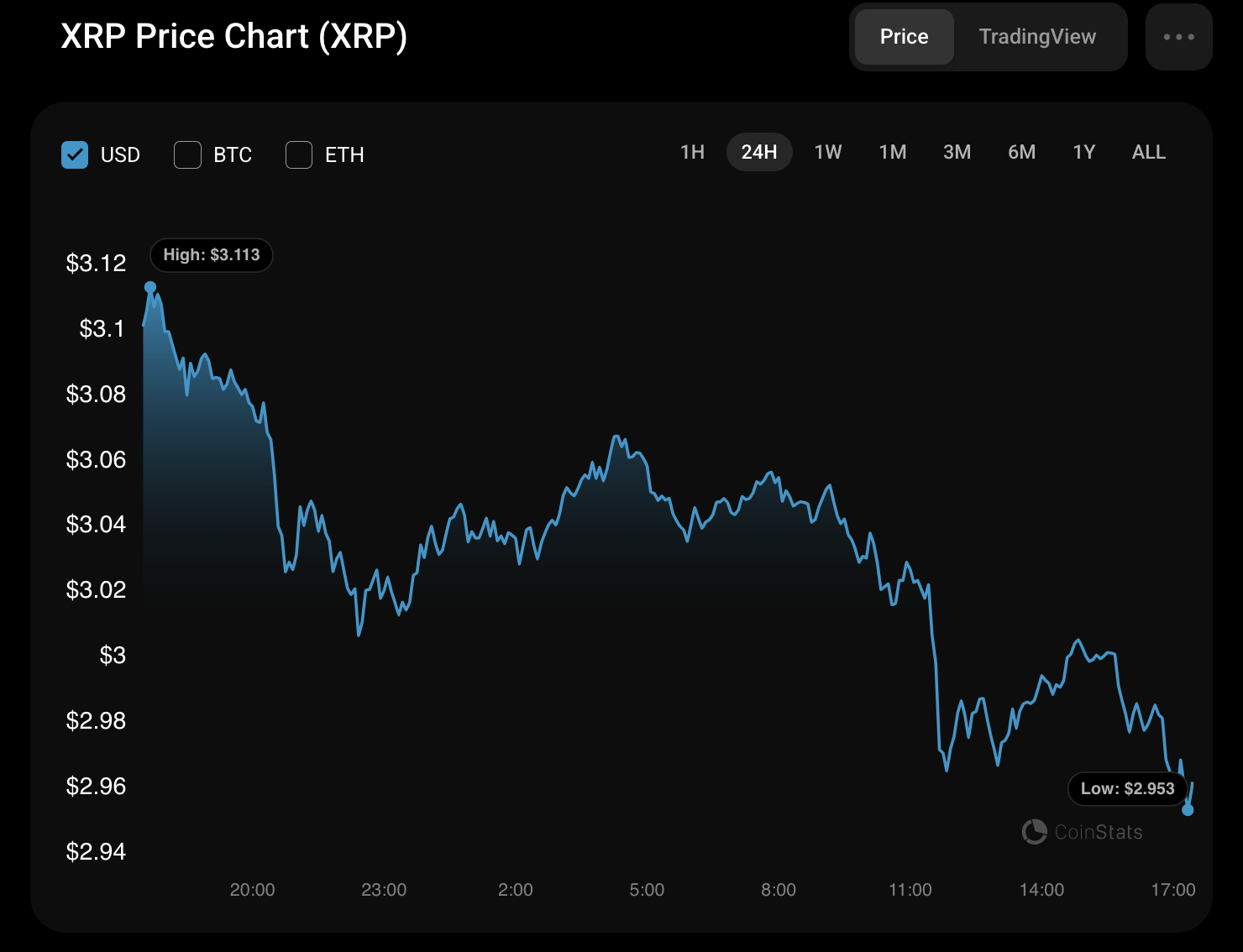

There is one key difference between the two cryptocurrencies. Bitcoin continues to climb to new highs, whereas XRP still hasn’t surpassed its record level of $3.40 from 2018. In fact, it plummeted by more than 90% shortly after peaking in 2018, and I don’t think there is anything stopping that from happening again.

The existence of ETFs and the broad ownership among retail and institutional investors alike can insulate Bitcoin from suffering a similar fate. If the U.S. government becomes a buyer, it might also legitimize the cryptocurrency’s status as a store of value and encourage other countries to set up similar initiatives.

As a result, Bitcoin is likely a better buy than XRP in 2025, and also over the long term.

XRP, often referred to as the “banker’s cryptocurrency,” is known for its fast transaction speeds and low fees. It has gained popularity as a tool for cross-border payments and has secured partnerships with major financial institutions around the world. Ripple’s focus on scalability and efficiency has positioned XRP as a strong contender in the cryptocurrency market.

On the other hand, Bitcoin, the original cryptocurrency, has established itself as a store of value and a hedge against inflation. With a finite supply of 21 million coins, Bitcoin has garnered a loyal following of investors who see it as a safe haven asset in times of economic uncertainty. Its decentralized nature and widespread adoption have solidified its place as the leading cryptocurrency in the market.

So, which one is the better buy in 2025? While both XRP and Bitcoin have their own merits, it ultimately depends on your investment goals and risk tolerance. If you believe in the future of blockchain technology and the potential for mass adoption, XRP may be the better buy with its focus on practical use cases in the financial sector. However, if you are looking for a long-term store of value and a proven track record, Bitcoin may be the safer bet.

Whichever cryptocurrency you choose to invest in, it’s important to do your own research and consult with financial experts before making any decisions. The crypto market is constantly evolving, and staying informed is key to making sound investment choices in 2025 and beyond.

Tags: