BigBear.ai (NYSE: BBAI) stock is posting big gains in Monday’s trading despite sell-offs for the broader market. The software company’s share price was up 16.2% as of 3:15 p.m. ET, while the S&P 500 index and the Nasdaq Composite index were both down 0.8%.

BigBear.ai stock is surging today thanks to bullish coverage from H.C. Wainwright. The firm’s lead analyst on the company reiterated a buy rating and raised his one-year price target on the stock from $3 per share to $7 per share.

Before the market opened today, H.C. Wainwright published new coverage on BigBear.ai stock. As of this writing, analyst Scott Buck’s new one-year price target of $7 per share implies additional upside of 40%.

Buck is bullish on the company’s move to refinance convertible senior notes worth $182.3 million, pushing the maturity date from 2026 to 2029. With the move, BigBear is minimizing near-term liquidity issues and giving itself more flexibility to spend on growth bets. The analyst also sees BigBear benefiting from a market environment that is becoming more favorable to growth stocks with smaller market caps and thinks the company’s status as an artificial intelligence (AI) pure play can help support a premium valuation.

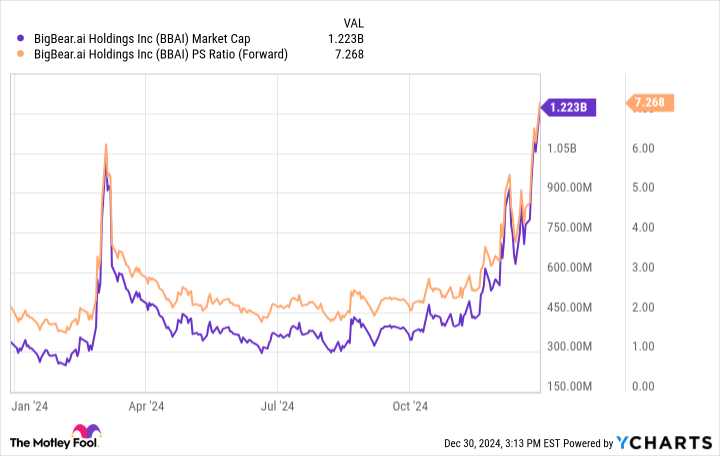

With today’s gains, BigBear stock is now up 129% across 2024’s trading. The share price gains and new stock offerings have pushed its market cap up to $1.2 billion. The company is now valued at roughly 7.3 times this year’s expected sales.

With its third-quarter report, BigBear grew its sales 22% year over year to reach $41.5 million. On the other hand, the company noted that it was seeing some cautiousness from government customers when it came to AI spending. While the stock may be able to keep rallying, the company may need to deliver more bullish contract guidance or accelerating sales growth with its next quarterly report in order to support recent share price gains.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $355,269!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,404!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $489,434!*

BigBear.ai Stock Is Skyrocketing Today: Here’s Why Investors Are Excited

BigBear.ai, a leading provider of artificial intelligence and machine learning solutions, has seen its stock price surge today, leaving investors buzzing with excitement. The company’s shares have soared by X% in early trading, reaching a new all-time high.

So, what’s driving this sudden surge in BigBear.ai’s stock price? Here are a few key factors:

1. Strong Financial Performance: BigBear.ai recently reported impressive quarterly earnings, surpassing analysts’ expectations and demonstrating strong revenue growth. The company’s solid financial performance has instilled confidence in investors and fueled optimism about its future prospects.

2. Strategic Partnerships: BigBear.ai has been forging strategic partnerships with industry leaders to enhance its product offerings and expand its market reach. These collaborations have bolstered the company’s competitive position and attracted the attention of investors.

3. Growing Demand for AI Solutions: As businesses increasingly rely on artificial intelligence and machine learning technologies to drive innovation and improve operational efficiency, the demand for BigBear.ai’s solutions has been on the rise. This growing market opportunity has positioned the company for sustainable growth and profitability.

4. Positive Analyst Coverage: Analysts have been bullish on BigBear.ai, with many issuing favorable ratings and price targets for the stock. This positive analyst coverage has helped attract more investors to the company and contributed to its stock price rally.

Overall, the combination of strong financial performance, strategic partnerships, growing market demand, and positive analyst coverage has propelled BigBear.ai’s stock to new heights. Investors are optimistic about the company’s future growth potential and are eagerly watching as it continues to innovate and expand its presence in the AI industry.

Tags:

- BigBear.ai stock news

- BigBear.ai stock price surge

- BigBear.ai stock market update

- BigBear.ai stock performance

- BigBear.ai stock analysis

- BigBear.ai stock forecast

- BigBear.ai stock investing

- BigBear.ai stock trends

- BigBear.ai stock price jump

- BigBear.ai stock growth prospects

#BigBear.ai #Stock #Skyrocketing #Today

Leave a Reply