Upstart Holdings’ stock has enjoyed a scintillating run in its past six months, surging by approximately 260%. However, despite its astounding form, the sustainability of Upstart’s latest surge can be contested by talks of re-inflation, a potential shift in credit risk, and Upstart’s ongoing profitability concerns.

Aside from the above-mentioned, JP Morgan recently downgraded Upstart to ‘underweight’ on the basis of an unjustified valuation. According to JP Morgan, Upstart’s “shares seem to be priced to perfection,” adding substance to a revision of the stock’s prospects.

The headwinds mentioned within the introduction provide a summary; let’s traverse into a more comprehensive discussion of Upstart’s emerging headwinds.

Critiquing Upstart requires an understanding of its business model. For those unaware, Upstart is a lending marketplace that leverages artificial intelligence to curate comprehensive borrower credit scores. The company passes its data analytics to banks, who ultimately write consumer loans.

Source: Upstart

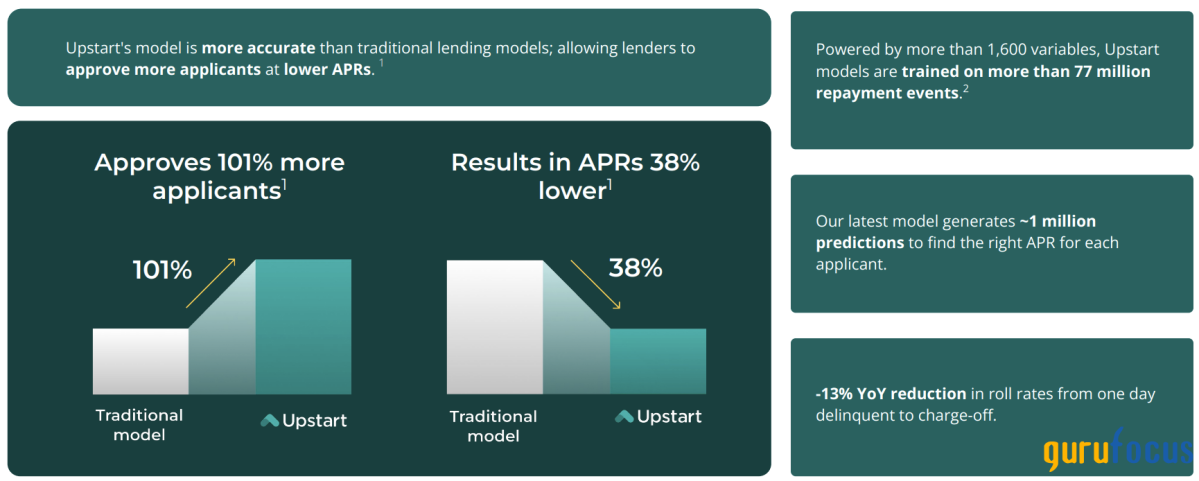

Upstart’s business model has delivered tangible success as the company’s loan approval rate outpaces that of traditional banks while also reducing the borrower’s repayment rate. Moreover, Upstart has successfully implemented a complex model, where it bases its scenario analysis on over 1,600 variables and 77 million repayment events, illustrating the company’s successful use of big data analytics to curate justified credit scores.

Another compelling feature of Upstart is its ‘skin in the game,’ whereby the company holds its very own loan portfolio, showing its commitment to its methodology. As illustrated in the following diagram, Upstart recorded approximately $334 million in co-investments during its latest quarter, a substantial increase from $66 million a year prior.

Source: Upstart

Upstart’s identifiable key drivers are both internal and external.

Firstly, as previously mentioned, the company utilizes a comprehensive screening methodology whereby it leverages artificial intelligence to optimize large data sets. Moreover, its machine learning techniques incorporate non-linear relationships, allowing Upstart to generate a wider breadth of scenarios than traditional economic models otherwise would.

Upstart’s digitalization has evidently resulted in a cutting-edge marketplace. However, the company’s internal drivers are influenced by external factors such as interest rates, inflation, credit risk, and related variables. Therefore, a secondary driver for Upstart is the overall health of the lending environment.

Upstart has been gaining a lot of attention in the fintech world recently, with its innovative approach to lending and use of artificial intelligence to assess creditworthiness. However, there are some signs that the company may have reached its peak, at least for the time being.

One reason for this is the increasing competition in the fintech space. Upstart’s success has attracted a number of new players to the market, all vying for a piece of the pie. This increased competition could make it harder for Upstart to continue growing at the same rapid pace it has been.

Another factor to consider is the overall economic climate. With interest rates rising and the possibility of an economic downturn looming, consumers may become more cautious about taking on new debt. This could impact Upstart’s loan volumes and profitability.

Additionally, there have been some concerns raised about Upstart’s business model. Critics have questioned the accuracy of the company’s AI-driven credit assessments and raised concerns about potential bias in the algorithms. These issues could lead to regulatory scrutiny and damage Upstart’s reputation.

While Upstart has been a standout in the fintech world, it’s important to consider these potential challenges and monitor how the company navigates them in the coming months. It’s possible that Upstart will continue to thrive, but it’s also worth being cautious about its future prospects.

Tags:

- Upstart growth analysis

- Upstart performance review

- Upstart market saturation

- Upstart peak analysis

- Upstart future prospects

- Upstart success evaluation

- Upstart growth projection

- Upstart market trends

- Upstart industry analysis

- Upstart competition assessment

#Upstart #Mightve #Reached #Peak

Leave a Reply

You must be logged in to post a comment.