Your cart is currently empty!

Tech Pushes US Stocks Lower as 2024 Nears an End: Markets Wrap

(Bloomberg) — US stocks fell as a powerful rally in technology shares faltered in the final trading sessions of 2024.

Most Read from Bloomberg

The S&P 500 extended declines after opening more than 1% lower, dragged down by technology stocks. Super Micro Computer Inc., Boeing Co., Broadcom Inc. weighed on the index on Monday.

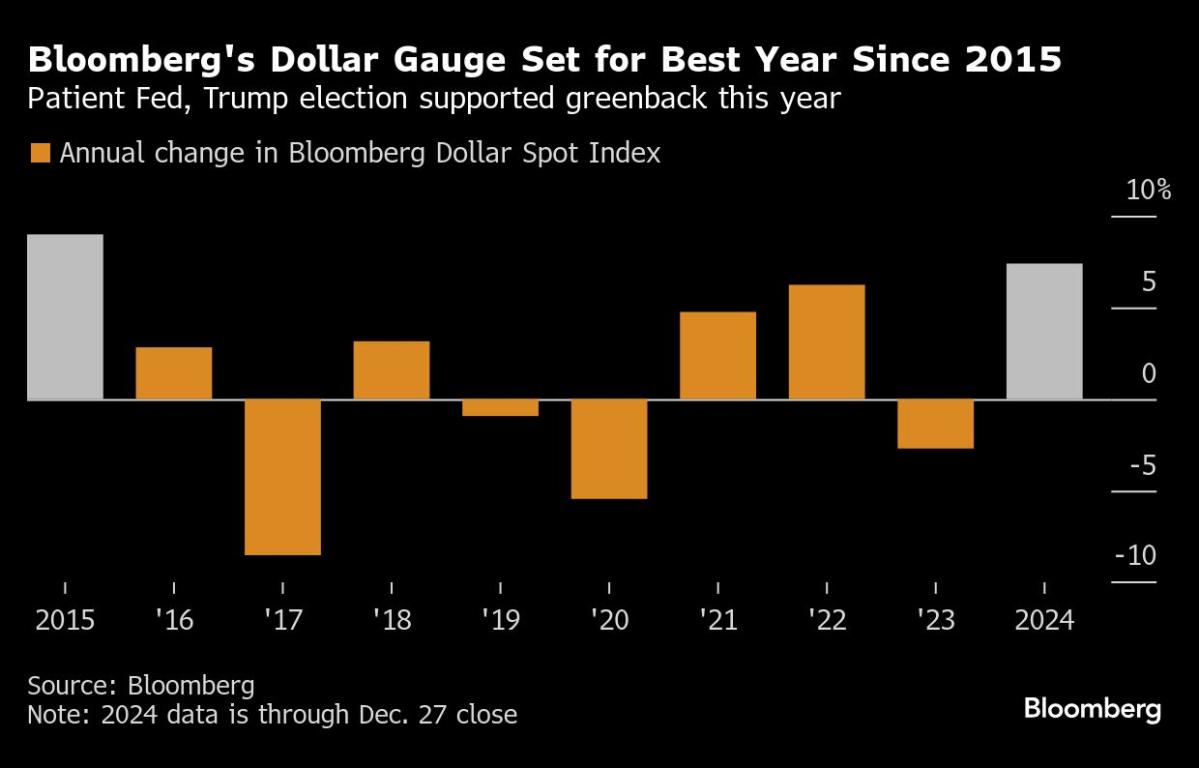

Treasuries continued to advance after Chicago Purchasing Managers’ Index data showed an unexpected decline. Data on Monday also showed pending sales of US homes increasing for a fourth month in November to the highest level since early 2023. The Bloomberg Dollar Spot Index fluctuated.

This year, the so-called Magnificent Seven cohort of US tech giants has driven a 25% advance in the S&P 500, while prompting some to worry that the gains are too concentrated in a small group of names. Still, few are calling for the rally to end and none of the 19 strategists tracked by Bloomberg expects the S&P 500 to decline next year.

“In these moments, it’s best to stay put,” said Nicolas Domont, a fund manager at Optigestion in Paris. “The US remains the place to be. Growth stocks continue to outperform and earnings forecasts are good, so there are good reasons to remain optimistic.”

Elsewhere, Europe’s Stoxx 600 index retreated, while Asian stocks snapped five days of gains. Trading volumes were thinner because of the holiday season.

“There’s a little bit of trepidation heading into year-end, owing in part to uncertainty over how the international trade picture may take shape in 2025,” said Tim Waterer, chief market analyst at Kohle Capital Markets Pty. “Some traders are taking risk off the table heading into year-end.”

Trading in Europe’s equity benchmark was about half of the 30-day average. It’s the final session of 2024 for some markets including Germany, where the DAX benchmark is on course for a 19% annual advance, beating peers in the UK and France.

Deadly Crash

Back in Asia, shares in Jeju Air fell 8.7% in Seoul to a record low after a Boeing Co. 737-800 aircraft operated by the carrier crashed on Sunday, causing the death of all but two of the 181 occupants. Boeing dropped as much as 5.1% in US premarket trading before paring its losses.

Investigators are focusing on a possible bird strike or landing-gear failure, and an analyst said it’s unlikely the events were related to Boeing’s production. Boeing said in a statement that it’s in contact with Jeju Air and ready to offer support.

Oil edged higher as traders focused on 2025 risks. Crude is heading for a loss this year, with trading confined to a narrow range since mid-October. Gold is set for one of its best years.

Tech Pushes US Stocks Lower as 2024 Nears an End: Markets Wrap

As the year 2024 comes to a close, tech stocks are exerting downward pressure on the US stock market. The recent sell-off in technology companies has led to a decline in major indices, with investors showing concern about the sector’s future performance.

The Nasdaq Composite, which is heavily weighted towards tech stocks, has been particularly hard hit, posting losses in recent trading sessions. Companies such as Apple, Amazon, and Microsoft have all seen their stock prices fall as investors reassess their growth prospects.

The broader market has also been affected, with the S&P 500 and Dow Jones Industrial Average both experiencing declines. Concerns about inflation, rising interest rates, and geopolitical tensions have added to the negative sentiment in the market.

Despite the recent downturn, some analysts remain optimistic about the market’s long-term prospects. They point to strong corporate earnings, a robust economy, and supportive fiscal and monetary policies as reasons to believe that stocks will rebound in the coming months.

As we head into 2025, investors will be closely watching how tech stocks perform and whether they can regain their footing. In the meantime, volatility is likely to persist as markets digest the latest developments and adjust to changing economic conditions.

Tags:

- Tech stocks

- US stocks

- Stock market

- Market analysis

- 2024 market trends

- Technology sector

- Market performance

- Financial news

- Stock market update

- Investment strategies

#Tech #Pushes #Stocks #Nears #Markets #Wrap

Leave a Reply